Virgin Media 2013 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VIRGIN MEDIA INC.

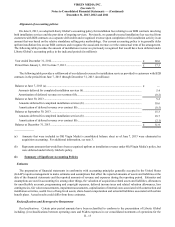

(See note 1)

Notes to Consolidated Financial Statements — (Continued)

December 31, 2013, 2012 and 2011

II - 15

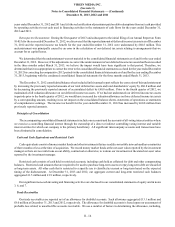

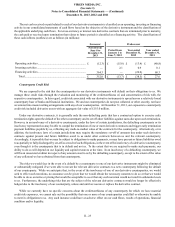

among other things, collection trends, prevailing and anticipated economic conditions and specific customer credit risk. The

allowance is maintained until either receipt of payment or the likelihood of collection is considered to be remote.

Concentration of credit risk with respect to trade receivables is limited due to the large number of customers. We also manage

this risk by disconnecting services to customers whose accounts are delinquent.

Financial Instruments

Due to the short maturities of cash and cash equivalents, restricted cash, short-term liquid investments, trade and other

receivables, other current assets, accounts payable, accrued liabilities, subscriber advance payments and deposits and other current

liabilities, their respective carrying values approximate their respective fair values. For information concerning the fair values of

our derivatives and debt, see notes 4 and 7, respectively. For information concerning how we arrive at certain of our fair value

measurements, see note 5.

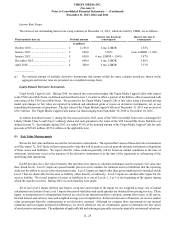

Derivative Instruments

All derivative instruments, whether designated as hedging relationships or not, are recorded on the balance sheet at fair value.

If the derivative instrument is designated as a fair value hedge, the changes in the fair value of the derivative instrument and of

the hedged item attributable to the hedged risk are recognized in earnings. If the derivative instrument is designated as a cash flow

hedge, the effective portions of changes in the fair value of the derivative instrument are recorded in other comprehensive earnings

or loss and subsequently reclassified into our consolidated statements of operations when the hedged forecasted transaction affects

earnings. Ineffective portions of changes in the fair value of cash flow hedges are recognized in earnings. If the derivative

instrument is not designated as a hedge, changes in the fair value of the derivative instrument are recognized in earnings. Although

we applied hedge accounting to certain of our derivative instruments prior to the LG/VM Transaction, we currently do not apply

hedge accounting to our derivative instruments. For information regarding our derivative instruments, including our policy for

classifying cash flows related to derivative instruments in our consolidated statements of cash flows, see note 4.

Property and Equipment

Property and equipment are stated at cost less accumulated depreciation. We capitalize costs associated with the construction

of new cable transmission and distribution facilities and the installation of new cable services. Capitalized construction and

installation costs include materials, labor and other directly attributable costs. Installation activities that are capitalized include

(i) the initial connection (or drop) from our cable system to a customer location, (ii) the replacement of a drop and (iii) the installation

of equipment for additional services, such as digital cable, telephone or broadband internet service. The costs of other customer-

facing activities such as reconnecting customer locations where a drop already exists, disconnecting customer locations and repairing

or maintaining drops, are expensed as incurred. Interest capitalized with respect to construction activities was not material during

any of the periods presented.

Capitalized internal-use software is included as a component of property and equipment. We capitalize internal and external

costs directly associated with the development of internal-use software. We also capitalize costs associated with the purchase of

software licenses. Maintenance and training costs, as well as costs incurred during the preliminary stage of an internal-use software

development project, are expensed as incurred.

Depreciation is computed using the straight-line method over the estimated useful life of the underlying asset. Equipment

under capital leases is amortized on a straight-line basis over the shorter of the lease term or estimated useful life of the asset.

Useful lives used to depreciate our property and equipment are assessed periodically and are adjusted when warranted. The useful

lives of cable distribution systems that are undergoing a rebuild are adjusted such that property and equipment to be retired will

be fully depreciated by the time the rebuild is completed. For additional information regarding the useful lives of our property

and equipment, see note 6.

Additions, replacements and improvements that extend the asset life are capitalized. Repairs and maintenance are charged

to operations.

We recognize a liability for asset retirement obligations in the period in which it is incurred if sufficient information is available

to make a reasonable estimate of fair values. Asset retirement obligations may arise from our legal obligations to dispose of