Virgin Media 2013 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.I - 20

entities. We are currently undergoing a review of one of our most significant accreditations. If we were to fail to maintain an

accreditation or to obtain a new one when required, it could impact our ability to provide certain offerings to the public sector.

Risks Relating to Our Indebtedness, Taxes and Other Financial Matters

We have substantial indebtedness that may have a material adverse effect on our available cash flow, our ability to obtain

additional financing if necessary in the future, our flexibility in reacting to competitive and technological changes and our

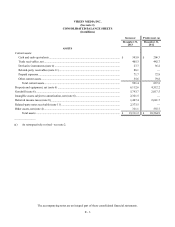

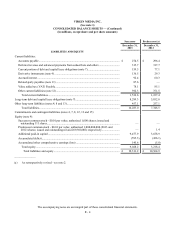

operations. We have a substantial amount of indebtedness. Our consolidated total long term debt, net of £72.5 million current

portion, was £8,150.8 million as of December 31, 2013.

Our ability to pay principal and interest on or to refinance the outstanding indebtedness depends upon our operating

performance, which will be affected by, among other things, general economic, financial, competitive, regulatory and other factors,

some of which are beyond our control. Moreover, we may not be able to refinance or redeem such debt on commercially reasonable

terms, on terms acceptable to us, or at all.

The level of our indebtedness could have important consequences, including the following:

• a substantial portion of our cash flow from operations will have to be dedicated to the payment of interest and principal

on existing indebtedness, thereby reducing the funds available for other purposes;

• our ability to obtain additional financing in the future for working capital, capital expenditures, product development,

acquisitions or general corporate purposes may be impaired;

• our flexibility in planning for, or reacting to, changes in our business, the competitive environment and the industry in

which we operate, and to technological and other changes may be limited;

• we may be placed at a competitive disadvantage as compared to our competitors that are not as highly leveraged;

• our substantial degree of leverage could make us more vulnerable in the event of a downturn in general economic conditions

or adverse developments in our business; and

• we are exposed to risks inherent in interest rate and foreign exchange rate fluctuations.

Any of these or other consequences or events could have a material adverse effect on our ability to satisfy our debt obligations,

which could adversely affect our business and operations.

We may not be able to fund our debt service obligations in the future. We have significant principal payments due from

2015 onwards that could require a partial or comprehensive refinancing of our senior credit facility and other debt instruments.

Our ability to implement such a refinancing successfully would be significantly dependent on stable debt capital markets. In

addition, we may not achieve or sustain sufficient cash flow in the future for the payment of principal or interest on our indebtedness

when due. Consequently, we may be forced to raise cash or reduce expenses by doing one or more of the following:

• raising additional debt;

• restructuring or refinancing our indebtedness prior to maturity, and/or on unfavorable terms;

• selling or disposing of some of our assets, possibly on unfavorable terms;

• issuing equity or equity-related instruments that will dilute the equity ownership interest of existing stockholders; or

• foregoing business opportunities, including the introduction of new products and services, acquisitions and joint ventures.

We cannot be sure that any of, or a combination of, the above actions would be sufficient to fund our debt service obligations,

particularly in times of turbulent capital markets.

The covenants under our debt agreements place certain limitations on our ability to finance future operations and how

we manage our business. The agreements that govern our indebtedness contain financial maintenance tests and restrictive

covenants that restrict our ability to incur additional debt and limit the discretion of our management over various business matters.

For example, the financial maintenance tests include leverage ratios, and the restrictive covenants impact our ability to: