Virgin Media 2013 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

III - 20

due to higher capital expenditures and (iii) an increase in cash used of £108.2 million associated with a loan repayment from an

equity investee during 2011.

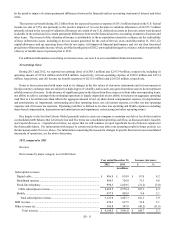

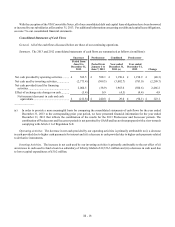

A reconciliation of our consolidated property and equipment additions to our consolidated capital expenditures as reported in

the consolidated statements of cash flows is set forth below:

Year ended December 31,

2012 2011

in millions

Property and equipment additions .................................................................................................... £ 883.4 £ 763.0

Assets acquired under capital leases................................................................................................. (88.9)(91.2)

Changes in current liabilities related to capital expenditures........................................................... (12.0)(15.1)

Capital expenditures ......................................................................................................................... £ 782.5 £ 656.7

The increase in our property and equipment additions is primarily due to the net effect of (i) an increase in expenditures for

new build and upgrade projects to expand services and (ii) a decrease in expenditures for the purchase and installation of customer

premises equipment. During 2012 and 2011, our property and equipment additions represented 21.5% and 19.1% of our revenue,

respectively.

Financing Activities. The decrease in net cash used by our financing activities is primarily attributable to the net effect of (i)

a decrease in cash used of £433.3 million related to higher net borrowings of debt, (ii) a decrease in cash used of £304.8 million

due to lower repurchases of common stock, (iii) an increase in cash used of £125.1 million due to higher payments of financing

costs and debt premiums and (vi) an increase in cash used of £94.3 million due to lower cash received related to derivative

instruments.

Off Balance Sheet Arrangements

In the ordinary course of business, we may provide indemnifications to our lenders, our vendors and certain other parties and

performance and/or financial guarantees to local municipalities, our customers and vendors. Historically, these arrangements have

not resulted in our company making any material payments and we do not believe that they will result in material payments in the

future.

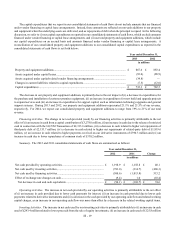

Contractual Commitments

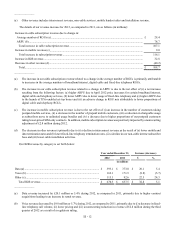

The pound sterling equivalents of our contractual commitments as of December 31, 2013 are presented below:

Payments due during:

2014 2015 2016 2017 2018 Thereafter Total

in millions

Debt (excluding interest)........................... £ 70.9 £ — £ — £ — £ 1,478.6 £ 6,542.9 £ 8,092.4

Capital leases (excluding interest)............. 87.0 62.0 34.3 7.5 0.1 34.6 225.5

Programming obligations .......................... 188.7 163.0 115.5 47.7 16.0 — 530.9

Network and connectivity commitments... 106.8 98.1 78.9 76.5 18.9 5.0 384.2

Purchase commitments.............................. 234.7 27.7 — — — — 262.4

Operating leases......................................... 37.6 32.2 25.5 18.9 13.1 51.7 179.0

Other commitments ................................... 89.5 66.8 36.6 26.4 9.8 — 229.1

Total (a)................................................. £ 815.2 £ 449.8 £ 290.8 £ 177.0 £ 1,536.5 £ 6,634.2 £ 9,903.5

Projected cash interest payments on debt

and capital lease obligations (b)............. £ 462.4 £ 458.7 £ 456.5 £ 453.3 £ 402.9 £ 879.7 £ 3,113.5