Virgin Media 2013 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC.

(See note 1)

Notes to Consolidated Financial Statements — (Continued)

December 31, 2013, 2012 and 2011

II - 13

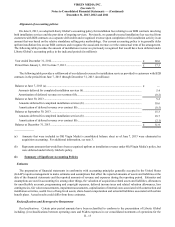

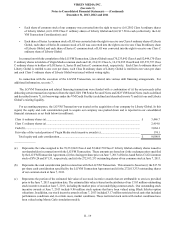

Alignment of accounting policies

On June 8, 2013, we adopted Liberty Global’s accounting policy for installation fees relating to our B2B contracts involving

both installation services and the provision of ongoing services. Previously, we generally treated installation fees received from

customers with B2B contracts as a separate deliverable and recognized revenue upon completion of the installation activity in an

amount that was based on the relative standalone selling price methodology. Our current accounting policy is to generally defer

upfront installation fees on our B2B contracts and recognize the associated revenue over the contractual term of the arrangement.

The following table provides the amount of installation revenue we previously recognized that would have been deferred under

Liberty Global’s accounting policy in the indicated periods (in millions):

Year ended December 31, 2012.............................................................................................................................. £ 69.6

Period from January 1, 2013 to June 7, 2013 ......................................................................................................... £ 17.5

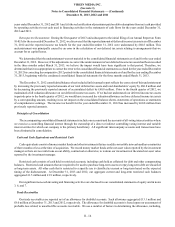

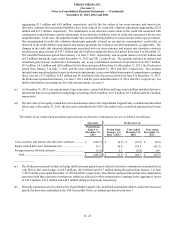

The following table provides a rollforward of our deferred revenue for installation services provided to customers with B2B

contracts in the period from June 7, 2013 through December 31, 2013 (in millions):

Balance at June 7, 2013 (a)..................................................................................................................................... £ —

Amounts deferred for completed installation services (b)................................................................................. 5.4

Amortization of deferred revenue over contract life.......................................................................................... (0.2)

Balance at June 30, 2013 ........................................................................................................................................ 5.2

Amounts deferred for completed installation services (b) ................................................................................ 10.6

Amortization of deferred revenue over contract life......................................................................................... (0.5)

Balance at September 30, 2013 .............................................................................................................................. 15.3

Amounts deferred for completed installation services (b) ................................................................................ 18.7

Amortization of deferred revenue over contract life......................................................................................... (2.1)

Balance at December 31, 2013............................................................................................................................... £ 31.9

______________

(a) Amounts that were included in Old Virgin Media’s consolidated balance sheet as of June 7, 2013 were eliminated in

acquisition accounting. For additional information, see note 3.

(b) Represents amounts that would have been recognized upfront as installation revenue under Old Virgin Media’s policy, but

were deferred under Liberty Global’s policy.

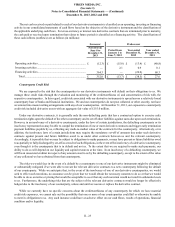

(2) Summary of Significant Accounting Policies

Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States

(GAAP) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the

date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Estimates and

assumptions are used in accounting for, among other things, the valuation of acquisition-related assets and liabilities, allowances

for uncollectible accounts, programming and copyright expenses, deferred income taxes and related valuation allowances, loss

contingencies, fair value measurements, impairment assessments, capitalization of internal costs associated with construction and

installation activities, useful lives of long-lived assets, share-based compensation and actuarial liabilities associated with certain

benefit plans. Actual results could differ from those estimates.

Reclassifications and Retrospective Restatement

Reclassifications. Certain prior period amounts have been reclassified to conform to the presentation of Liberty Global

including (i) reclassifications between operating costs and SG&A expenses in our consolidated statements of operations for the