Virgin Media 2013 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VIRGIN MEDIA INC.

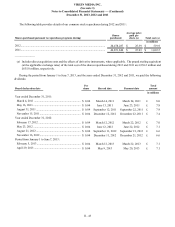

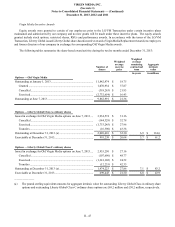

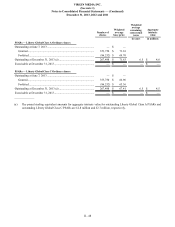

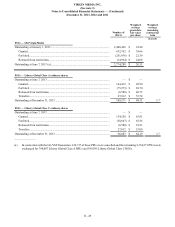

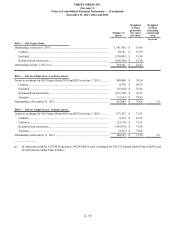

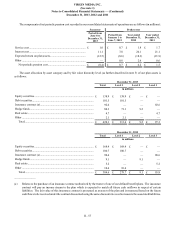

(See note 1)

Notes to Consolidated Financial Statements — (Continued)

December 31, 2013, 2012 and 2011

II - 53

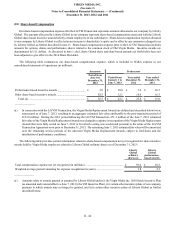

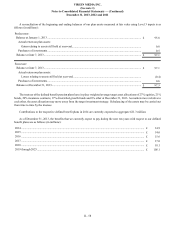

Transaction date, whereby a subsidiary of Liberty Global contributed cash to Virgin Media that was subsequently

used to repay amounts outstanding under the MergerCo Bridge Facility Agreement;

(ii) a note receivable from Lynx Europe 2 that is owed to us. At December 31, 2013, this note, which matures on or

before April 15, 2023, had a principal balance of $107.5 million (£64.9 million) and bore interest at a rate of

7.875%; and

(iii) a note receivable with Liberty Global. At December 31, 2013, this note, which matures on April 6, 2018, had a

principal balance of £11.3 million and bore interest at a rate of 1.22%. This note receivable originated as a result

of a non-cash transaction on the date of the LG/VM Transaction that resulted in a corresponding increase to our

additional paid-in capital. This non-cash transaction involved the transfer of shares of Old Virgin Media held in

a trust to a trust consolidated by Liberty Global in exchange for this note.

(c) Represents (i) £66.0 million (equivalent) arising from capital charges from LGI, as described in note (d) below, (ii) £16.3

million (equivalent) related to deferred financing costs paid by LGI on our behalf and (iii) certain payables to other Liberty

Global subsidiaries arising in the normal course of business. The payables related to the capital charges and deferred

financing costs are settled periodically. None of these payables are currently interest bearing. In addition, we repaid a

$1,615.5 million (£987.4 million at the transaction date) demand note to Liberty Global during the fourth quarter of 2013.

This note, which did not bear interest, arose from the settlement of the VM Convertible Notes with Liberty Global ordinary

shares following the LG/VM Transaction.

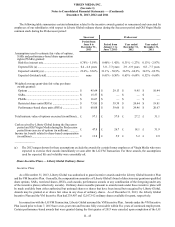

(d) During 2013, we recorded a capital charge of $109.4 million (£69.5 million at the applicable rate) in our consolidated

statement of equity in connection with the exercise of Liberty Global SARs and options and the vesting of Liberty Global

restricted share awards held by employees of our subsidiaries. These capital charges, which we and LGI have agreed will

not exceed the cumulative amount of share-based compensation allocated to our company by LGI following the LG/VM

Transaction, are based on the fair value of the underlying Liberty Global shares on the exercise or vesting date, as applicable.

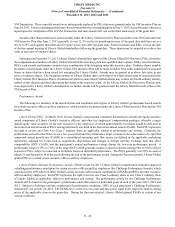

Subsequent events

Subsequent to December 31, 2013, we loaned £115.0 million to Liberty Global Incorporated Limited and €327.3 million

(£272.4 million) to LGE Holdco V BV, both of which are subsidiaries of Liberty Global. The loan receivable from Liberty Global

Incorporated Limited bears interest at 4.1% and matures on January 30, 2017 and the loan receivable from LGE Holdco V BV

bears interest at 5.93% and matures on March 6, 2019.