Virgin Media 2013 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC.

(See note 1)

Notes to Consolidated Financial Statements — (Continued)

December 31, 2013, 2012 and 2011

II - 41

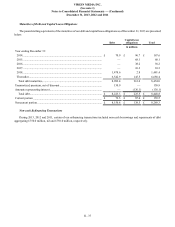

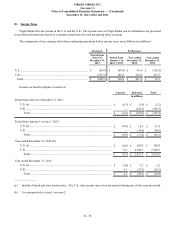

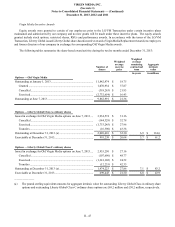

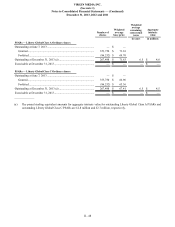

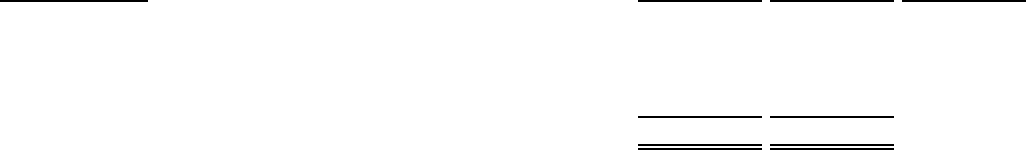

The significant components of our tax loss carryforwards and related tax assets at December 31, 2013 are as follows:

Country Net operating

loss (a) Related

tax asset Expiration

date

in millions

U.K...................................................................................................................... £ 1,473.0 £ 294.6 Indefinite

U.S....................................................................................................................... 1,030.9 366.0 2019-2033

Total.................................................................................................................. £ 2,503.9 £ 660.6

_______________

(a) The U.S. amount is calculated by dividing the related tax asset by the assumed blended rate for our combined federal and

state net operating losses of 35.5%.

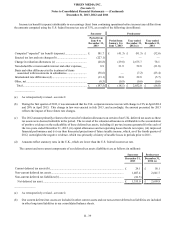

Our tax loss carryforwards within each jurisdiction (both capital and ordinary losses) are limited. Certain tax jurisdictions

limit the ability to offset taxable income of a separate company or different tax group with the tax losses associated with another

separate company or group.

We intend to indefinitely reinvest earnings from certain non-U.S. subsidiaries except to the extent the earnings are subject to

current income taxes. At December 31, 2013, income and withholding taxes for which a net deferred tax liability might otherwise

be required have not been provided on an estimated £4.3 billion of cumulative temporary differences (including, for this purpose,

any difference between the aggregate tax basis in stock of a consolidated subsidiary and the corresponding amount of the subsidiary’s

net equity determined for financial reporting purposes) on non-U.S. subsidiaries. The determination of the additional withholding

tax that would arise upon a reversal of temporary differences is subject to offset by available foreign tax credits, subject to certain

limitations, and it is impractical to estimate the amount of withholding tax that might be payable.

In general, a U.K. or U.S. corporation may claim a foreign tax credit against its income tax expense for foreign income taxes

paid or accrued. A U.S. corporation may also claim a credit for foreign income taxes paid or accrued on the earnings of a foreign

corporation paid to the U.S. corporation as a dividend.

Our ability to claim a foreign tax credit for dividends received from our foreign subsidiaries or foreign taxes paid or accrued

is subject to various significant limitations under U.S. tax laws including a limited carry back and carry forward period. Limitations

on the ability to claim a foreign tax credit and the inability to offset losses in one jurisdiction against income earned in another

jurisdiction could result in a high effective tax rate on our earnings. Since substantially all of our revenue is generated outside the

U.S., these risks are greater for us than for companies that generate most of their revenue in the U.S.

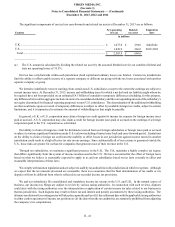

Through our subsidiaries, we maintain a significant presence in the U.K. The U.K. maintains a highly complex tax regime

that differs significantly from the system of income taxation used in the U.S. We have accounted for the effect of foreign taxes

based on what we believe is reasonably expected to apply to us and our subsidiaries based on tax laws currently in effect and

reasonable interpretations of these laws.

We comply with taxation legislation and are subject to audit by tax authorities in all jurisdictions in which we operate. Although

we expect that the tax amounts presented are reasonable, there is no assurance that the final determination of tax audits or tax

disputes will not be different from what is reflected in our recorded income tax provisions.

We and our subsidiaries file consolidated and standalone income tax returns in the U.S. and U.K. In the normal course of

business, our income tax filings are subject to review by various taxing authorities. In connection with such reviews, disputes

could arise with the taxing authorities over the interpretation or application of certain income tax rules related to our business in

that tax jurisdiction. Such disputes may result in future tax and interest and penalty assessments by these taxing authorities. The

ultimate resolution of tax contingencies will take place upon the earlier of (i) the settlement date with the applicable taxing authorities

in either cash or agreement of income tax positions or (ii) the date when the tax authorities are statutorily prohibited from adjusting

the company’s tax computations.