Virgin Media 2013 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VIRGIN MEDIA INC.

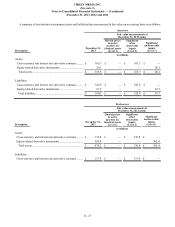

(See note 1)

Notes to Consolidated Financial Statements — (Continued)

December 31, 2013, 2012 and 2011

II - 31

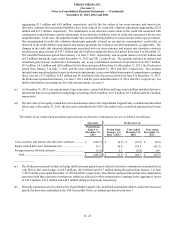

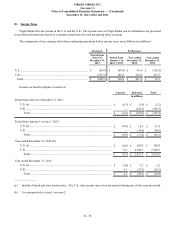

(e) The amount reported in the estimated fair value column for the VM Convertible Notes represents the estimated fair value

of the remaining VM Convertible Notes outstanding as of December 31, 2013, including both the debt and equity

components.

(f) Represents amounts owed pursuant to interest-bearing vendor financing arrangements that are generally due within one

year. At December 31, 2013, the amount owed pursuant to these arrangements includes £3.0 million of value-added taxes

that were paid on our behalf by the vendor. Repayments of vendor financing obligations are included in repayments and

repurchases of debt and capital lease obligations in our consolidated statements of cash flows.

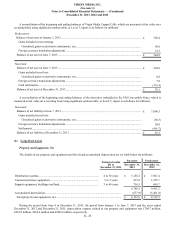

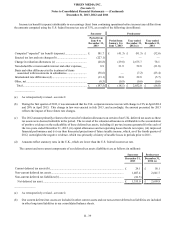

VM Convertible Notes

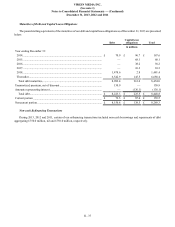

In April 2008, Old Virgin Media issued $1.0 billion (£603.6 million) principal amount of 6.50% convertible senior notes (the

VM Convertible Notes), pursuant to an indenture (as supplemented, the VM Convertible Notes Indenture). The VM Convertible

Notes mature on November 15, 2016, unless the VM Convertible Notes are exchanged or repurchased prior thereto pursuant to

the terms of the VM Convertible Notes Indenture.

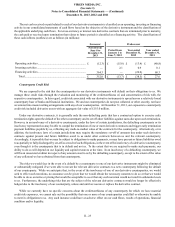

As a result of the application of acquisition accounting in connection with the LG/VM Transaction, the $2,716.8 million

(£1,748.7 million on the date of the LG/VM Transaction) estimated fair value of the VM Convertible Notes at June 7, 2013 was

allocated between the respective debt and equity components. The portion allocated to the debt component of $1,056.8 million

(£680.2 million on the date of the LG/VM Transaction) was measured based on the estimated fair value of a debt instrument that

has the same terms as the VM Convertible Notes without the conversion feature. The amount allocated to the debt component

resulted in a premium to the principal amount of the VM Convertible Notes. The $1,660.0 million (£1,068.5 million on the date

of the LG/VM Transaction) portion allocated to the equity component at June 7, 2013 was recorded as a derivative instrument

included within current liabilities in our consolidated balance sheet. The equity component is accounted for as an embedded

derivative that requires bifurcation from the debt instrument due to the fact that the conversion option is indexed to Liberty Global

shares.

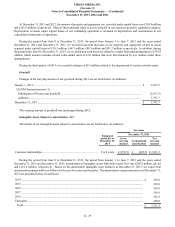

The VM Convertible Notes are exchangeable under certain conditions for (subject to further adjustment as provided in the

VM Convertible Notes Indenture and subject to our right to settle in cash or a combination of Liberty Global ordinary shares and

cash) 13.4339 Class A ordinary shares of Liberty Global, 10.0312 Class C ordinary shares of Liberty Global and $910.51 (£549.59)

in cash (without interest) for each $1,000 (£603.61) in principal amount of VM Convertible Notes exchanged. The circumstances

under which the VM Convertible Notes are exchangeable are more fully described in the VM Convertible Notes Indenture,

including, for example, based on the relationship of the value of the LG/VM Transaction Consideration to the conversion price of

the VM Convertible Notes. Based on the trading prices of Liberty Global’s Class A and Class C ordinary shares during a specified

period, as provided for in the VM Convertible Notes Indenture, the VM Convertible Notes are currently exchangeable. Because

the LG/VM Transaction constituted a “Fundamental Change” and a “Make-Whole Fundamental Change” under the VM Convertible

Notes Indenture, a holder of the VM Convertible Notes who exchanged such notes at any time from June 7, 2013 through July 9,

2013 received 13.8302 Class A ordinary shares of Liberty Global, 10.3271 Class C ordinary shares of Liberty Global and $937.37

(£565.81) in cash (without interest) for each $1,000 (£603.61) in principal amount of VM Convertible Notes exchanged.

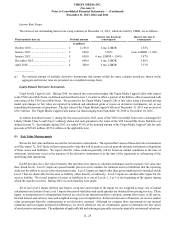

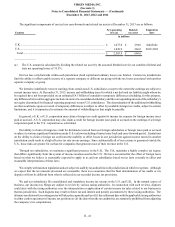

As of December 31, 2013, an aggregate of $944.2 million (£569.9 million) principal amount of VM Convertible Notes had

been exchanged following the LG/VM Transaction for 13.1 million Class A ordinary shares of Liberty Global and 9.8 million

Class C ordinary shares of Liberty Global and $885.1 million (£534.3 million) of cash. No gain or loss on extinguishment was

recorded for these exchanges as the debt component of the VM Convertible Notes was measured at fair value shortly before the

exchanges pursuant to the application of acquisition accounting in connection with the LG/VM Transaction. After giving effect

to all exchanges completed, the remaining principal amount outstanding under the VM Convertible Notes was $54.8 million (£33.1

million) as of December 31, 2013. The fair value of the derivative liability at December 31, 2013 was £67.3 million.

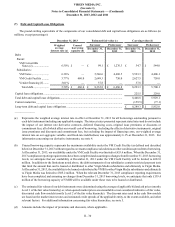

The VM Convertible Notes are senior unsecured obligations of our company that rank equally in right of payment with all of

our existing and future senior and unsecured indebtedness and ranks senior in right to all of our existing and future subordinated

indebtedness. The VM Convertible Notes are effectively subordinated to all existing and future indebtedness and other obligations

of our subsidiaries. The VM Convertible Notes Indenture does not contain any financial or restrictive covenants. The VM

Convertible Notes are non-callable.