SunTrust 2003 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2003 SunTrust Banks, Inc. 89

NOTE 24

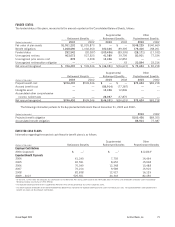

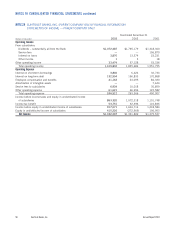

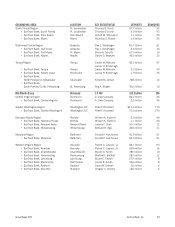

OTHER NONINTEREST INCOME AND FEES AND OTHER CHARGES

Other noninterest income in the Consolidated Statements of Income includes:

Year Ended December 31

(Dollars in thousands) 2003 2002 2001

Trading account profits and commissions $109,878 $103,170 $ 95,683

Other income 150,980 130,953 160,486

Total other noninterest income $260,858 $234,123 $256,169

Fees and other charges in the Consolidated Statements of Income include:

Other charges and fees $326,311 $296,860 $240,284

Investment banking income 192,480 176,960 108,486

Retail investment services 161,753 136,659 107,758

Credit card and other fees 119,585 119,982 113,640

Total fees and other charges $800,129 $730,461 $570,168

NOTE 25

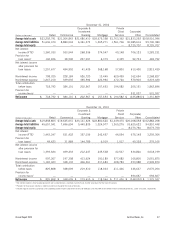

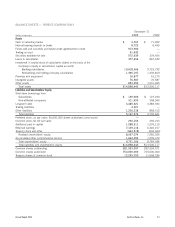

OTHER NONINTEREST EXPENSE

Other noninterest expense in the Consolidated Statements of Income includes:

Year Ended December 31

(Dollars in thousands) 2003 2002 2001

Outside processing and software $246,654 $225,169 $199,093

Credit and collection services 70,316 64,601 74,642

Postage and delivery 69,036 69,377 63,991

Amortization of intangible assets 64,515 58,898 46,258

Communications 61,261 64,845 59,232

Other staff expense 60,353 51,975 58,546

Consulting and legal 57,421 91,067 87,704

Operating supplies 39,837 46,795 48,297

FDIC premiums 17,958 17,352 15,985

Other expense 252,713 210,757 164,473

Total other noninterest expense $940,064 $900,836 $818,221

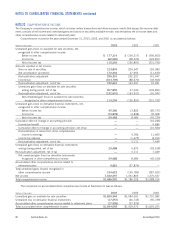

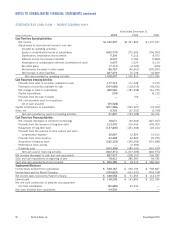

On January 1, 2001, an unrealized loss of $10.6 million,

net of tax, was recorded as a transition adjustment to other com-

prehensive income for the current value of cash flow hedges that

were not required to be marked to market prior to the adoption

SFAS No. 133. $3.1 million and $7.5 million of this transition

adjustment were reclassified from other comprehensive income as

an expense in 2002 and 2001, respectively. As of December 31,

2002, all of the transition adjustment had been reclassified to

income. Fair value adjustments to accumulated other compre-

hensive income for cash flow hedges in 2003 amounted to

$29.5 million, net of tax.

Other comprehensive income on December 31, 2003

included an unrealized loss of $17.3 million. In the next twelve

months, $12.6 million of these losses is expected to be reclassified

from other comprehensive income to the net interest margin.