Virgin Media 2013 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC.

(See note 1)

Notes to Consolidated Financial Statements — (Continued)

December 31, 2013, 2012 and 2011

II - 18

Sale of Multiple Products and Services. We sell digital cable, broadband internet and fixed-line telephony services to our

customers in bundled packages at a rate lower than if the customer purchased each product on a standalone basis. Revenue from

bundled packages generally is allocated proportionally to the individual services based on the relative standalone price for each

respective service.

Mobile Revenue. We recognize revenue from mobile services in the period the related services are provided. Revenue from

pre-pay customers is recorded as deferred revenue prior to the commencement of services and is recognized as the services are

rendered or usage rights expire. Mobile handset revenue is recognized to the extent of cash collected when the goods have been

delivered and title has passed.

B2B Revenue. For periods beginning on or after June 8, 2013, we defer upfront installation and certain nonrecurring fees

received on B2B contracts where we maintain ownership of the installed equipment. The deferred fees are amortized into revenue

on a straight-line basis over the term of the arrangement or the expected period of performance. For information regarding our

policy prior to June 8, 2013, see note 1.

Promotional Discounts. For subscriber promotions, such as discounted or free services during an introductory period, revenue

is recognized only to the extent of the discounted monthly fees charged to the subscriber, if any.

Subscriber Advance Payments and Deposits. Payments received in advance for the services we provide are deferred and

recognized as revenue when the associated services are provided.

Sales and Other Value-added Taxes. Revenue is recorded net of applicable sales and other value-added taxes.

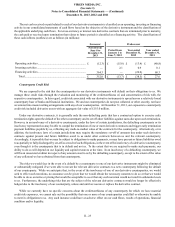

Share-Based Compensation

Share-based compensation expense prior to the LG/VM Transaction includes amounts for options, shares and performance

shares related to the common stock of Old Virgin Media. Share-based compensation expense after the LG/VM Transaction

represents amounts allocated to our company by Liberty Global.

We recognize all share-based payments from Liberty Global to employees of our subsidiaries, including grants of employee

share incentive awards based on their grant-date fair values and Liberty Global’s estimates of forfeitures. We recognize the fair

value of outstanding options as a charge to operations over the vesting period. The cash benefits of tax deductions in excess of

deferred taxes on recognized compensation expense are reported as a financing cash flow.

We use the straight-line method to recognize share-based compensation expense for Liberty Global’s outstanding share awards

to employees of our subsidiaries that do not contain a performance condition and the accelerated expense attribution method for

our outstanding share awards that contain a performance condition and vest on a graded basis. We also recognize the equity

component of deferred compensation as additional paid-in capital.

Liberty Global has calculated the expected life of options and share appreciation rights (SARs) granted by Liberty Global to

employees based on historical exercise trends. The expected volatility for Liberty Global options and SARs is generally based on

a combination of (i) historical volatilities of Liberty Global ordinary shares for a period equal to the expected average life of the

Liberty Global awards and (ii) volatilities implied from publicly traded Liberty Global options.

For additional information regarding our share-based compensation, see note 10.

Litigation Costs

Legal fees and related litigation costs are expensed as incurred.

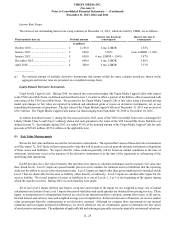

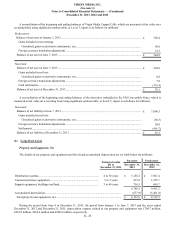

(3) LG/VM Transaction

Pursuant to the terms and conditions of an Agreement and Plan of Merger agreement (the LG/VM Transaction Agreement)

between LGI and Old Virgin Media: