Virgin Media 2013 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.III - 17

The liquidity of our operating subsidiaries generally is used to fund property and equipment additions, debt service requirements

and other liquidity requirements that may arise from time to time. For a discussion of our consolidated cash flows, see the discussion

under Consolidated Statements of Cash Flows below. Our subsidiaries may also require funding in connection with (i) the repayment

of outstanding debt, (ii) acquisitions and other investment opportunities or (iii) distributions or loans to Virgin Media, Liberty

Global or other Liberty Global subsidiaries. No assurance can be given that any external funding would be available to our

subsidiaries on favorable terms, or at all.

Our most significant financial obligations are our debt obligations, as described in note 7 to our consolidated financial

statements. The terms of our debt instruments contain certain restrictions, including covenants that restrict our ability to incur

additional debt. As a result, additional debt financing is only a potential source of liquidity if the incurrence of any new debt is

permitted by the terms of our existing debt instruments.

Capitalization

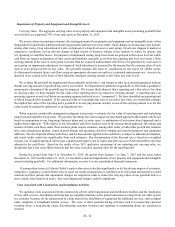

Liberty Global seeks to maintain its debt at levels that provide for attractive equity returns without assuming undue risk. In

this regard, Liberty Global generally seeks to cause our company to maintain our debt at levels that result in a consolidated debt

balance (measured using debt figures at swapped foreign currency exchange rates, consistent with the covenant calculation

requirements of our debt agreements) that is between four and five times our consolidated operating cash flow, although it should

be noted that the timing of financing transactions may temporarily cause this ratio to exceed the targeted range. The ratio of our

December 31, 2013 Senior Net Debt to annualized operating cash flow (last two quarters annualized) for purposes of the applicable

maintenance tests was 3.91x. In addition, the ratio of our December 31, 2013 Total Net Debt to annualized operating cash flow

(last two quarters annualized) for purposes of the applicable maintenance tests was 4.63x, with each ratio defined and calculated

in accordance with the VM Credit Facility.

As further discussed in note 4 to our consolidated financial statements, we use derivative instruments to mitigate foreign

currency and interest rate risk associated with our debt instruments.

Our ability to service or refinance our debt and to maintain compliance with the leverage covenants in our credit agreements

and indentures is dependent primarily on our ability to maintain or increase the operating cash flow of our operating subsidiaries

and to achieve adequate returns on our property and equipment additions and acquisitions. In addition, our ability to obtain

additional debt financing is limited by the leverage covenants contained in the various debt instruments of our subsidiaries. In this

regard, if our operating cash flow were to decline, we could be required to repay or limit our borrowings under the VM Credit

Facility in order to maintain compliance with applicable covenants. No assurance can be given that we would have sufficient

sources of liquidity, or that any external funding would be available on favorable terms, or at all, to fund any such required

repayment. We do not anticipate any instances of non-compliance with respect to any of our subsidiaries’ debt covenants that

would have a material adverse impact on our liquidity during the next 12 months.

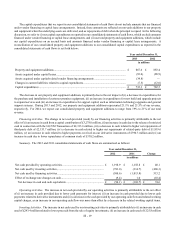

At December 31, 2013, our outstanding consolidated third-party debt and capital lease obligations aggregated £8,448.8 million,

including £159.5 million that is classified as current in our consolidated balance sheet and £8,185.5 million that is not due until

2018 or thereafter.

We believe that we have sufficient resources to repay or refinance the current portion of our debt and capital lease obligations

and to fund our foreseeable liquidity requirements during the next 12 months. However, as our maturing debt grows in later years,

we anticipate that we will seek to refinance or otherwise extend our debt maturities. No assurance can be given that we will be

able to complete these refinancing transactions or otherwise extend our debt maturities. In this regard, it is not possible to predict

how political and economic conditions, sovereign debt concerns or any adverse regulatory developments could impact the credit

markets we access and, accordingly, our future liquidity and financial position. However, (i) the financial failure of any of our

counterparties could (a) reduce amounts available under committed credit facilities and (b) adversely impact our ability to access

cash deposited with any failed financial institution and (ii) tightening of the credit markets could adversely impact our ability to

access debt financing on favorable terms, or at all. In addition, sustained or increased competition, particularly in combination

with adverse economic or regulatory developments, could have an unfavorable impact on our cash flows and liquidity.