SunTrust 2003 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72 SunTrust Banks, Inc. Annual Report 2003

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

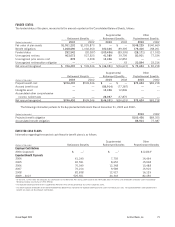

NOTE 13

LONG-TERM DEBT

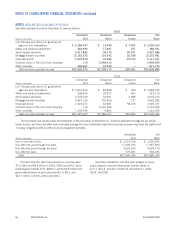

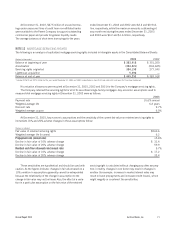

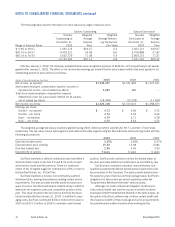

Long-term debt at December 31 consisted of the following:

(Dollars in thousands) 2003 2002

Parent Company Only

6.125% notes due 2004 $200,000 $200,000

7.375% notes due 2006 200,000 200,000

Floating rate notes due 2007 300,000 300,000

6.25% notes due 2008 294,250 294,250

7.75% notes due 2010 300,000 300,000

Floating rate notes due 2019 50,563 50,563

6.00% notes due 2026 200,000 200,000

Floating rate notes due 20271350,000 350,000

7.90% notes due 20271250,000 250,000

Floating rate notes due 20281250,000 250,000

6.00% notes due 2028 222,925 222,925

7.125% notes due 20311300,000 300,000

7.05% notes due 20311300,000 300,000

Capital lease obligations 1,111 1,977

Other 72,850 (12,237)

Total Parent Company (excluding intercompany

of $193,922 in 2003 and $176,456 in 2002) 3,291,699 3,207,478

Subsidiaries

Floating rate notes due 2004 850,000 —

8.75% notes due 2004 149,966 149,927

Floating rate notes due 2005 1,001,057 —

2.125% notes due 2006 149,979 —

2.50% notes due 2006 399,289 —

7.25% notes due 2006 249,655 249,528

6.90% notes due 2007 99,747 99,676

6.375% notes due 2011 1,000,949 1,001,076

5.45% notes due 2017 498,960 498,885

6.50% notes due 2018 141,119 141,393

8.16% notes due 20261200,000 200,000

Capital lease obligations 15,892 16,299

FHLB advances (2003: 0.50 – 8.79%, 2002: 0.50 – 8.79%) 6,847,124 6,274,240

Direct finance lease obligations 164,718 —

Other 253,768 41,318

Total subsidiaries 12,022,223 8,672,342

Total long-term debt $15,313,922 $11,879,820

1Notes payable to trusts formed to issue Trust Preferred Securities totaled $1.65 billion at December 31, 2003 and 2002.

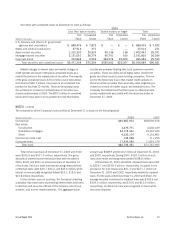

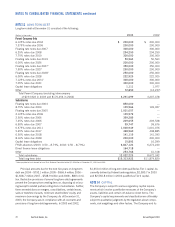

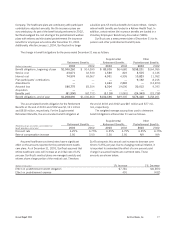

Principal amounts due for the next five years on long-term

debt are: 2004 – $792.1 million; 2005 – $966.4 million; 2006 –

$1,608.7 million; 2007 – $528.9 million; and 2008 – $803.4 mil-

lion. Restrictive provisions of several long-term debt agreements

prevent the Company from creating liens on, disposing of, or issu-

ing (except to related parties) voting stock of subsidiaries. Further,

there are restrictions on mergers, consolidations, certain leases,

sales or transfers of assets, minimum shareholders’ equity, and

maximum borrowings by the Company. As of December 31,

2003, the Company was in compliance with all covenants and

provisions of long-term debt agreements. In 2003 and 2002,

$1,650.0 million of long-term debt qualified as Tier 1 capital. As

currently defined by Federal bank regulators, $2,380.7 in 2003

and $2,560.8 million in 2002 qualified as Tier 2 capital.

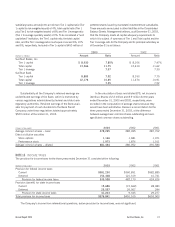

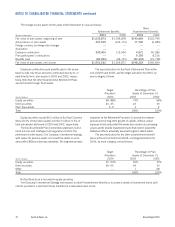

NOTE 14

CAPITAL

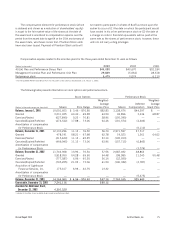

The Company is subject to various regulatory capital require-

ments which involve quantitative measures of the Company’s

assets, liabilities and certain off-balance sheet items. The

Company’s capital requirements and classification are ultimately

subject to qualitative judgments by the regulators about compo-

nents, risk weightings and other factors. The Company and its