Virgin Media 2013 Annual Report Download - page 39

Download and view the complete annual report

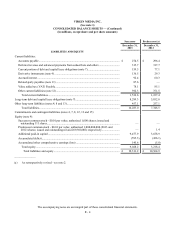

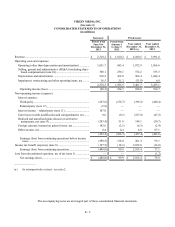

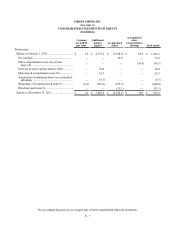

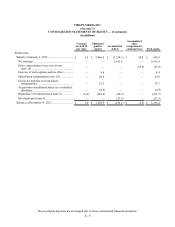

Please find page 39 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VIRGIN MEDIA INC.

(See note 1)

Notes to Consolidated Financial Statements — (Continued)

December 31, 2013, 2012 and 2011

II - 14

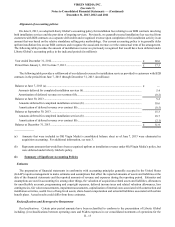

years ended December 31, 2012 and 2011 and (ii) the reclassification of premiums paid on debt redemptions from net cash provided

by operating activities to net cash used in financing activities in the statements of cash flows for the years ended December 31,

2012 and 2011.

Retrospective Restatement. During the first quarter of 2013 and subsequent to the initial filing of our Annual Report on Form

10-K/A for the year ended December 31, 2012, we discovered that the reported amount of deferred income tax assets as of December

31, 2012 and the reported income tax benefit for the year ended December 31, 2012 were understated by £60.8 million. This

understatement was principally caused by an error in the calculation of our deferred tax assets relating to arrangements that we

account for as capital leases.

We determined that the understatement was not material to the consolidated financial statements as of and for the year ended

December 31, 2012. However, if the adjustments to correct the understatement of our deferred income tax assets had been recorded

in the three months ended March 31, 2013, we believe the impact would have been significant to that period. Therefore, we

determined that it was appropriate to correct the error to the consolidated financial statements as of and for the year ended December

31, 2012 by correcting the comparative 2012 periods in the consolidated financial statements as of and for the year ending December

31, 2013, beginning with the condensed consolidated financial statements for the three months ended March 31, 2013.

The December 31, 2012 consolidated balance sheet included in this annual report reflects the correction of this understatement

by increasing the previously reported amounts of our total deferred tax assets and total shareholders’ equity by £60.8 million and

by decreasing the previously reported amount of accumulated deficit by £60.8 million. Prior to the fourth quarter of 2012, we

maintained a full valuation allowance on our deferred income tax assets. If we had not understated our deferred income tax assets

in periods prior to the fourth quarter of 2012, we would have increased the valuation allowance on those deferred income tax assets

by a corresponding amount, resulting in no net impact on the consolidated balance sheets, statements of operations or statements

of comprehensive earnings. The income tax benefit for the year ended December 31, 2012 has increased by £60.8 million from

previously reported amounts.

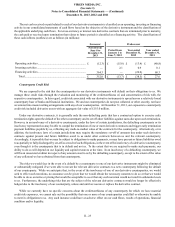

Principles of Consolidation

The accompanying consolidated financial statements include our accounts and the accounts of all voting interest entities where

we exercise a controlling financial interest through the ownership of a direct or indirect controlling voting interest and variable

interest entities for which our company is the primary beneficiary. All significant intercompany accounts and transactions have

been eliminated in consolidation.

Cash and Cash Equivalents and Restricted Cash

Cash equivalents consist of money market funds and other investments that are readily convertible into cash and have maturities

of three months or less at the time of acquisition. We record money market funds at the net asset value reported by the investment

manager as there are no restrictions on our ability, contractual or otherwise, to redeem our investments at the stated net asset value

reported by the investment manager.

Restricted cash consists of cash held in restricted accounts, including cash held as collateral for debt and other compensating

balances. Restricted cash amounts that are required to be used to purchase long-term assets or repay long-term debt are classified

as long-term assets. All other cash that is restricted to a specific use is classified as current or long-term based on the expected

timing of the disbursement. At December 31, 2013 and 2012, our aggregate current and long-term restricted cash balances

aggregated £1.5 million and £1.9 million, respectively.

Our significant non-cash investing and financing activities are disclosed in our consolidated statements of equity and in notes

3, 6, and 7.

Trade Receivables

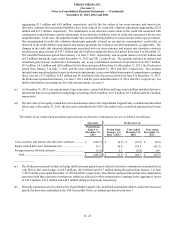

Our trade receivables are reported net of an allowance for doubtful accounts. Such allowance aggregated £13.1 million and

£9.0 million at December 31, 2013 and 2012, respectively. The allowance for doubtful accounts is based upon our assessment of

probable loss related to uncollectible accounts receivable. We use a number of factors in determining the allowance, including,