Virgin Media 2013 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VIRGIN MEDIA INC.

(See note 1)

Notes to Consolidated Financial Statements — (Continued)

December 31, 2013, 2012 and 2011

II - 46

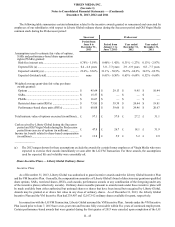

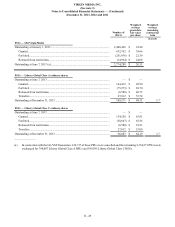

VM Transaction. These canceled awards were subsequently replaced by PSUs that were granted under the VM Incentive Plan on

June 24, 2013. For the remaining performance-based awards that were outstanding prior to June 7, 2013, the performance objectives

lapsed upon the completion of the LG/VM Transaction and such awards will vest on the third anniversary of the grant date.

Awards (other than performance-based awards) under the Liberty Global Incentive Plan issued after June 2005 and under the

VM Incentive Plan after June 7, 2013 generally (i) vest 12.5% on the six month anniversary of the grant date and then vest at a

rate of 6.25% each quarter thereafter and (ii) expire seven years after the grant date. Restricted shares and RSUs vest on the date

of the first annual meeting of Liberty Global shareholders following the grant date. These shares may be awarded at or above fair

value in any class of ordinary shares.

Subsequent to December 31, 2013, Liberty Global’s shareholders approved the Liberty Global 2014 Incentive Plan. Generally,

the compensation committee of Liberty Global’s board of directors may grant non-qualified share options, SARs, restricted shares,

RSUs, cash awards, performance awards or any combination of the foregoing under this incentive plan. Ordinary shares issuable

pursuant to awards made under the Liberty Global 2014 Incentive Plan will be made available from either authorized but unissued

shares or shares that have been issued but reacquired by Liberty Global. Awards may be granted at or above fair value in any

series of ordinary shares. The maximum number of Liberty Global shares with respect to which awards may be issued under the

Liberty Global 2014 Incentive Plan is 50 million (of which no more than 25 million shares may consist of Class B ordinary shares),

subject to anti-dilution and other adjustment provisions in the respective plan. As the Liberty Global 2014 Incentive Plan has now

been approved by Liberty Global’s shareholders, no further awards will be granted under the Liberty Global Incentive Plan or the

VM Incentive Plan.

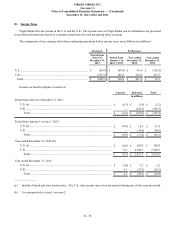

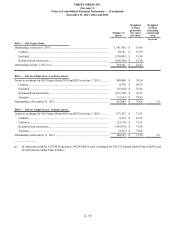

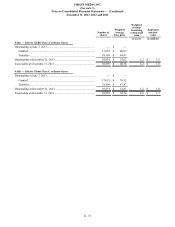

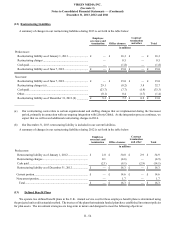

Performance Awards

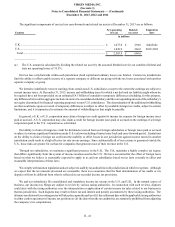

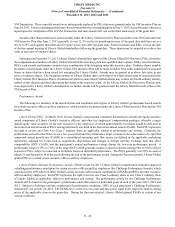

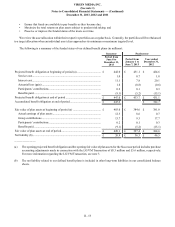

The following is a summary of the material terms and conditions with respect to Liberty Global’s performance-based awards

for certain executive officers and key employees, which awards were granted under the Liberty Global Incentive Plan and the VM

Incentive Plan.

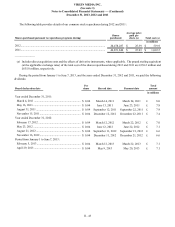

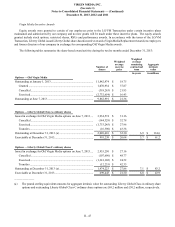

Liberty Global PSUs. In March 2010, Liberty Global’s compensation committee determined to modify the equity incentive

award component of Liberty Global’s executive officers’ and other key employees’ compensation packages, whereby a target

annual equity value would be set for each executive or key employee, of which approximately two-thirds would be delivered in

the form of an annual award of PSUs and approximately one-third in the form of an annual award of SARs. Each PSU represents

the right to receive one Class A or Class C ordinary share, as applicable, subject to performance and vesting. Generally, the

performance period for the PSUs covers a two-year period and the performance target is based on the achievement of a specified

compound annual growth rate (CAGR) in a consolidated operating cash flow metric (as defined in the applicable underlying

agreement), adjusted for events such as acquisitions, dispositions and changes in foreign currency exchange rates that affect

comparability (OCF CAGR), and the participant’s annual performance ratings during the two-year performance period. A

performance range of 75% to 125% of the target OCF CAGR generally results in award recipients earning 50% to 150% of their

respective PSUs, subject to reduction or forfeiture based on individual performance. The PSUs generally vest 50% on each of

March 31 and September 30 of the year following the end of the performance period. During the Successor period, Liberty Global

granted PSUs to certain of our executive officers and key employees.

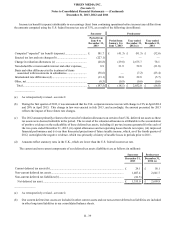

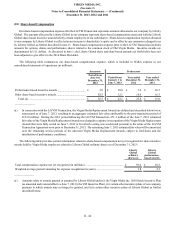

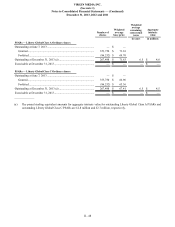

Liberty Global Challenge Performance Awards. Effective June 24, 2013, Liberty Global’s compensation committee approved

a challenge performance award plan for certain executive officers and key employees (the Challenge Performance Awards), which

consisted solely of PSARs for Liberty Global’s senior executive officers and a combination of PSARs and PSUs for other executive

officers and key employees. Each PSU represents the right to receive one Class A ordinary share or one Class C ordinary share

of Liberty Global, as applicable, subject to performance and vesting. The performance criteria for the Challenge Performance

Awards will be based on the participant’s performance and achievement of individual goals in each of the years 2013, 2014 and

2015. Subject to forfeitures and the satisfaction of performance conditions, 100% of each participant’s Challenge Performance

Awards will vest on June 24, 2016. The PSARs have a term of seven years and base prices equal to the respective market closing

prices of the applicable class on the grant date. During the Successor period, Liberty Global granted PSARs to certain of our

executive officers.