Virgin Media 2013 Annual Report Download - page 57

Download and view the complete annual report

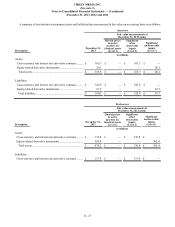

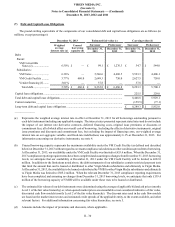

Please find page 57 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VIRGIN MEDIA INC.

(See note 1)

Notes to Consolidated Financial Statements — (Continued)

December 31, 2013, 2012 and 2011

II - 32

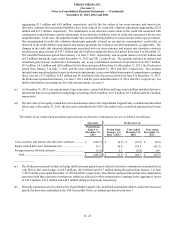

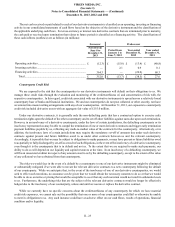

As discussed in note 1, the Liberty Global share and share-based amounts set forth above have not been adjusted to give effect

to the 2014 Share Dividend.

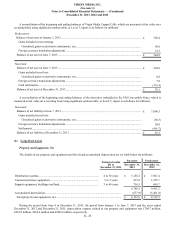

VM Notes

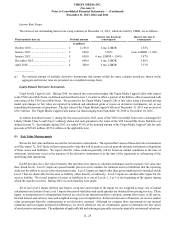

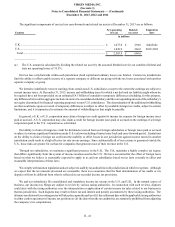

At December 31, 2013, the following senior notes of certain of our subsidiaries were outstanding:

• $507.1 million (£306.1 million) principal amount of 8.375% senior notes (the 2019 VM Dollar Senior Notes) and £253.5

million principal amount of 8.875% senior notes (the 2019 VM Sterling Senior Notes and, together with the 2019 VM

Dollar Senior Notes, the 2019 VM Senior Notes). The 2019 VM Senior Notes were issued by Virgin Media Finance PLC

(Virgin Media Finance), a wholly-owned subsidiary of Virgin Media;

• $1.0 billion (£603.6 million) principal amount of 6.50% senior secured notes (the 2018 VM Dollar Senior Secured Notes)

and £875.0 million principal amount of 7.0% senior secured notes (the 2018 VM Sterling Senior Secured Notes and,

together with the 2018 VM Dollar Senior Secured Notes, the 2018 VM Senior Secured Notes). The 2018 VM Senior

Secured Notes were issued by Virgin Media Secured Finance PLC (Virgin Media Secured Finance), a wholly-owned

subsidiary of Virgin Media;

• $447.9 million (£270.4 million) principal amount of 5.25% senior secured notes (the January 2021 VM Dollar Senior

Secured Notes) and £628.4 million principal amount of 5.50% senior secured notes (the January 2021 VM Sterling Senior

Secured Notes and, together with the January 2021 VM Dollar Senior Secured Notes, the January 2021 VM Senior Secured

Notes). The January 2021 VM Senior Secured Notes were issued by Virgin Media Secured Finance;

• $95.0 million (£57.3 million) principal amount of 5.25% senior notes (the 2022 VM 5.25% Dollar Senior Notes);

• $118.7 million (£71.6 million) principal amount of 4.875% senior notes (the 2022 VM 4.875% Dollar Senior Notes) and

£44.1 million principal amount of 5.125% senior notes (the 2022 VM Sterling Senior Notes and, together with the 2022

VM 4.875% Dollar Senior Notes and the 2022 VM 5.25% Dollar Senior Notes, the 2022 VM Senior Notes). The 2022

VM Senior Notes were issued by Virgin Media Finance;

• $1.0 billion (£603.6 million) principal amount of 5.375% senior secured notes (the April 2021 VM Dollar Senior Secured

Notes) and £1.1 billion principal amount of 6.0% senior secured notes (the April 2021 VM Sterling Senior Secured Notes

and, together with the April 2021 VM Dollar Senior Secured Notes, the April 2021 VM Senior Secured Notes); and

• $530.0 million (£319.9 million) principal amount of 6.375% senior notes (the 2023 VM Dollar Senior Notes) and £250.0

million principal amount of 7.0% senior notes (the 2023 VM Sterling Senior Notes and, together with the 2023 VM Dollar

Senior Notes, the 2023 VM Senior Notes).

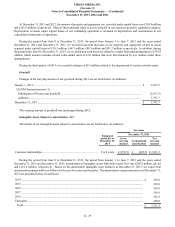

The April 2021 VM Senior Secured Notes and the 2023 VM Senior Notes were originally issued by subsidiaries of Liberty

Global in February 2013 in connection with the execution of the LG/VM Transaction Agreement. The net proceeds (after deducting

certain transaction expenses) from the April 2021 VM Senior Secured Notes and the 2023 VM Senior Notes of £2,198.3 million

(equivalent at the transaction date) were placed into segregated escrow accounts with a trustee. Such net proceeds were released

in connection with the closing of the LG/VM Transaction. In addition, upon completion of the LG/VM Transaction, the April

2021 VM Senior Secured Notes and the 2023 VM Senior Notes were pushed down to Virgin Media Secured Finance and Virgin

Media Finance, respectively.

The 2018 VM Senior Secured Notes, the January 2021 VM Senior Secured Notes and the April 2021 VM Senior Secured

Notes are collectively referred to as the “VM Senior Secured Notes.” The 2019 VM Senior Notes, the 2022 VM Senior Notes and

the 2023 VM Senior Notes are collectively referred to as the “VM Senior Notes” (and together with the VM Senior Secured Notes,

the VM Notes).

Under the terms of the applicable indentures, the completion of the LG/VM Transaction represented a “Change of Control”

event that required Virgin Media Secured Finance and Virgin Media Finance, as applicable, to offer to repurchase the January

2021 VM Senior Secured Notes and the 2022 VM Senior Notes at a repurchase price of 101% of par. In this regard, on June 11,

2013, Virgin Media Secured Finance and Virgin Media Finance, as applicable, redeemed (i) $52.1 million (£31.4 million) of the