Virgin Media 2013 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC.

(See note 1)

Notes to Consolidated Financial Statements — (Continued)

December 31, 2013, 2012 and 2011

II - 29

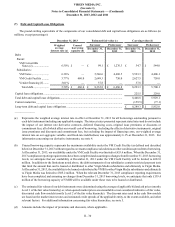

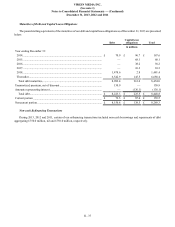

At December 31, 2013 and 2012, the amount of property and equipment, net, recorded under capital leases was £305.9 million

and £242.6 million, respectively. Most of these amounts relate to assets included in our customer premises equipment category.

Depreciation of assets under capital leases of our continuing operations is included in depreciation and amortization in our

consolidated statements of operations.

During the period from June 8 to December 31, 2013, the period from January 1 to June 7, 2013 and the years ended

December 31, 2012 and December 31, 2011, we recorded non-cash increases to our property and equipment related to assets

acquired under capital leases of £28.3 million, £64.7 million, £88.9 million and £91.2 million, respectively. In addition, during

the period from June 8 to December 31, 2013, we recorded non-cash increases related to vendor financing arrangements of £34.8

million, which amount excludes related value-added taxes of £3.0 million that were also financed by our vendors under these

arrangements.

During the third quarter of 2013, we recorded a charge of £9.2 million related to the impairment of certain network assets.

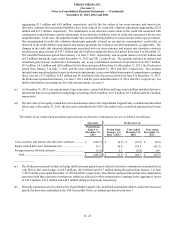

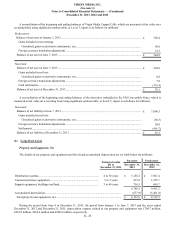

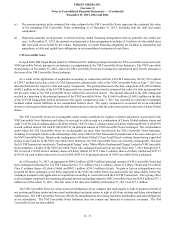

Goodwill

Changes in the carrying amount of our goodwill during 2013 are set forth below (in millions):

January 1, 2013....................................................................................................................................................... £ 2,017.5

LG/VM Transaction (note 3):

Elimination of Predecessor goodwill................................................................................................................. (2,017.5)

Addition ............................................................................................................................................................. 5,793.7

December 31, 2013................................................................................................................................................. £ 5,793.7

The carrying amount of goodwill was unchanged during 2012.

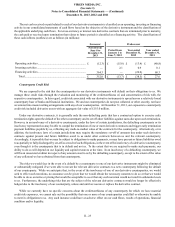

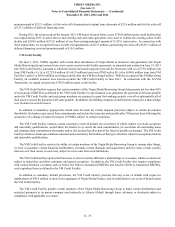

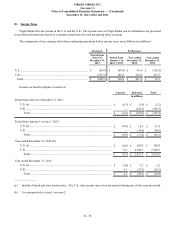

Intangible Assets Subject to Amortization, Net

The details of our intangible assets subject to amortization are set forth below (in millions):

Estimated

useful life at

December 31,

2013

Successor

December 31, 2013

Gross

carrying

amount Accumulated

amortization

Net

carrying

amount

Customer relationships............................................................................... 5 to 8 years £ 2,527.0 £ (205.5) £ 2,321.5

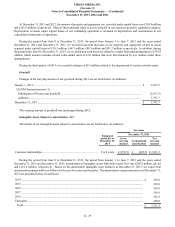

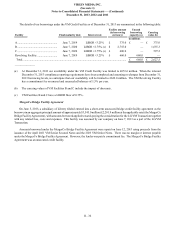

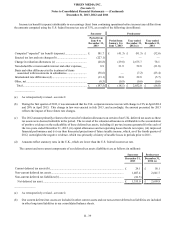

During the period from June 8 to December 31, 2013, the period from January 1 to June 7, 2013 and the years ended

December 31, 2012 and December 31, 2011, amortization of intangible assets with finite useful lives was £205.5 million, nil, nil

and £118.4 million, respectively. Based on the amortizable intangible asset balances at December 31, 2013, we expect that

amortization expense will be as follows for the next five years and thereafter. The amortization expense amounts as of December 31,

2013 are presented below (in millions):

2014 .......................................................................................................................................................................... £ 365.0

2015 .......................................................................................................................................................................... 365.0

2016 .......................................................................................................................................................................... 365.0

2017 .......................................................................................................................................................................... 365.0

2018 .......................................................................................................................................................................... 363.5

Thereafter.................................................................................................................................................................. 498.0

Total........................................................................................................................................................................ £ 2,321.5