SunTrust 2003 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

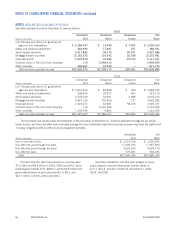

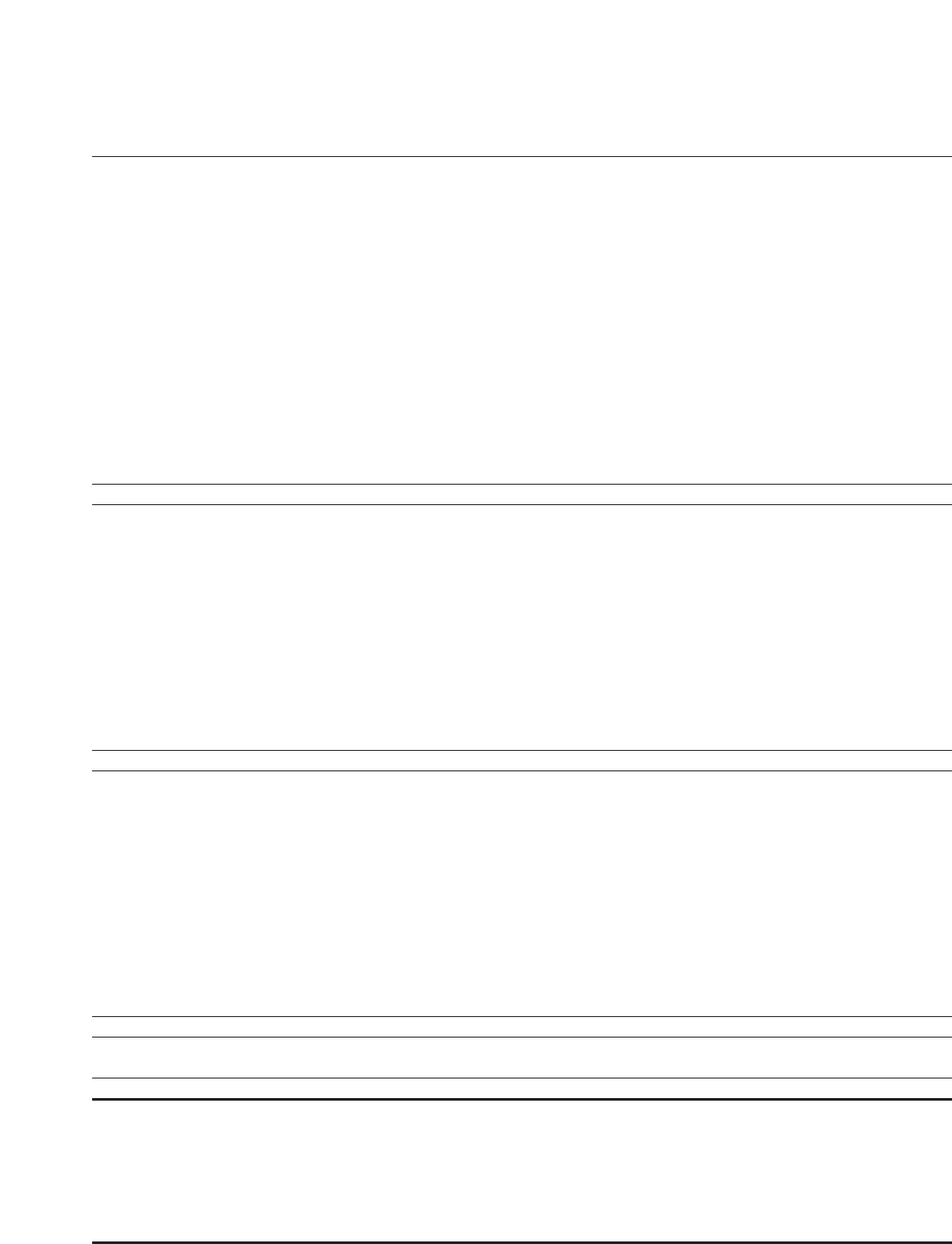

Annual Report 2003 SunTrust Banks, Inc. 59

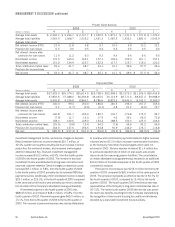

Year Ended December 31

(Dollars in thousands) 2003 2002 2001

Cash Flows from Operating Activities

Net income $1,332,297 $1,331,809 $ 1,375,537

Adjustments to reconcile net income to net cash

provided by operating activities:

Net gain on extinguishment of debt ——(9,720)

Depreciation, amortization and accretion 881,542 619,965 357,371

Origination of mortgage servicing rights (384,198) (277,343) (159,278)

Provisions for loan losses and foreclosed property 314,667 470,730 275,541

Deferred income tax provision 179,905 146,326 42,035

Amortization of compensation element of performance stock 5,475 3,074 6,110

Securities gains (123,876) (204,547) (153,080)

Net gain on sale of assets (12,596) (16,030) (8,467)

Originated loans held for sale, net (43,816,219) (28,954,686) (21,455,760)

Sales of loans held for sale 46,011,952 25,526,486 18,895,447

Net increase in other assets (526,923) (852,597) (679,140)

Net increase in other liabilities 271,207 643,203 359,155

Net cash provided by (used in) operating activities 4,133,233 (1,563,610) (1,154,249)

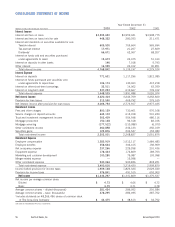

Cash Flows from Investing Activities

Proceeds from maturities of securities available for sale 10,841,607 5,217,479 3,114,827

Proceeds from sales of securities available for sale 7,633,468 5,626,929 5,419,095

Purchases of securities available for sale (19,933,984) (14,687,010) (7,754,258)

Net (increase) decrease in loans (5,533,737) (2,744,616) 332,021

Proceeds from sale of loans 392,412 721,195 762,405

Capital expenditures (157,608) (123,245) (89,224)

Proceeds from the sale of other assets 39,324 29,599 35,889

Net cash proceeds received from consolidation of affordable

housing partnerships 13,932 ——

Net cash proceeds (used for) received from acquisitions,

net of cash acquired (34,261) 1,160,333 —

Net cash (used in) provided by investing activities (6,738,847) (4,799,336) 1,820,755

Cash Flows from Financing Activities

Net increase in consumer and commercial deposits 2,404,052 3,481,945 5,644,915

Net (decrease) increase in foreign and brokered deposits (1,328,925) 4,224,638 (7,641,830)

Net decrease in funds purchased and other short-term borrowings (1,124,378) (131,681) (902,003)

Proceeds from the issuance of long-term debt 3,281,676 1,451,692 7,114,068

Repayment of long-term debt (257,119) (2,236,225) (3,389,198)

Proceeds from the exercise of stock options and stock

compensation expense 36,667 12,824 19,013

Proceeds from stock issuance 44,268 40,809 22,235

Acquisition of treasury stock (182,152) (340,656) (551,485)

Performance stock activity —(2,606) —

Dividends paid (505,396) (489,543) (463,529)

Net cash provided by (used in) financing activities 2,368,693 6,011,197 (147,814)

Net (decrease) increase in cash and cash equivalents (236,921) (351,749) 518,692

Cash and cash equivalents at beginning of year 5,558,295 5,910,044 5,391,352

Cash and cash equivalents at end of period $5,321,374 $5,558,295 $ 5,910,044

Supplemental Disclosure

Interest paid $1,465,030 $1,926,320 $ 3,118,383

Income taxes paid, net 358,391 440,518 446,814

Non-cash impact to total assets as a result of

consolidation of Three Pillars 2,857,316 ——

Non-cash impact of securitizing loans ——1,903,518

Non-cash impact of STAR Systems Inc. sale ——52,919

See notes to Consolidated Financial Statements.

CONSOLIDATED STATEMENTS OF CASH FLOW