Virgin Media 2013 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.III - 2

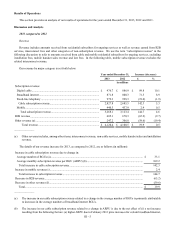

As of December 31, 2013, our network passed 12,520,100 homes and served 12,261,700 revenue generating units (RGUs),

consisting of 4,375,700 broadband internet subscribers, 4,136,400 fixed-line telephony subscribers, and 3,749,600 digital cable

subscribers. We also served 2,990,200 mobile subscribers.

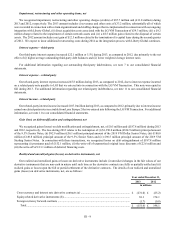

We added 19,500 RGUs on an organic basis during 2013, as compared to 248,300 RGUs that we added on an organic basis

during 2012. The organic RGU growth during 2013 is attributable to the growth of our broadband internet services, which added

103,500 RGUs partially offset by declines in (i) fixed-line telephony services, which declined by 42,700 RGUs, and (ii) digital

cable services, which declined by 41,300 RGUs.

We lost 7,400 mobile subscribers during 2013, as compared to growth of 200 mobile subscribers during 2012. The organic

loss during 2013 is attributable to a decrease in our prepaid mobile subscribers, which declined by 209,100 subscribers, partially

offset by the growth in our postpaid mobile subscribers, which added 201,700 subscribers.

In addition to competition, our operations are subject to macroeconomic and political risks that are outside of our control.

For example, high levels of sovereign debt in the U.S. and certain European countries, combined with weak growth and high

unemployment, could lead to fiscal reforms (including austerity measures), sovereign debt restructurings, currency

instability, increased counterparty credit risk, high levels of volatility and, potentially, disruptions in the credit and equity markets,

as well as other outcomes that might adversely impact our company.

The digital cable, broadband internet and fixed-line telephony businesses in which we operate are capital intensive. Significant

additions to our property and equipment are required to add customers to our network and to upgrade our broadband communications

network and customer premises equipment to enhance our service offerings and improve the customer experience, including

expenditures for equipment and labor costs. Significant competition, the introduction of new technologies, the expansion of

existing technologies such as fiber-to-the-home, -cabinet, -building or -node and advanced DSL technologies, or adverse regulatory

developments could cause us to decide to undertake previously unplanned upgrades of our networks and customer premises

equipment in the impacted markets. In addition, no assurance can be given that any future upgrades will generate a positive return

or that we will have adequate capital available to finance such future upgrades. If we are unable to, or elect not to, pay for costs

associated with adding new customers, expanding or upgrading our networks or making our other planned or unplanned additions

to our property and equipment, our growth could be limited and our competitive position could be harmed. For information

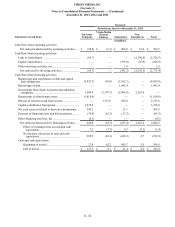

regarding our property and equipment additions, see Liquidity and Capital Resources — Consolidated Statements of Cash Flows

below.

We rely on third-party vendors for the equipment, software and services that we require in order to provide services to our

customers. Our suppliers often conduct business worldwide and their ability to meet our needs are subject to various risks, including

political and economic instability, natural calamities, interruptions in transportation systems, terrorism and labor issues. As a

result, we may not be able to obtain the equipment, software and services required for our businesses on a timely basis or on

satisfactory terms. Any shortfall in customer premises equipment could lead to delays in connecting customers to our services,

and accordingly, could adversely impact our ability to maintain or increase our RGUs, revenue and cash flows.

On July 12, 2010, we completed the sale of our television channel business known as Virgin Media TV. Virgin Media TV’s

operations comprised our former Content segment. Our consolidated financial statements reflect Virgin Media TV as a discontinued

operation.

LG/VM Transaction

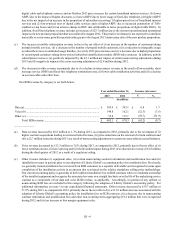

Virgin Media became a wholly-owned subsidiary of Liberty Global as a result of the LG/VM Transaction, pursuant to which

Liberty Global became the publicly-held parent company of the successors by merger of Old Virgin Media and LGI. For further

information, see note 3 to our consolidated financial statements.

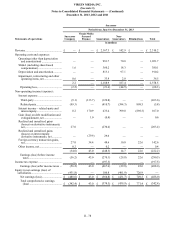

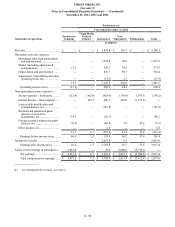

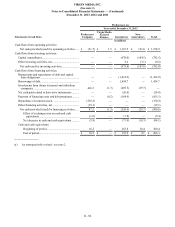

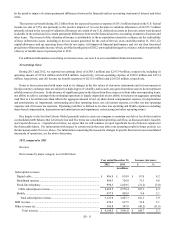

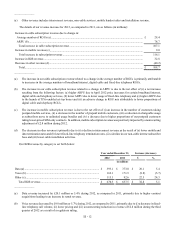

As a result of Liberty Global’s push-down of its investment basis in Virgin Media arising from the LG/VM Transaction, a

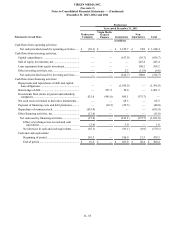

new basis of accounting was created on June 7, 2013. In the following discussion, the results of operations and cash flows of Old

Virgin Media for the periods ended on or prior to June 7, 2013 and the financial position of Old Virgin Media as of balance sheet

dates prior to June 7, 2013 are referred to herein as “Predecessor” consolidated financial information and the results of operations

and cash flows of Virgin Media for periods beginning on June 8, 2013 and the financial position of Virgin Media as of June 7,

2013 and subsequent balance sheet dates are referred to herein as “Successor” consolidated financial information.