Virgin Media 2013 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC.

(See note 1)

Notes to Consolidated Financial Statements — (Continued)

December 31, 2013, 2012 and 2011

II - 34

indebtedness of £50.0 million or more in the aggregate of Virgin Media, Virgin Media Finance, Virgin Media Secured Finance or

VMIH (as applicable under the relevant indenture), or the Restricted Subsidiaries (as defined in the applicable indenture) is an

event of default under the VM Notes.

Subject to the circumstances described below, the January 2021 VM Senior Secured Notes and the 2022 VM Senior Notes

are non-callable. At any time prior to maturity, Virgin Media Secured Finance or Virgin Media Finance (as applicable) may redeem

some or all of the January 2021 VM Senior Secured Notes or the 2022 VM Senior Notes (as applicable) by paying a “make-whole”

premium, which is the present value of all remaining scheduled interest payments to (i) January 15, 2021 using the discount rate

(as specified in the applicable indenture) as of the applicable redemption date plus 25 basis points in the case of the January 2021

VM Senior Secured Notes or (ii) February 15, 2022 using the discount rate (as specified in the applicable indenture) as of the

applicable redemption date plus 50 basis points in the case of the 2022 VM Senior Notes.

Subject to the circumstances described below, the 2018 VM Senior Secured Notes are non-callable until January 15, 2014,

the 2019 VM Senior Notes are non-callable until October 15, 2014, the April 2021 VM Senior Secured Notes are non-callable

until April 15, 2017 and the 2023 VM Senior Notes are non-callable until April 15, 2018. At any time prior to January 15, 2014

in the case of the 2018 VM Senior Secured Notes, October 15, 2014 in the case of the 2019 VM Senior Notes, April 15, 2017 in

the case of the April 2021 VM Senior Secured Notes or April 15, 2018 in the case of the 2023 VM Senior Notes, Virgin Media

Secured Finance and Virgin Media Finance (as applicable) may redeem some or all of the 2018 VM Senior Secured Notes, the

2019 VM Senior Notes, the April 2021 VM Senior Secured Notes or the 2023 VM Senior Notes (as applicable) by paying a “make-

whole” premium, which is the present value of all remaining scheduled interest payments to January 15, 2014, October 15, 2014,

April 15, 2017 or April 15, 2018 (as applicable) using the discount rate (as specified in the applicable indenture) as of the redemption

date plus 50 basis points.

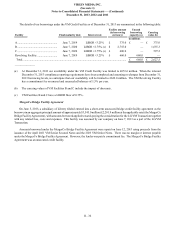

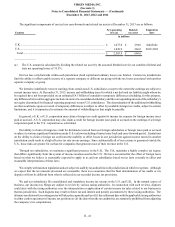

Virgin Media Finance and Virgin Media Secured Finance (as applicable) may redeem some or all of the 2018 VM Senior

Secured Notes, the 2019 VM Senior Notes, the April 2021 VM Senior Secured Notes or the 2023 VM Senior Notes at the following

redemption prices (expressed as a percentage of the principal amount) plus accrued and unpaid interest and Additional Amounts

(as defined in the applicable indenture), if any, to the applicable redemption date, if redeemed during the twelve-month period

commencing on January 15, in the case of the 2018 VM Senior Secured Notes, October 15, in the case of the 2019 VM Senior

Notes, or April 15, in the case of the April 2021 VM Senior Secured Notes and the 2023 VM Senior Notes, of the years set forth

below:

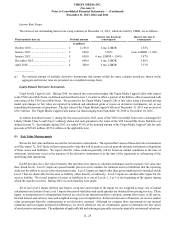

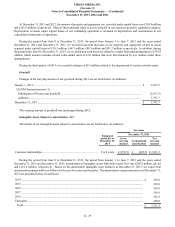

Redemption price

Year

2018 VM

Dollar

Senior

Secured

Notes

2018 VM

Sterling

Senior

Secured

Notes

2019 VM

Dollar

Senior

Notes

2019 VM

Sterling

Senior

Notes

April 2021

VM Dollar

Senior

Secured

Notes

April 2021

VM

Sterling

Senior

Secured

Notes

2023 VM

Dollar

Senior

Notes

2023 VM

Sterling

Senior

Notes

2014 .......................... 103.250% 103.500% 104.188% 104.438% N.A. N.A. N.A. N.A.

2015 .......................... 101.625% 101.750% 102.792% 102.958% N.A. N.A. N.A. N.A.

2016 .......................... 100.000% 100.000% 101.396% 101.479% N.A. N.A. N.A. N.A.

2017 .......................... 100.000% 100.000% 100.000% 100.000% 102.688% 103.000% N.A. N.A.

2018 .......................... N.A. N.A. 100.000% 100.000% 101.344% 101.500% 103.188% 103.500%

2019 .......................... N.A. N.A. N.A. N.A. 100.000% 100.000% 102.125% 102.333%

2020 .......................... N.A. N.A. N.A. N.A. 100.000% 100.000% 101.063% 101.667%

2021 and thereafter ... N.A. N.A. N.A. N.A. N.A. N.A. 100.000% 100.000%

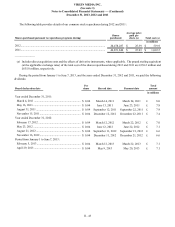

During March 2012, the net proceeds of the 2022 VM 5.25% Dollar Senior Notes and existing cash and cash equivalents were

used to redeem a portion of the $1,350.0 million (£814.9 million) principal amount of our then existing 9.5% senior notes (the

9.5% Senior Notes). During October 2012, a portion of (i) the net proceeds of the 2022 VM 4.875% Dollar Senior Notes and (ii)

a portion of the net proceeds of the 2022 VM Sterling Senior Notes were used to redeem (a) the remaining amount of the 9.5%

Senior Notes, (b) €180.0 million (£149.8 million) principal amount of 9.5% senior notes, (c) $92.9 million (£56.1 million) principal

amount of the 2019 VM Dollar Senior Notes and (d) £96.5 million principal amount of the 2019 VM Sterling Senior Notes. In

connection with these transactions, we recognized aggregate losses on debt extinguishments of £187.8 million representing (i)