Virgin Media 2013 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC.

(See note 1)

Notes to Consolidated Financial Statements — (Continued)

December 31, 2013, 2012 and 2011

II - 33

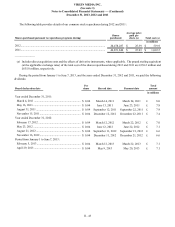

January 2021 VM Dollar Senior Secured Notes, (ii) £21.6 million of the January 2021 VM Sterling Senior Secured Notes, (iii)

$405.0 million (£244.5 million) of the 2022 VM 5.25% Dollar Senior Notes, (iv) $781.3 million (£471.6 million) of the 2022 VM

4.875% Dollar Senior Notes and (v) £355.9 million of the 2022 VM Sterling Senior Notes. With respect to the 2019 VM Senior

Notes and the 2018 VM Senior Secured Notes, Virgin Media previously had obtained consent from holders of such notes to waive

its repurchase obligations under the respective indentures related to the “Change of Control” provisions. The LG/VM Transaction

did not constitute a “Change of Control” event under the indentures governing the April 2021 VM Senior Secured Notes and the

2023 VM Senior Notes.

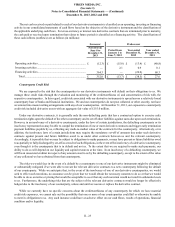

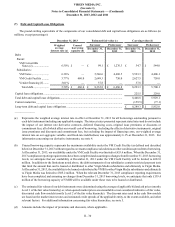

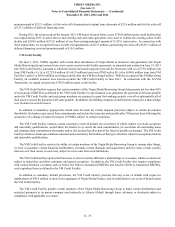

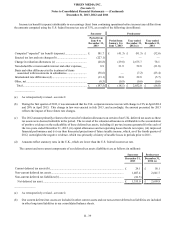

The details of the VM Notes as of December 31, 2013 are summarized in the following table:

Outstanding principal

amount

VM Notes Maturity Interest

rate Borrowing

currency

Pound

sterling

equivalent Estimated

fair value Carrying

value (a)

in millions

2018 VM Dollar Senior Secured Notes .... January 15, 2018 6.500% $ 1,000.0 £ 603.6 £ 626.6 £ 629.3

2018 VM Sterling Senior Secured

Notes...................................................... January 15, 2018 7.000% £ 875.0 875.0 910.0 914.8

2019 VM Dollar Senior Notes .................. October 15, 2019 8.375% $ 507.1 306.1 334.4 336.3

2019 VM Sterling Senior Notes................ October 15, 2019 8.875% £ 253.5 253.5 276.9 277.5

January 2021 VM Dollar Senior Secured

Notes...................................................... January 15, 2021 5.250% $ 447.9 270.4 276.8 279.0

January 2021 VM Sterling Senior

Secured Notes........................................ January 15, 2021 5.500% £ 628.4 628.4 634.3 638.2

April 2021 VM Dollar Senior Secured

Notes...................................................... April 15, 2021 5.375% $ 1,000.0 603.6 608.9 603.6

April 2021 VM Sterling Senior Secured

Notes...................................................... April 15, 2021 6.000% £ 1,100.0 1,100.0 1,135.1 1,100.0

2022 VM 5.25% Dollar Senior Notes....... February 15, 2022 5.250% $ 95.0 57.3 51.1 57.9

2022 VM 4.875% Dollar Senior Notes..... February 15, 2022 4.875% $ 118.7 71.6 62.8 72.3

2022 VM Sterling Senior Notes................ February 15, 2022 5.125% £ 44.1 44.1 40.9 44.5

2023 VM Dollar Senior Notes .................. April 15, 2023 6.375% $ 530.0 319.9 327.7 319.9

2023 VM Sterling Senior Notes................ April 15, 2023 7.000% £ 250.0 250.0 261.1 250.0

Total................................................................................................................................ £ 5,383.5 £ 5,546.6 £ 5,523.3

______________

(a) Amounts include the impact of premiums and discounts, where applicable, including amounts recorded in connection with

the acquisition accounting for the LG/VM Transaction.

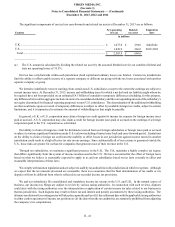

The VM Senior Notes are unsecured senior obligations of Virgin Media Finance that rank equally with all of the existing and

future senior debt of Virgin Media Finance and are senior to all existing and future subordinated debt of Virgin Media Finance.

The VM Senior Notes are guaranteed on a senior basis by our company and certain of our subsidiaries and on a senior subordinated

basis by VMIH and Virgin Media Investments Limited (VMIL).

The VM Senior Secured Notes are senior obligations of Virgin Media Secured Finance that rank equally with all of the existing

and future senior debt of Virgin Media Secured Finance and are senior to all existing and future subordinated debt of Virgin Media

Secured Finance. The VM Senior Secured Notes are guaranteed on a senior basis by our company and certain of our subsidiaries

(the VM Senior Secured Guarantors) and are secured by liens on substantially all of the assets of Virgin Media Secured Finance

and the VM Senior Secured Guarantors (except for Virgin Media). The VM Notes contain certain customary incurrence-based

covenants. For example, the ability to raise certain additional debt and make certain distributions or loans to other subsidiaries of

Liberty Global is subject to a Consolidated Leverage Ratio test, as defined in the applicable indenture. In addition, the VM Notes

provide that any failure to pay principal prior to expiration of any applicable grace period, or any acceleration with respect to other