Virgin Media 2013 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC.

(See note 1)

Notes to Consolidated Financial Statements — (Continued)

December 31, 2013, 2012 and 2011

II - 42

Tax returns filed by our company or our subsidiaries for years prior to 2008 are no longer subject to examination by tax

authorities.

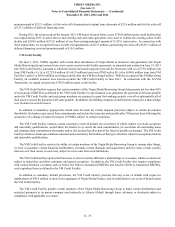

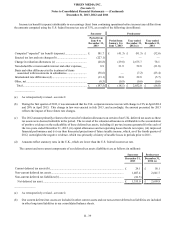

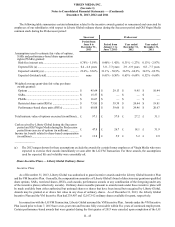

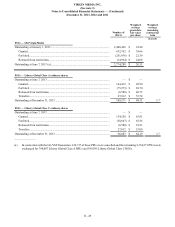

The changes in our unrecognized tax benefits are summarized below (in millions):

Successor Predecessor

Period from

June 8 to

December 31,

2013

Period from

January 1 to

June 7, 2013

Year ended

December 31,

2012

Year ended

December 31,

2011

Balance at beginning of period .................................................... £ 8.3 £ 7.9 £ 10.2 £ 9.9

Reductions for tax positions of prior years.................................. (0.6) — (0.3) —

Additions based on tax positions related to the current year ....... — 0.4 — 0.3

Lapse of statute of limitations...................................................... — — (1.7) —

Foreign currency translation ........................................................ — — (0.3) —

Balance at end of period .............................................................. £ 7.7 £ 8.3 £ 7.9 £ 10.2

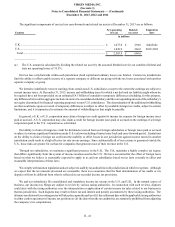

No assurance can be given that any of these tax benefits will be recognized or realized.

As of December 31, 2013, our unrecognized tax benefits did not include any tax benefits that would have a favorable impact

on our effective income tax rate if ultimately recognized, after considering amounts that we would expect to be offset by valuation

allowances.

We do not expect that any changes in our unrecognized tax benefits during 2014 will have a material impact on our unrecognized

tax benefits. No assurance can be given as to the nature or impact of any changes in our unrecognized tax positions during 2014.

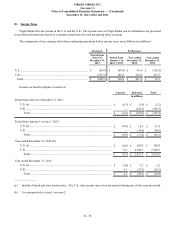

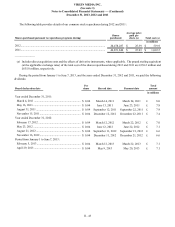

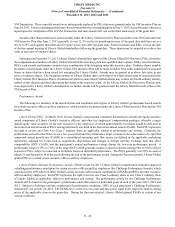

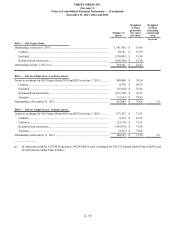

(9) Equity

On June 7, 2013, as a result of the LG/VM Transaction, all of Old Virgin Media’s issued share capital was cancelled with the

holders becoming entitled to receive the LG/VM Transaction Consideration of $17.50 and 0.2582 Class A ordinary shares in Liberty

Global and 0.1928 Class C ordinary shares in Liberty Global. Virgin Media has 111 shares of common stock outstanding.

During the 2013 Successor period, we received capital contributions of £2,343.2 million comprising (i) a cash contribution

of £2,290.6 million (equivalent at the transaction date) that was used to repay amounts outstanding under the MergerCo Bridge

Facility Agreement, (ii) a non-cash contribution of £40.6 million (equivalent at the transaction date) related to certain deferred

financing costs and (iii) a non-cash contribution of £12.0 million (equivalent at the transaction date) relating to the transfer of

shares of Old Virgin Media held in a trust to a trust consolidated by Liberty Global in exchange for a note. For additional information,

see note 11.

In addition, during the fourth quarter of 2013, we received cash consideration of £987.4 million from Lynx Europe 2 Limited

(Lynx Europe 2), our immediate parent, in exchange for 11 additional shares of our common stock. The proceeds from the issuance

of these shares were used to repay a demand note owed to Liberty Global for the Liberty Global ordinary shares that were used,

together with cash consideration, to settle the exchanged VM Convertible Notes. For additional information, see note 7 .

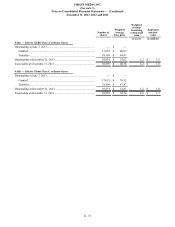

During 2012 and 2011, Old Virgin Media’s board of directors authorized various stock repurchase programs. Under these

plans, we received authorization to acquire up to the specified amount of Old Virgin Media common stock from time to time

through open market or privately negotiated transactions. These stock repurchase programs were cancelled during 2013 as a result

of the LG/VM Transaction. During the 2013 Predecessor period, we did not issue or repurchase any common stock.