Virgin Media 2013 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC.

(See note 1)

Notes to Consolidated Financial Statements — (Continued)

December 31, 2013, 2012 and 2011

II - 38

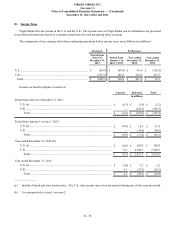

(8) Income Taxes

Virgin Media files tax returns in the U.S. and the U.K. The income taxes of Virgin Media and its subsidiaries are presented

in our financial statements based on a separate return basis for each tax-paying entity or group.

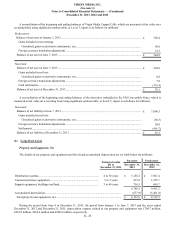

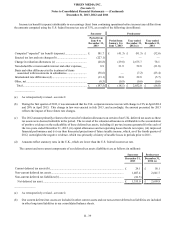

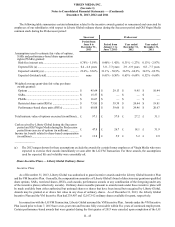

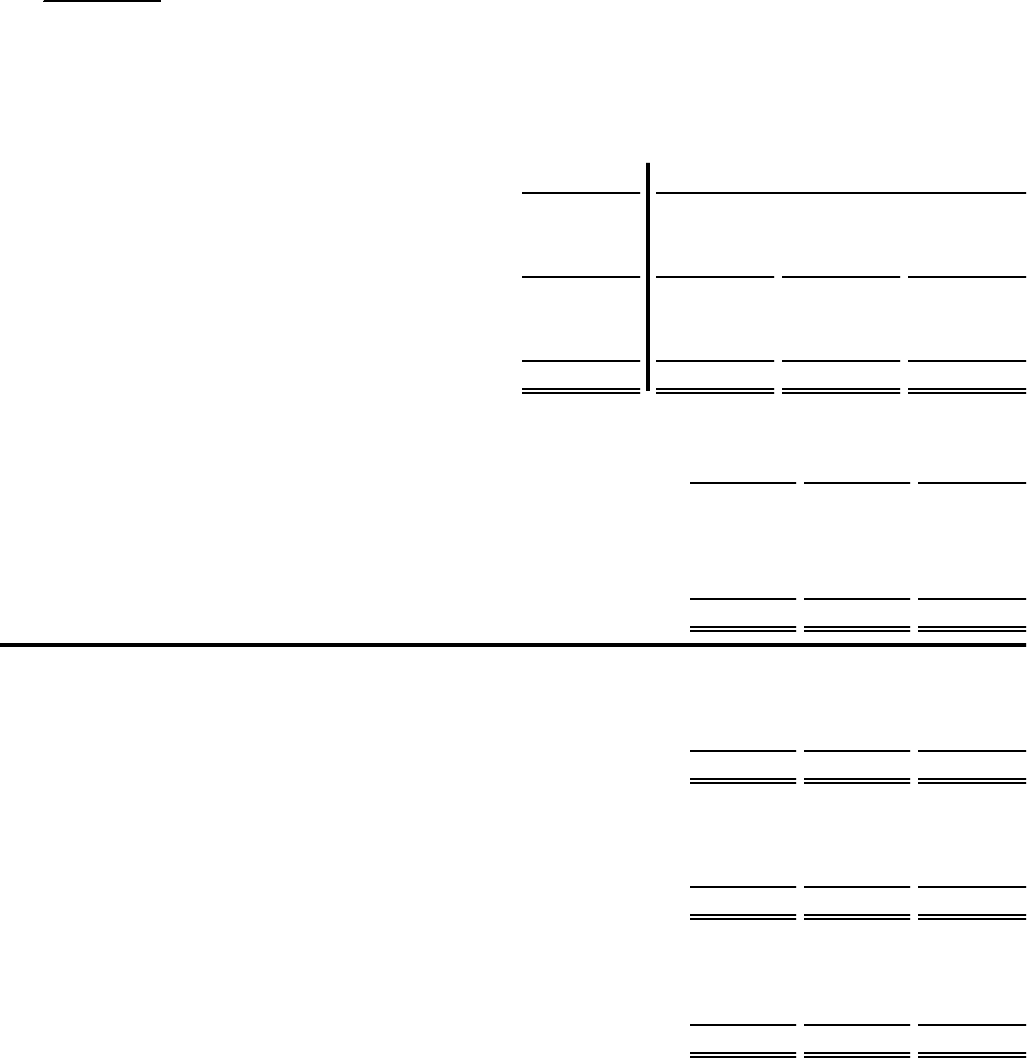

The components of our earnings (loss) from continuing operations before income taxes are as follows (in millions):

Successor Predecessor

Period from

June 8 to

December 31,

2013

Period from

January 1 to

June 7, 2013

Year ended

December 31,

2012

Year ended

December 31,

2011

U.S. .............................................................................................. £(56.6) £ (68.8) £ 45.4 £ (122.4)

U.K............................................................................................... (233.9) 186.8 216.0 215.5

Total........................................................................................... £(290.5) £ 118.0 £ 261.4 £ 93.1

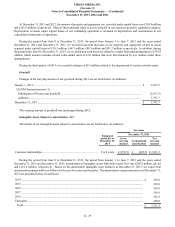

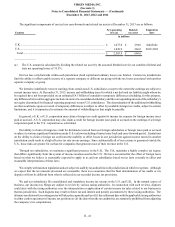

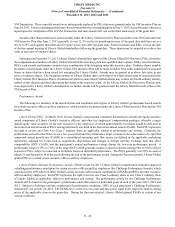

Income tax benefit (expense) consists of:

Current Deferred Total

in millions

Period from June 8 to December 31, 2013:

U.S. (a) ................................................................................................................... £(0.3) £ (1.9) £ (2.2)

U.K......................................................................................................................... —(195.3)(195.3)

Total................................................................................................................... £(0.3) £ (197.2) £ (197.5)

Period from January 1 to June 7, 2013:

U.S. (a) ................................................................................................................... £(0.9) £ 12.8 £ 11.9

U.K......................................................................................................................... —(30.0)(30.0)

Total................................................................................................................... £(0.9) £ (17.2) £ (18.1)

Year ended December 31, 2012 (b):

U.S. (a) ................................................................................................................... £(0.6) £ 103.4 £ 102.8

U.K......................................................................................................................... 0.1 2,549.1 2,549.2

Total................................................................................................................... £(0.5) £ 2,652.5 £ 2,652.0

Year ended December 31, 2011:

U.S. (a) ................................................................................................................... £(1.0) £ 3.2 £ 2.2

U.K......................................................................................................................... 5.1 (23.3)(18.2)

Total................................................................................................................... £ 4.1 £ (20.1) £ (16.0)

_______________

(a) Includes federal and state income taxes. Our U.S. state income taxes were not material during any of the years presented.

(b) As retrospectively revised - see note 2.