Virgin Media 2013 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

III - 29

Sensitivity Information

Information concerning the sensitivity of the fair value of certain of our more significant derivative instruments to changes in

market conditions is set forth below. The potential changes in fair value set forth below do not include any amounts associated

with the remeasurement of the derivative asset or liability into the applicable functional currency. For additional information, see

notes 4 and 5 to our consolidated financial statements.

Cross-currency and Interest Rate Derivative Contracts

Holding all other factors constant, at December 31, 2013:

(i) an instantaneous increase (decrease) of 10% in the value of the British pound sterling relative to the U.S. dollar would

have decreased (increased) the aggregate fair value of the cross-currency and interest rate derivative contracts by

approximately £498 million; and

(ii) an instantaneous increase (decrease) in the relevant base rate of 50 basis points (0.50%) would have increased (decreased)

the aggregate fair value of the cross-currency and interest rate derivative contracts by approximately £57 million.

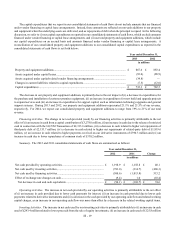

Projected Cash Flows Associated with Derivative Instruments

The following table provides information regarding the projected cash flows associated with our derivative instruments at

December 31, 2013. The pound sterling equivalents presented below are based on interest rates and exchange rates that were in

effect as of December 31, 2013. These amounts are presented for illustrative purposes only and will likely differ from the actual

cash payments required in future periods. For additional information regarding our derivative instruments, see note 4 to our

consolidated financial statements. For information concerning the counterparty credit risk associated with our derivative

instruments, see the discussion under Counterparty Credit Risk above.

Payments (receipts) due during:

Total 2014 2015 2016 2017 2018 Thereafter

in millions

Projected derivative cash payments

(receipts), net:

Interest-related (a)............................ £ 41.8 £ 48.9 £ 29.8 £ 29.4 £ 24.6 £ (4.5) £ 170.0

Principal-related (b) ......................... — — — — 12.0 166.4 178.4

Other (c)........................................... — — 47.2 — — — 47.2

Total.............................................. £ 41.8 £ 48.9 £ 77.0 £ 29.4 £ 36.6 £ 161.9 £ 395.6

_______________

(a) Includes the interest-related cash flows of our cross-currency and cross-currency interest rate swap contracts.

(b) Includes the principal-related cash flows of our cross-currency and cross-currency interest rate swap contracts.

(c) Includes amounts related to the Virgin Media Capped Calls and the derivative embedded in the VM Convertible Notes. For

information regarding the settlement of these instruments, see notes 4 and 7 to our consolidated financial statements.