SunTrust 2003 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34 SunTrust Banks, Inc. Annual Report 2003

MANAGEMENT’S DISCUSSION continued

$2,558.8 million, or 16.8%, and money market accounts

increased $1,747.6 million, or 8.5%, compared to 2002. The

continued uncertainty of the financial markets contributed to the

success of these initiatives.

LIQUIDITY MANAGEMENT

Liquidity risk is the risk of being unable to timely meet obligations as

they come due at a reasonable funding cost. SunTrust manages this

risk by maintaining borrowing resources to fund increases in assets

and replace maturing obligations or deposit withdrawals, both in the

normal course of business and in times of unusual events. In addi-

tion, the Company enters into off-balance sheet arrangements and

commitments which could impact the Company’s liquidity posi-

tion. These activities are discussed in the Off-Balance Sheet

Arrangements section on pages 35 through 37. The Asset Liability

Management Committee (ALCO) of the Company sets the policies

and reviews adherence to these policies.

The Company’s sources of funds include a large, stable

deposit base, secured advances from the Federal Home Loan

Bank and access to the capital markets. The Company struc-

tures its balance sheet so that illiquid assets, such as loans,

are funded through customer deposits, long-term debt, other

liabilities and capital.

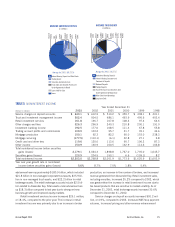

Customer-based core deposits, the Company’s largest and

most cost-effective source of funding, accounted for 65% of the

funding base on average for 2003, as compared to 69% in 2002.

The decrease over 2002 is largely attributable to funding growth in

loans held for sale and the investment portfolio, which have been

largely financed through wholesale funding sources. The yearly

average of customer deposits increased by 6.1%, or $4.0 billion,

from 2002 to 2003 reflecting a full year of the Huntington-Florida

branch acquisition, successful marketing campaigns and growth

from customer uncertainty due to volatility of the financial markets.

Increases in rates, improved economic activity and confidence in

the financial markets may lead to disintermediation of deposits,

which may need to be replaced with higher cost borrowings in

the future.

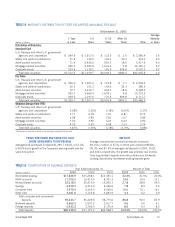

Net short-term unsecured borrowed funds, including whole-

sale domestic and international deposits and fed funds, totaled

$15.9 billion at year-end 2003, as compared to $14.7 billion

at year-end 2002. Net short-term unsecured borrowed funds

included $3.2 billion of commercial paper at December 31, 2003,

related to Three Pillars, which was not consolidated at year-end

2002. Total net wholesale funding, including short-term unsecured

borrowings, secured wholesale borrowings and long-term debt,

totaled $35.9 billion at year-end 2003, compared to $32.0 billion

at year-end 2002. Long-term debt increased from $11.9 billion at

December 31, 2002 to $15.3 billion at December 31, 2003.

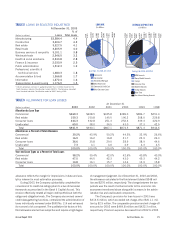

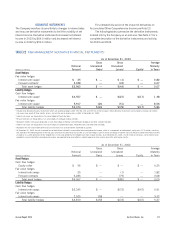

TABLE 16

LOAN MATURITY

At December 31, 2003

Remaining Maturities of Selected Loans

Within 1–5 After

(Dollars in millions) Total 1 Year Years 5 Years

Loan Maturity

Commercial1$26,553.8 $13,447.9 $ 9,105.8 $4,000.1

Real estate – construction 4,479.8 2,137.6 1,121.2 1,221.0

Total $31,033.6 $15,585.5 $10,227.0 $5,221.1

Interest Rate Sensitivity

Selected loans with:

Predetermined interest rates $1,701.7 $2,039.7

Floating or adjustable interest rates 8,525.3 3,181.4

Total $10,227.0 $5,221.1

1Excludes $4,128.1 million in lease financing.

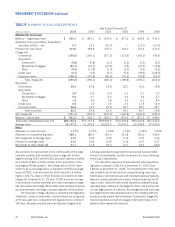

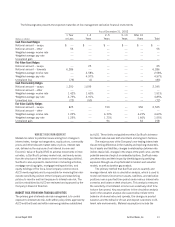

TABLE 17

MATURITY OF CONSUMER TIME AND OTHER TIME DEPOSITS IN AMOUNTS OF $100,000 OR MORE

At December 31, 2003

(Dollars in millions) Consumer Brokered Foreign Other Total

Months to Maturity

3 or less $1,267.2 $ 515.8 $5,080.8 $1.6 $ 6,865.4

Over 3 through 6 601.8 1,096.9 — — 1,698.7

Over 6 through 12 622.3 953.9 — — 1,576.2

Over 12 995.8 617.5 — — 1,613.3

Total $3,487.1 $3,184.1 $5,080.8 $1.6 $11,753.6