Virgin Media 2013 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VIRGIN MEDIA INC.

(See note 1)

Notes to Consolidated Financial Statements — (Continued)

December 31, 2013, 2012 and 2011

II - 62

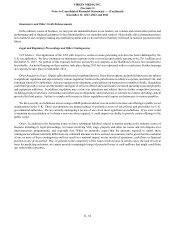

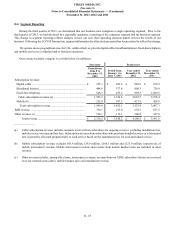

Guarantees and Other Credit Enhancements

In the ordinary course of business, we may provide indemnifications to our lenders, our vendors and certain other parties and

performance and/or financial guarantees to local municipalities, our customers and vendors. Historically, these arrangements have

not resulted in our company making any material payments and we do not believe that they will result in material payments in the

future.

Legal and Regulatory Proceedings and Other Contingencies

VAT Matters. Our application of the VAT with respect to certain revenue generating activities has been challenged by the

U.K. tax authorities. We have estimated our maximum exposure in the event of an unfavorable outcome to be £36.1 million as of

December 31, 2013. No portion of this exposure has been accrued by our company as the likelihood of loss is not considered to

be probable. An initial hearing on these matters took place during 2013 but was adjourned with no conclusion. Further hearings

are expected to take place in September 2014.

Other Regulatory Issues. Digital cable distribution, broadband internet, fixed-line telephony and mobile businesses are subject

to significant regulation and supervision by various regulatory bodies in the jurisdictions in which we operate, and other U.K. and

European Union (EU) authorities. Adverse regulatory developments could subject our businesses to a number of risks. Regulation

could limit growth, revenue and the number and types of services offered and could lead to increased operating costs and property

and equipment additions. In addition, regulation may restrict our operations and subject them to further competitive pressure,

including pricing restrictions, interconnect and other access obligations, and restrictions or controls on content, including content

provided by third parties. Failure to comply with current or future regulation could expose our businesses to various penalties.

We have security accreditations across a range of B2B products and services in order to increase our offerings to public sector

organizations in the U.K. These accreditations are granted subject to periodic reviews of our policies and procedures by U.K.

governmental authorities. We are currently undergoing a review of one of our most significant accreditations. If we were to fail

to maintain an accreditation or to obtain a new one when required, it could impact our ability to provide certain offerings to the

public sector.

Other. In addition to the foregoing items, we have contingent liabilities related to matters arising in the ordinary course of

business including (i) legal proceedings, (ii) issues involving VAT, wage, property and other tax issues and (iii) disputes over

interconnection, programming, and copyright fees. While we generally expect that the amounts required to satisfy these

contingencies will not materially differ from any estimated amounts we have accrued, no assurance can be given that the resolution

of one or more of these contingencies will not result in a material impact on our results of operations, cash flows or financial

position in any given period. Due, in general, to the complexity of the issues involved and, in certain cases, the lack of a clear

basis for predicting outcomes, we cannot provide a meaningful range of potential losses or cash outflows that might result from

any unfavorable outcomes.