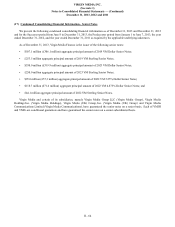

Virgin Media 2013 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC.

(See note 1)

Notes to Consolidated Financial Statements — (Continued)

December 31, 2013, 2012 and 2011

II - 69

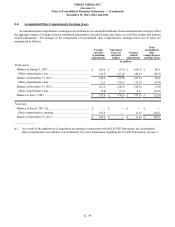

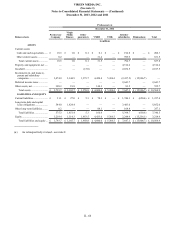

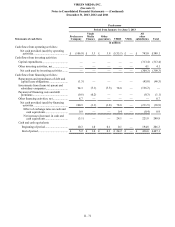

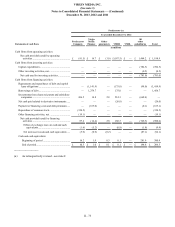

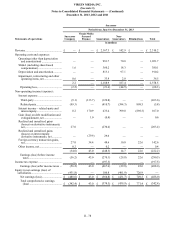

Predecessor (a)

Year ended December 31, 2012

Statements of operations Predecessor

Company

Virgin

Media

Finance Other

guarantors VMIH VMIL All other

subsidiaries Eliminations Total

in millions

Revenue............................... £ — £ — £ — £ — £ — £ 4,100.5 £ — £ 4,100.5

Operating costs and

expenses:

Operating (other than

depreciation and

amortization)................. — — — — — 1,872.9 — 1,872.9

SG&A (including share-

based compensation)..... 15.3 — — — — 558.9 — 574.2

Depreciation and

amortization.................. — — — — — 966.4 — 966.4

Impairment, restructuring

and other operating

items, net....................... — — — — — (11.8) — (11.8)

15.3 — — — — 3,386.4 — 3,401.7

Operating income

(loss)........................... (15.3) — — — — 714.1 — 698.8

Non-operating income

(expense):

Interest expense – third-

party.............................. (112.4) (155.2) (10.9) (344.4) — (938.9) 1,163.6 (398.2)

Interest income –

intercompany ................ — 167.2 15.5 185.8 — 795.1 (1,163.6) —

Loss on debt modification

and extinguishment,

net ................................. — (187.8) — — — — — (187.8)

Realized and unrealized

gains (losses) on

derivative instruments,

net ................................. 174.2 — — (26.1) — — — 148.1

Foreign currency

transaction losses, net ... (0.1) (7.8) (2.8) (24.5) — (4.5) 33.4 (6.3)

Other income, net ............. — — — 0.4 — 6.4 — 6.8

61.7 (183.6) 1.8 (208.8) — (141.9) 33.4 (437.4)

Earnings (loss) before

income taxes............... 46.4 (183.6) 1.8 (208.8) — 572.2 33.4 261.4

Income tax benefit

(expense) ......................... — — 0.1 (0.6) — 2,652.5 — 2,652.0

Earnings (loss) after

income taxes............... 46.4 (183.6) 1.9 (209.4) — 3,224.7 33.4 2,913.4

Equity in net earnings of

subsidiaries...................... 2,867.0 2,963.2 2,865.0 3,139.2 3,137.2 — (14,971.6) —

Net earnings ................... £ 2,913.4 £ 2,779.6 £ 2,866.9 £ 2,929.8 £ 3,137.2 £ 3,224.7 £ (14,938.2) £ 2,913.4

Total comprehensive

earnings...................... £ 2,877.6 £ 2,732.5 £ 2,822.0 £ 2,882.6 £ 3,137.8 £ 3,225.3 £ (14,800.2) £ 2,877.6

_________________

(a) As retrospectively revised - see note 2.