Virgin Media 2013 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC.

(See note 1)

Notes to Consolidated Financial Statements — (Continued)

December 31, 2013, 2012 and 2011

II - 55

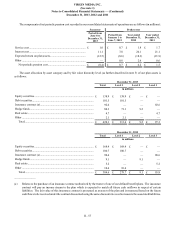

• Ensure that funds are available to pay benefits as they become due;

• Maximize the total returns on plan assets subject to prudent risk taking; and

• Preserve or improve the funded status of the trusts over time.

We review the asset allocation within their respective portfolios on a regular basis. Generally, the portfolios will be rebalanced

to a target allocation when an individual asset class approaches its minimum or maximum targeted level.

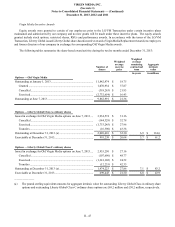

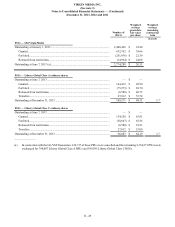

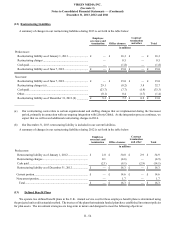

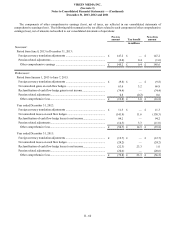

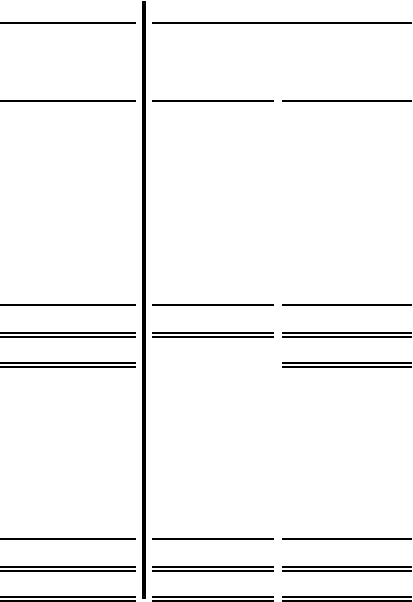

The following is a summary of the funded status of our defined benefit plans (in millions):

Successor Predecessor

Period from

June 8 to

December 31,

2013

Period from

January 1 to

June 7, 2013

Year ended

December 31,

2012

Projected benefit obligation at beginning of period (a).................................. £ 442.0 £ 431.1 £ 424.6

Service cost................................................................................................ 1.0 0.7 1.8

Interest cost................................................................................................ 11.1 7.8 20.1

Actuarial loss (gain) .................................................................................. 1.8 (0.8)(0.6)

Participants’ contributions......................................................................... 0.2 0.1 0.3

Benefits paid.............................................................................................. (9.1)(5.2)(15.1)

Projected benefit obligation at end of period ................................................. £ 447.0 £ 433.7 £ 431.1

Accumulated benefit obligation at end of period........................................... £ 443.6 £ 342.7

Fair value of plan assets at beginning of period (a) ....................................... £ 403.0 £ 384.6 £ 381.0

Actual earnings of plan assets ................................................................... 12.3 8.6 0.7

Group contributions................................................................................... 13.7 9.3 17.7

Participants’ contributions......................................................................... 0.2 0.1 0.3

Benefits paid.............................................................................................. (9.1)(5.2)(15.1)

Fair value of plan assets at end of period....................................................... £ 420.1 £ 397.4 £ 384.6

Net liability (b)............................................................................................... £ 26.9 £ 36.3 £ 46.5

_______________

(a) The opening projected benefit obligation and the opening fair value of plan assets for the Successor period includes purchase

accounting adjustments made in connection with the LG/VM Transaction of £8.3 million and £5.6 million, respectively.

For more information regarding the LG/VM Transaction, see note 3.

(b) The net liability related to our defined benefit plans is included in other long-term liabilities in our consolidated balance

sheets.