Virgin Media 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC.

(See note 1)

Notes to Consolidated Financial Statements — (Continued)

December 31, 2013, 2012 and 2011

II - 36

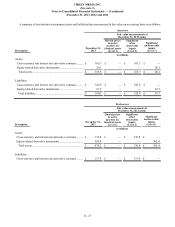

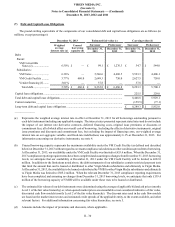

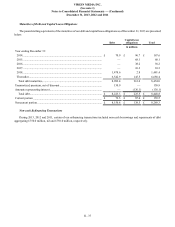

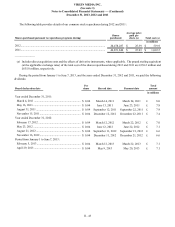

The details of our borrowings under the VM Credit Facility as of December 31, 2013 are summarized in the following table:

Facility Final maturity date Interest rate

Facility amount

(in borrowing

currency)

Unused

borrowing

capacity (a) Carrying

value (b)

in millions

A........................................................ June 7, 2019 LIBOR +3.25% £ 375.0 £ — £ 375.0

B........................................................ June 7, 2020 LIBOR +2.75% (c) $ 2,755.0 — 1,655.3

C........................................................ June 7, 2020 LIBOR +3.75% (c) £ 600.0 — 597.2

Revolving Facility............................. June 7, 2019 LIBOR +3.25% £ 660.0 660.0 —

Total................................................................................................................................................. £ 660.0 £ 2,627.5

______________

(a) At December 31, 2013 our availability under the VM Credit Facility was limited to £653.6 million. When the relevant

December 31, 2013 compliance reporting requirements have been completed and assuming no changes from December 31,

2013 borrowing levels, we anticipate that our availability will be limited to £622.0 million. The VM Revolving Facility

has a commitment fee on unused and uncanceled balances of 1.3% per year.

(b) The carrying values of VM Facilities B and C include the impact of discounts.

(c) VM Facilities B and C have a LIBOR floor of 0.75%.

MergerCo Bridge Facility Agreement

On June 5, 2013, a subsidiary of Liberty Global entered into a short-term unsecured bridge credit facility agreement as the

borrower in an aggregate principal amount of approximately $3,545.0 million (£2,281.9 million at the applicable rate) (the MergerCo

Bridge Facility Agreement), with amounts borrowed applied towards paying the consideration for the LG/VM Transaction together

with any related fees, costs and expenses. This facility was assumed by our company on June 7, 2013 as a part of the LG/VM

Transaction.

Amounts borrowed under the MergerCo Bridge Facility Agreement were repaid on June 12, 2013 using proceeds from the

issuance of the April 2021 VM Senior Secured Notes and the 2023 VM Senior Notes. There was no margin or interest payable

under the MergerCo Bridge Facility Agreement. However, the lender was paid a commitment fee. The MergerCo Bridge Facility

Agreement was an unsecured credit facility.