Virgin Media 2013 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

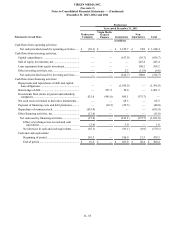

VIRGIN MEDIA INC.

(See note 1)

Notes to Consolidated Financial Statements — (Continued)

December 31, 2013, 2012 and 2011

II - 84

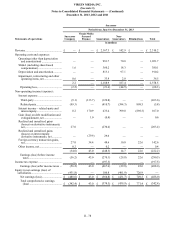

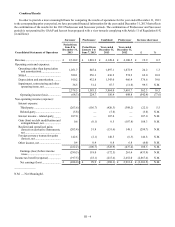

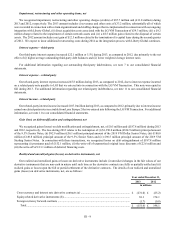

Predecessor (a)

Year ended December 31, 2012

Statements of cash flows Predecessor

Company

Virgin Media

Secured

Finance Guarantors Non-

Guarantors Total

in millions

Cash flows from operating activities:

Net cash provided (used) by operating activities...... £(91.5) £ 1.5 £ 1,167.9 £ 121.0 £ 1,198.9

Cash flows from investing activities:

Capital expenditures.................................................... — — (678.0)(104.5)(782.5)

Other investing activities, net...................................... — — 2.6 (3.1)(0.5)

Net cash used by investing activities........................ — — (675.4)(107.6)(783.0)

Cash flows from financing activities:

Repayments and repurchases of debt and capital

lease obligations ...................................................... — — (1,414.9) — (1,414.9)

Borrowings of debt...................................................... — — 1,454.7 — 1,454.7

Investments from (loans to) parent and subsidiary

companies................................................................ 436.5 (1.3)(405.5)(29.7) —

Net cash paid related to derivative instruments .......... — — (26.0) — (26.0)

Payment of financing costs and debt premiums.......... —(0.2)(164.9) — (165.1)

Repurchase of common stock ..................................... (330.2) — — — (330.2)

Other financing activities, net..................................... (19.1) — — — (19.1)

Net cash provided (used) by financing activities...... 87.2 (1.5)(556.6)(29.7)(500.6)

Effect of exchange rates on cash and cash

equivalents........................................................ (1.6) — (7.8) — (9.4)

Net decrease in cash and cash equivalents........... (5.9) — (71.9)(16.3)(94.1)

Cash and cash equivalents:

Beginning of period ............................................. 16.2 — 263.8 20.4 300.4

End of period........................................................ £ 10.3 £ — £ 191.9 £ 4.1 £ 206.3

_________________

(a) As retrospectively revised - see note 2.