Virgin Media 2013 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC.

(See note 1)

Notes to Consolidated Financial Statements — (Continued)

December 31, 2013, 2012 and 2011

II - 25

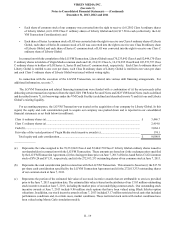

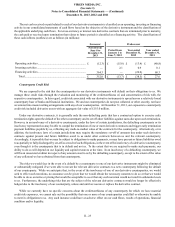

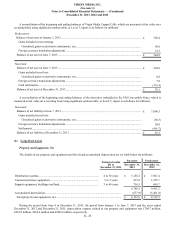

Interest Rate Swaps:

The terms of our outstanding interest rate swap contracts at December 31, 2013, which are held by VMIH, are as follows:

Final maturity date (a) Notional amount Interest rate due from

counterparty Interest rate due to

counterparty

in millions

October 2018 ................................................. £ 2,155.0 6 mo. LIBOR 1.52%

January 2021.................................................. £ 650.0 5.50% 6 mo. LIBOR + 1.84%

January 2021.................................................. £ 650.0 6 mo. LIBOR + 1.84% 3.87%

December 2015.............................................. £ 600.0 6 mo. LIBOR 2.86%

April 2018...................................................... £ 300.0 6 mo. LIBOR 1.37%

______________

(a) The notional amount of multiple derivative instruments that mature within the same calendar month are shown in the

aggregate and interest rates are presented on a weighted average basis.

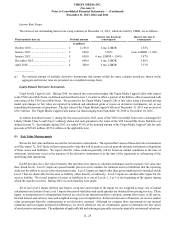

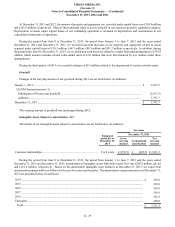

Equity-Related Derivative Instruments

Virgin Media Capped Calls. During 2010, we entered into conversion hedges (the Virgin Media Capped Calls) with respect

to the VM Convertible Notes, as defined and described in note 7, in order to offset a portion of the dilutive effects associated with

conversion of the VM Convertible Notes. We account for the Virgin Media Capped Calls at fair value using a binomial pricing

model and changes in fair value are reported in realized and unrealized gains or losses on derivative instruments, net, in our

consolidated statements of operations. The fair value of the Virgin Media Capped Calls as of December 31, 2013 was an asset of

£20.1 million. The Virgin Media Capped Calls mature on dates ranging from September 30, 2016 to November 10, 2016.

As further described in note 7, during the Successor period in 2013, most of the VM Convertible Notes were exchanged for

Liberty Global Class A and Class C ordinary shares and cash pursuant to the terms of the VM Convertible Notes Indenture (as

defined in note 7). Accordingly, during 2013, we settled 93.8% of the notional amount of the Virgin Media Capped Calls for cash

proceeds of $534.8 million (£353.4 million at the applicable rate).

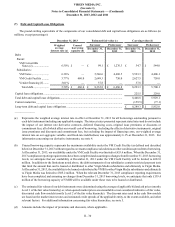

(5) Fair Value Measurements

We use the fair value method to account for our derivative instruments. The reported fair values of these derivative instruments

as of December 31, 2013 likely will not represent the value that will be paid or received upon the ultimate settlement or disposition

of these assets and liabilities. We expect that the values realized generally will be based on market conditions at the time of

settlement, which may occur at the maturity of the derivative instrument or at the time of the repayment or refinancing of the

underlying debt instrument.

GAAP provides for a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value into

three broad levels. Level 1 inputs are quoted market prices in active markets for identical assets or liabilities that the reporting

entity has the ability to access at the measurement date. Level 2 inputs are inputs other than quoted market prices included within

Level 1 that are observable for the asset or liability, either directly or indirectly. Level 3 inputs are unobservable inputs for the

asset or liability. We record transfers of assets or liabilities in or out of Levels 1, 2 or 3 at the beginning of the quarter during

which the transfer occurred. During 2013, no such transfers were made.

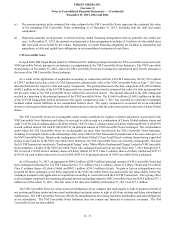

All of our Level 2 inputs (interest rate futures, swap rates and certain of the inputs for our weighted average cost of capital

calculations) and certain of our Level 3 inputs (forecasted volatilities and credit spreads) are obtained from pricing services. These

inputs, or interpolations or extrapolations thereof, are used in our internal models to calculate, among other items, yield curves,

forward interest and currency rates and weighted average cost of capital rates. In the normal course of business, we receive market

value assessments from the counterparties to our derivative contracts. Although we compare these assessments to our internal

valuations and investigate unexpected differences, we do not otherwise rely on counterparty quotes to determine the fair values

of our derivative instruments. The midpoints of applicable bid and ask ranges generally are used as inputs for our internal valuations.