Virgin Media 2013 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC.

(See note 1)

Notes to Consolidated Financial Statements — (Continued)

December 31, 2013, 2012 and 2011

II - 19

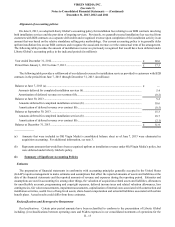

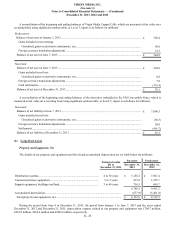

• Each share of common stock of our company was converted into the right to receive (i) 0.2582 Class A ordinary shares

of Liberty Global, (ii) 0.1928 Class C ordinary shares of Liberty Global and (iii) $17.50 in cash (collectively, the LG/

VM Transaction Consideration); and

• Each share of Series A common stock of LGI was converted into the right to receive one Class A ordinary share of Liberty

Global, each share of Series B common stock of LGI was converted into the right to receive one Class B ordinary share

of Liberty Global; and each share of Series C common stock of LGI was converted into the right to receive one Class C

ordinary share of Liberty Global.

In connection with the completion of the LG/VM Transaction, Liberty Global issued 70,233,842 Class A and 52,444,170 Class

C ordinary shares to holders of Virgin Media common stock and 141,234,331 Class A, 10,176,295 Class B and 105,572,797 Class

C ordinary shares to holders of LGI Series A, Series B and Series C common stock, respectively. Each Class A ordinary share of

Liberty Global is entitled to one vote per share, each Class B ordinary share of Liberty Global is entitled to ten votes per share

and each Class C ordinary share of Liberty Global was issued without voting rights.

In connection with the execution of the LG/VM Transaction, we entered into various debt financing arrangements. For

additional information, see note 7.

The LG/VM Transaction and related financing transactions were funded with a combination of (i) the net proceeds (after

deducting certain transaction expenses) from the April 2021 VM Senior Secured Notes and 2023 VM Senior Notes (each as defined

and described in note 7), (ii) borrowings under the VM Credit Facility (as defined and described in note 7) and (iii) our and Liberty

Global’s existing liquidity.

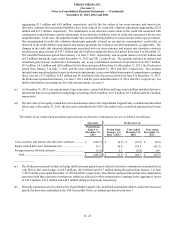

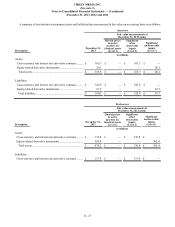

For accounting purposes, the LG/VM Transaction was treated as the acquisition of our company by Liberty Global. In this

regard, the equity and cash consideration paid to acquire our company was pushed down and is reported in our consolidated

financial statements as set forth below (in millions):

Class A ordinary shares (a)................................................................................................................................... £ 3,446.7

Class C ordinary shares (a)................................................................................................................................... 2,414.0

Cash (b)................................................................................................................................................................. 3,064.1

Fair value of the vested portion of Virgin Media stock incentive awards (c)....................................................... 174.1

Total equity and cash consideration................................................................................................................. £ 9,098.9

_______________

(a) Represents the value assigned to the 70,233,842 Class A and 52,444,170 Class C Liberty Global ordinary shares issued to

our shareholders in connection with the LG/VM Transaction. These amounts are based on (i) the exchange ratios specified

by the LG/VM Transaction Agreement, (ii) the closing per share price on June 7, 2013 of Series A and Series C LGI common

stock of $76.24 and $71.51, respectively, and (iii) the 272,013,333 outstanding shares of our common stock at June 7, 2013.

(b) Represents the cash consideration paid in connection with the LG/VM Transaction. This amount is based on (i) the $17.50

per share cash consideration specified by the LG/VM Transaction Agreement and (ii) the 272,013,333 outstanding shares

of our common stock at June 7, 2013.

(c) Represents the portion of the estimated fair value of our stock incentive awards that are attributable to services provided

prior to the June 7, 2013 acquisition date. The estimated fair value is based on the attributes of our 13.03 million outstanding

stock incentive awards at June 7, 2013, including the market price of our underlying common stock. Our outstanding stock

incentive awards at June 7, 2013 include 9.86 million stock options that have been valued using Black Scholes option

valuations. In addition, our stock incentive awards at June 7, 2013 included 3.17 million restricted stock units that included

performance conditions and, in certain cases, market conditions. Those restricted stock units with market conditions have

been valued using Monte Carlo simulation models.