Virgin Media 2013 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.III - 22

Impairment of Property and Equipment and Intangible Assets

Carrying Value. The aggregate carrying value of our property and equipment and intangible assets (including goodwill) that

were held for use comprised 74% of our total assets at December 31, 2013.

We review, when circumstances warrant, the carrying amounts of our property and equipment and our intangible assets (other

than goodwill) to determine whether such carrying amounts continue to be recoverable. Such changes in circumstance may include,

among other items, (i) an expectation of a sale or disposal of a long-lived asset or asset group, (ii) adverse changes in market or

competitive conditions, (iii) an adverse change in legal factors or business climate in the markets in which we operate and

(iv) operating or cash flow losses. For purposes of impairment testing, long-lived assets are grouped at the lowest level for which

cash flows are largely independent of other assets and liabilities, generally at or below the reporting unit level (see below). If the

carrying amount of the asset or asset group is greater than the expected undiscounted cash flows to be generated by such asset or

asset group, an impairment adjustment is recognized. Such adjustment is measured by the amount that the carrying value of such

asset or asset group exceeds its fair value. We generally measure fair value by considering (a) sale prices for similar assets,

(b) discounted estimated future cash flows using an appropriate discount rate and/or (c) estimated replacement cost. Assets to be

disposed of are carried at the lower of their financial statement carrying amount or fair value less costs to sell.

We evaluate the goodwill for impairment at least annually on October 1 and whenever other facts and circumstances indicate

that the carrying amounts of goodwill may not be recoverable. For impairment evaluations on goodwill, we first make a qualitative

assessment to determine if the goodwill may be impaired. If it is more likely than not that a reporting unit’s fair value is less than

its carrying value, we then compare the fair value of the reporting unit to its respective carrying amount. A reporting unit is an

operating segment or one level below an operating segment (referred to as a “component”). We have identified one reporting unit

to which all goodwill is assigned. If the carrying value of a reporting unit were to exceed its fair value, we would then compare

the implied fair value of the reporting unit’s goodwill to its carrying amount, and any excess of the carrying amount over the fair

value would be charged to operations as an impairment loss.

When required, considerable management judgment is necessary to estimate the fair value of reporting units and underlying

long-lived and indefinite-lived assets. We typically determine fair value using an income-based approach (discounted cash flows)

based on assumptions in our long-range business plans and, in some cases, a combination of an income-based approach and a

market-based approach. With respect to our discounted cash flow analysis used in the income-based approach, the timing and

amount of future cash flows under these business plans require estimates, among other items, of subscriber growth and retention

rates, rates charged per product, expected gross margin and operating cash flow margins and expected property and equipment

additions. The development of these cash flows, and the discount rate applied to the cash flows, is subject to inherent uncertainties,

and actual results could vary significantly from such estimates. Our determination of the discount rate is based on a weighted

average cost of capital approach, which uses a market participant’s cost of equity and after-tax cost of debt and reflects the risks

inherent in the cash flows. Based on the results of our 2013 qualitative assessment of our reporting unit carrying value, we

determined that it was more-likely-than-not that fair value exceeded carrying value for the reporting unit.

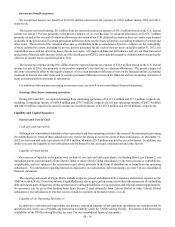

During the period from June 8 to December 31, 2013, the period from January 1 to June 7, 2013 and the years ended

December 31, 2012 and December 31, 2011, we recorded no material impairments of our property and equipment and intangible

assets (including goodwill). For additional information, see note 6 to our consolidated financial statements.

If, among other factors, (i) Liberty Global’s equity values were to decline significantly, or (ii) the adverse impacts of economic,

competitive, regulatory or other factors were to cause our results of operations or cash flows to be worse than anticipated, we could

conclude in future periods that impairment charges are required in order to reduce the carrying values of our goodwill and, to a

lesser extent, other long-lived assets. Any such impairment charges could be significant.

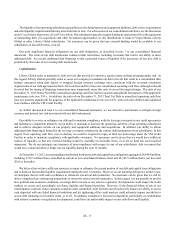

Costs Associated with Construction and Installation Activities

We capitalize costs associated with the construction of new cable transmission and distribution facilities and the installation

of new cable services. Installation activities that are capitalized include (i) the initial connection (or drop) from our cable system

to a customer location, (ii) the replacement of a drop and (iii) the installation of equipment for additional services, such as digital

cable, telephone or broadband internet service. The costs of other customer-facing activities such as reconnecting customer

locations where a drop already exists, disconnecting customer locations and repairing or maintaining drops, are expensed as

incurred.