Virgin Media 2013 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VIRGIN MEDIA INC.

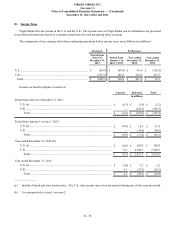

(See note 1)

Notes to Consolidated Financial Statements — (Continued)

December 31, 2013, 2012 and 2011

II - 35

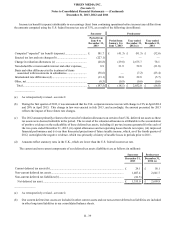

premiums paid of £152.1 million, (ii) the write-off of unamortized original issue discounts of £22.6 million and (iii) the write-off

of £13.1 million of deferred financing costs.

During 2011, the net proceeds of the January 2021 VM Senior Secured Notes, a new £750.0 million senior credit facility (that

was repaid during 2013 as noted above) and existing cash and cash equivalents were used to redeem the existing senior credit

facility and $550.0 million (£332.0 million) of our then existing principal amount of 9.125% senior notes. In connection with

these transactions, we recognized losses on debt extinguishments of £47.2 million, representing the write-off of £30.7 million of

deferred financing costs and premiums paid of £16.5 million.

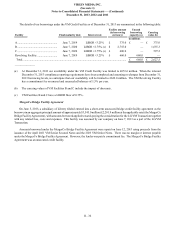

VM Credit Facility

On June 7, 2013, VMIH, together with certain other subsidiaries of Virgin Media as borrowers and guarantors (the Virgin

Media Borrowing Group) entered into a new senior secured credit facility agreement, as amended and restated on June 14, 2013

(the VM Credit Facility), pursuant to which the lenders thereunder agreed to provide the borrowers with (i) a £375.0 million term

loan (VM Facility A), (ii) a $2,755.0 million (£1,662.9 million) term loan (VM Facility B), (iii) a £600.0 million term loan (VM

Facility C) and (iv) a £660.0 million revolving credit facility (the VM Revolving Facility). With the exception of the VM Revolving

Facility, all available amounts were borrowed under the VM Credit Facility in June 2013. In connection with the LG/VM

Transaction, we repaid our previous £750.0 million senior credit facility.

The VM Credit Facility requires that certain members of the Virgin Media Borrowing Group that generate not less than 80%

of such group’s EBITDA (as defined in the VM Credit Facility) in any financial year, guarantee the payment of all sums payable

under the VM Credit Facility and such group members are required to grant first-ranking security over all or substantially all of

their assets to secure the payment of all sums payable. In addition, the holding company of each borrower must give a share pledge

over its shares in such borrower.

In addition to mandatory prepayments which must be made for certain disposal proceeds (subject to certain de minimis

thresholds), the lenders may cancel their commitments and declare the loans due and payable after 30 business days following the

occurrence of a change of control in respect of VMIH, subject to certain exceptions.

The VM Credit Facility contains certain customary events of default, the occurrence of which, subject to certain exceptions

and materiality qualifications, would allow the lenders to (i) cancel the total commitments, (ii) accelerate all outstanding loans

and terminate their commitments thereunder and/or (iii) declare that all or part of the loans be payable on demand. The VM Credit

Facility contains certain representations and warranties customary for facilities of this type, which are subject to exceptions, baskets

and materiality qualifications.

The VM Credit Facility restricts the ability of certain members of the Virgin Media Borrowing Group to, among other things,

(i) incur or guarantee certain financial indebtedness, (ii) make certain disposals and acquisitions and (iii) create certain security

interests over their assets, in each case, subject to carve-outs from such limitations.

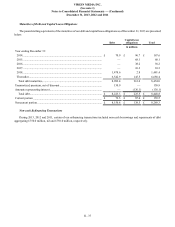

The VM Credit Facility requires the borrowers to observe certain affirmative undertakings or covenants, which covenants are

subject to materiality and other customary and agreed exceptions. In addition, the VM Credit Facility also requires compliance

with various financial covenants such as Senior Net Debt to Annualized EBITDA and Total Net Debt to Annualized EBITDA,

each capitalized term as defined in the VM Credit Facility.

In addition to customary default provisions, the VM Credit Facility provides that any event of default with respect to

indebtedness of £50.0 million or more in the aggregate of Virgin Media Finance, and its subsidiaries is an event of default under

the VM Credit Facility.

The VM Credit Facility permits certain members of the Virgin Media Borrowing Group to make certain distributions and

restricted payments to its parent company (and indirectly to Liberty Global) through loans, advances or dividends subject to

compliance with applicable covenants.