Virgin Media 2013 Annual Report Download - page 41

Download and view the complete annual report

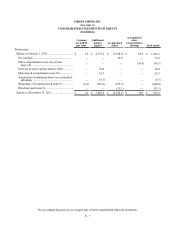

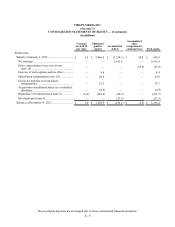

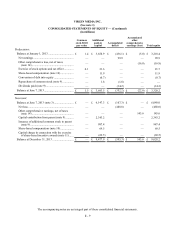

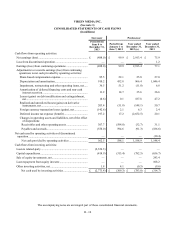

Please find page 41 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VIRGIN MEDIA INC.

(See note 1)

Notes to Consolidated Financial Statements — (Continued)

December 31, 2013, 2012 and 2011

II - 16

customer premises equipment whereby we accrue the cost to dispose of certain of our customer premises equipment at the time

of acquisition. In addition, asset retirement obligations may arise from the loss of rights of way that we obtain from local

municipalities or other relevant authorities. Under certain circumstances, the authorities could require us to remove our network

equipment from an area if, for example, we were to discontinue using the equipment for an extended period of time or the authorities

were to decide not to renew our access rights. However, because the rights of way are integral to our ability to deliver broadband

communications services to our customers, we expect to conduct our business in a manner that will allow us to maintain these

rights for the foreseeable future. In addition, we have no reason to believe that the authorities will not renew our rights of way

and, historically, renewals have been granted. We also have obligations in lease agreements to restore the property to its original

condition or remove our property at the end of the lease term.

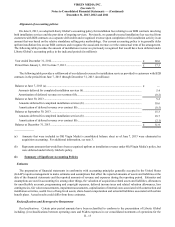

As of December 31, 2013 and 2012, the recorded value of our asset retirement obligations was £30.0 million and £62.4 million,

respectively.

Intangible Assets

Our primary intangible assets relate to goodwill and customer relationships. Goodwill represents the excess purchase price

over the fair value of the identifiable net assets acquired in a business combination. Customer relationships were originally recorded

at their fair values in connection with business combinations.

Goodwill is not amortized, but instead is tested for impairment at least annually. Intangible assets with finite lives are amortized

on a straight-line basis over their respective estimated useful lives to their estimated residual values, and reviewed for impairment

when a triggering event occurs.

For additional information regarding the useful lives of our intangible assets, see note 6.

Impairment of Property and Equipment and Intangible Assets

We review, when circumstances warrant, the carrying amounts of our property and equipment and our intangible assets (other

than goodwill) to determine whether such carrying amounts continue to be recoverable. Such changes in circumstance may include,

among other items, (i) an expectation of a sale or disposal of a long-lived asset or asset group, (ii) adverse changes in market or

competitive conditions, (iii) an adverse change in legal factors or business climate in the markets in which we operate and

(iv) operating or cash flow losses. For purposes of impairment testing, long-lived assets are grouped at the lowest level for which

cash flows are largely independent of other assets and liabilities, generally at or below the reporting unit level (see below). If the

carrying amount of the asset or asset group is greater than the expected undiscounted cash flows to be generated by such asset or

asset group, an impairment adjustment is recognized. Such adjustment is measured by the amount that the carrying value of such

asset or asset group exceeds its fair value. We generally measure fair value by considering (a) sale prices for similar assets,

(b) discounted estimated future cash flows using an appropriate discount rate and/or (c) estimated replacement cost. Assets to be

disposed of are carried at the lower of their financial statement carrying amount or fair value less costs to sell.

We evaluate the goodwill for impairment at least annually on October 1 and whenever other facts and circumstances indicate

that the carrying amounts of goodwill may not be recoverable. For impairment evaluations with respect to goodwill, we first make

a qualitative assessment to determine if the goodwill may be impaired. If it is more-likely-than-not that a reporting unit’s fair

value is less than its carrying value, we then compare the fair value of the reporting unit to its respective carrying amount. A

reporting unit is an operating segment or one level below an operating segment (referred to as a “component”). We have identified

one reporting unit to which all goodwill is assigned. If the carrying value of a reporting unit were to exceed its fair value, we

would then compare the implied fair value of the reporting unit’s goodwill to its carrying amount, and any excess of the carrying

amount over the fair value would be charged to operations as an impairment loss.