Virgin Media 2013 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC.

(See note 1)

Notes to Consolidated Financial Statements — (Continued)

December 31, 2013, 2012 and 2011

II - 23

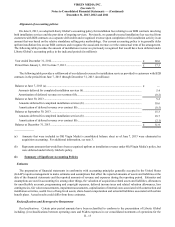

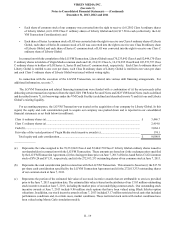

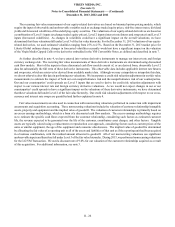

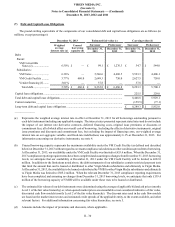

The net cash received or paid related to each of our derivative instruments is classified as an operating, investing or financing

activity in our consolidated statements of cash flows based on the objective of the derivative instrument and the classification of

the applicable underlying cash flows. For cross-currency or interest rate derivative contracts that are terminated prior to maturity,

the cash paid or received upon termination that relates to future periods is classified as a financing activity. The classification of

these cash inflows (outflows) are as follows (in millions):

Successor Predecessor

Period from

June 8 to

December 31,

2013

Period from

January 1 to

June 7, 2013

Year ended

December 31,

2012

Year ended

December 31,

2011

Operating activities................................................................... £(12.3) £ (15.8) £ (13.4) £ (40.8)

Investing activities.................................................................... — 2.1 0.9 0.1

Financing activities................................................................... 364.3 — (26.0) 68.3

Total..................................................................................... £ 352.0 £ (13.7) £ (38.5) £ 27.6

Counterparty Credit Risk

We are exposed to the risk that the counterparties to our derivative instruments will default on their obligations to us. We

manage these credit risks through the evaluation and monitoring of the creditworthiness of, and concentration of risk with, the

respective counterparties. In this regard, credit risk associated with our derivative instruments is spread across a relatively broad

counterparty base of banks and financial institutions. We and our counterparties do not post collateral or other security, nor have

we entered into master netting arrangements with any of our counterparties. At December 31, 2013, our exposure to counterparty

credit risk included derivative assets with an aggregate fair value of £155.0 million.

Under our derivative contracts, it is generally only the non-defaulting party that has a contractual option to exercise early

termination rights upon the default of the other counterparty and to set off other liabilities against sums due upon such termination.

However, in an insolvency of a derivative counterparty, under the laws of certain jurisdictions, the defaulting counterparty or its

insolvency representatives may be able to compel the termination of one or more derivative contracts and trigger early termination

payment liabilities payable by us, reflecting any mark-to-market value of the contracts for the counterparty. Alternatively, or in

addition, the insolvency laws of certain jurisdictions may require the mandatory set-off of amounts due under such derivative

contracts against present and future liabilities owed to us under other contracts between us and the relevant counterparty.

Accordingly, it is possible that we may be subject to obligations to make payments, or may have present or future liabilities owed

to us partially or fully discharged by set-off as a result of such obligations, in the event of the insolvency of a derivative counterparty,

even though it is the counterparty that is in default and not us. To the extent that we are required to make such payments, our

ability to do so will depend on our liquidity and capital resources at the time. In an insolvency of a defaulting counterparty, we

will be an unsecured creditor in respect of any amount owed to us by the defaulting counterparty, except to the extent of the value

of any collateral we have obtained from that counterparty.

The risks we would face in the event of a default by a counterparty to one of our derivative instruments might be eliminated

or substantially mitigated if we were able to novate the relevant derivative contracts to a new counterparty following the default

of our counterparty. While we anticipate that, in the event of the insolvency of one of our derivative counterparties, we would

seek to effect such novations, no assurance can be given that we would obtain the necessary consents to do so or that we would

be able to do so on terms or pricing that would be acceptable to us or that any such novation would not result in substantial costs

to us. Furthermore, the underlying risks that are the subject of the relevant derivative contracts would no longer be effectively

hedged due to the insolvency of our counterparty, unless and until we novate or replace the derivative contract.

While we currently have no specific concerns about the creditworthiness of any counterparty for which we have material

credit risk exposures, we cannot rule out the possibility that one or more of our counterparties could fail or otherwise be unable

to meet its obligations to us. Any such instance could have an adverse effect on our cash flows, results of operations, financial

condition and/or liquidity.