Virgin Media 2013 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC.

(See note 1)

Notes to Consolidated Financial Statements — (Continued)

December 31, 2013, 2012 and 2011

II - 57

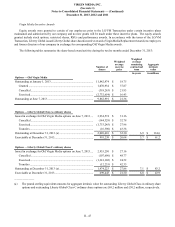

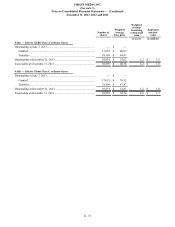

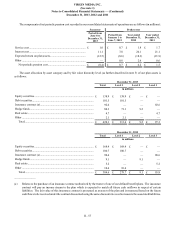

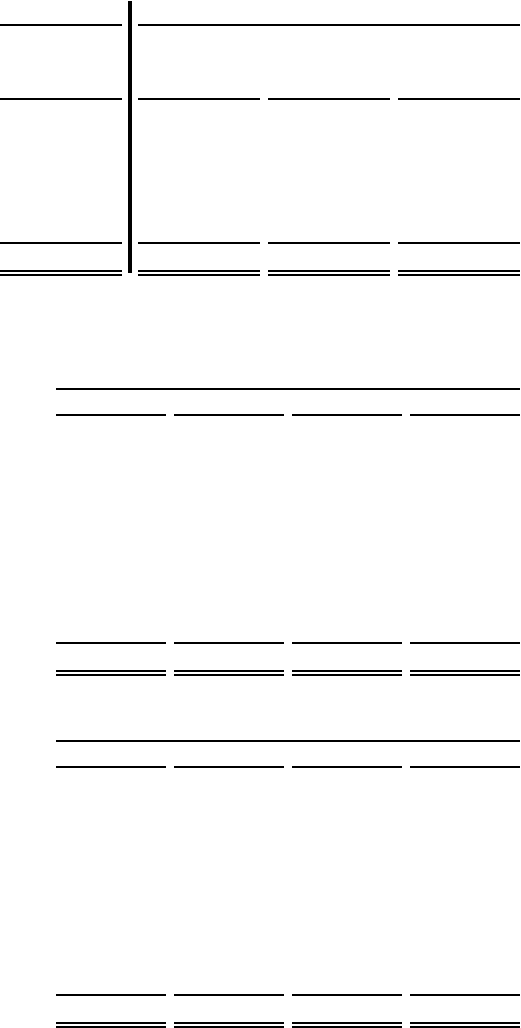

The components of net periodic pension cost recorded in our consolidated statements of operations are as follows (in millions):

Successor Predecessor

Period from

June 8 to

December 31,

2013

Period from

January 1 to

June 7, 2013

Year ended

December 31,

2012

Year ended

December 31,

2011

Service cost............................................................................... £ 1.0 £ 0.7 £ 1.8 £ 1.7

Interest cost............................................................................... 11.1 7.8 20.1 21.1

Expected return on plan assets.................................................. (12.5)(8.6)(18.3)(21.9)

Other ......................................................................................... — 0.8 2.6 0.6

Net periodic pension cost..................................................... £(0.4) £ 0.7 £ 6.2 £ 1.5

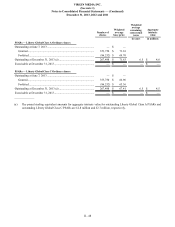

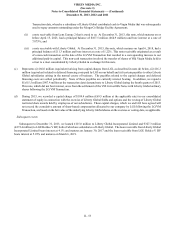

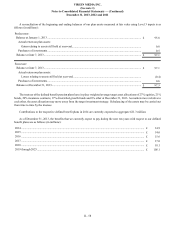

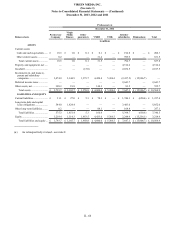

The asset allocation by asset category and by fair value hierarchy level (as further described in note 5) of our plan assets is

as follows:

December 31, 2013

Total Level 1 Level 2 Level 3

in millions

Equity securities................................................................................... £ 138.9 £ 138.9 £ — £ —

Debt securities...................................................................................... 101.5 101.5 — —

Insurance contract (a)........................................................................... 92.6 — — 92.6

Hedge funds ......................................................................................... 80.3 71.1 9.2 —

Real estate............................................................................................ 4.7 — — 4.7

Other .................................................................................................... 2.1 2.1 — —

Total................................................................................................. £ 420.1 £ 313.6 £ 9.2 £ 97.3

December 31, 2012

Total Level 1 Level 2 Level 3

in millions

Equity securities................................................................................... £ 168.4 £ 168.4 £ — £ —

Debt securities...................................................................................... 100.7 100.7 — —

Insurance contract (a)........................................................................... 90.6 — — 90.6

Hedge funds ......................................................................................... 9.1 — 9.1 —

Real estate............................................................................................ 5.2 — — 5.2

Other .................................................................................................... 10.6 10.6 — —

Total................................................................................................. £ 384.6 £ 279.7 £ 9.1 £ 95.8

_______________

(a) Relates to the purchase of an insurance contract authorized by the trustee of one of our defined benefit plans. The insurance

contract will pay an income stream to the plan which is expected to match all future cash outflows in respect of certain

liabilities. The fair value of this insurance contract is presented as an asset of the plan and is measured based on the future

cash flows to be received under the contract discounted using the same discount rate used to measure the associated liabilities.