SunTrust 2003 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

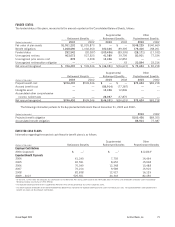

Annual Report 2003 SunTrust Banks, Inc. 69

Corporate and Private

Investment Client Corporate/

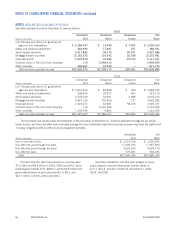

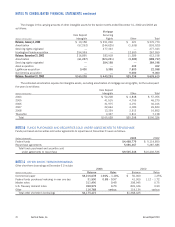

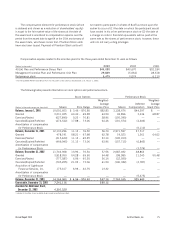

(Dollars in thousands) Retail Commercial Banking Mortgage Services Other Total

Balance, January 1, 2002 $299,984 $ 20,781 $93,442 $ 1,859 $24,431 $ — $ 440,497

Huntington-Florida acquisition 395,412 68,730 — 14,650 44,902 — 523,694

Reallocation 744 — — (744) — — —

Contingent consideration — 7,115 — — — — 7,115

Purchase price adjustment (8,955) — 1,410 — — — (7,545)

Balance, December 31, 2002 687,185 96,626 94,852 15,765 69,333 — 963,761

Purchase price adjustment 7,499 2,203 — 2,236 — — 11,938

Lighthouse acquisition 41,830 24,447 — 24,804 — — 91,081

Sun America acquisition — — — 10,168 — — 10,168

Other acquisitions — — — 690 — — 690

Balance, December 31, 2003 $736,514 $123,276 $94,852 $53,663 $69,333 $ — $1,077,638

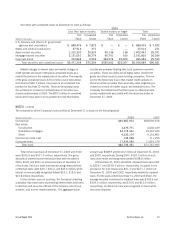

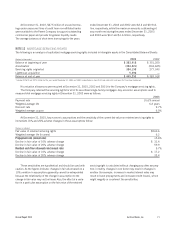

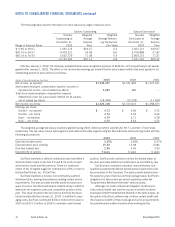

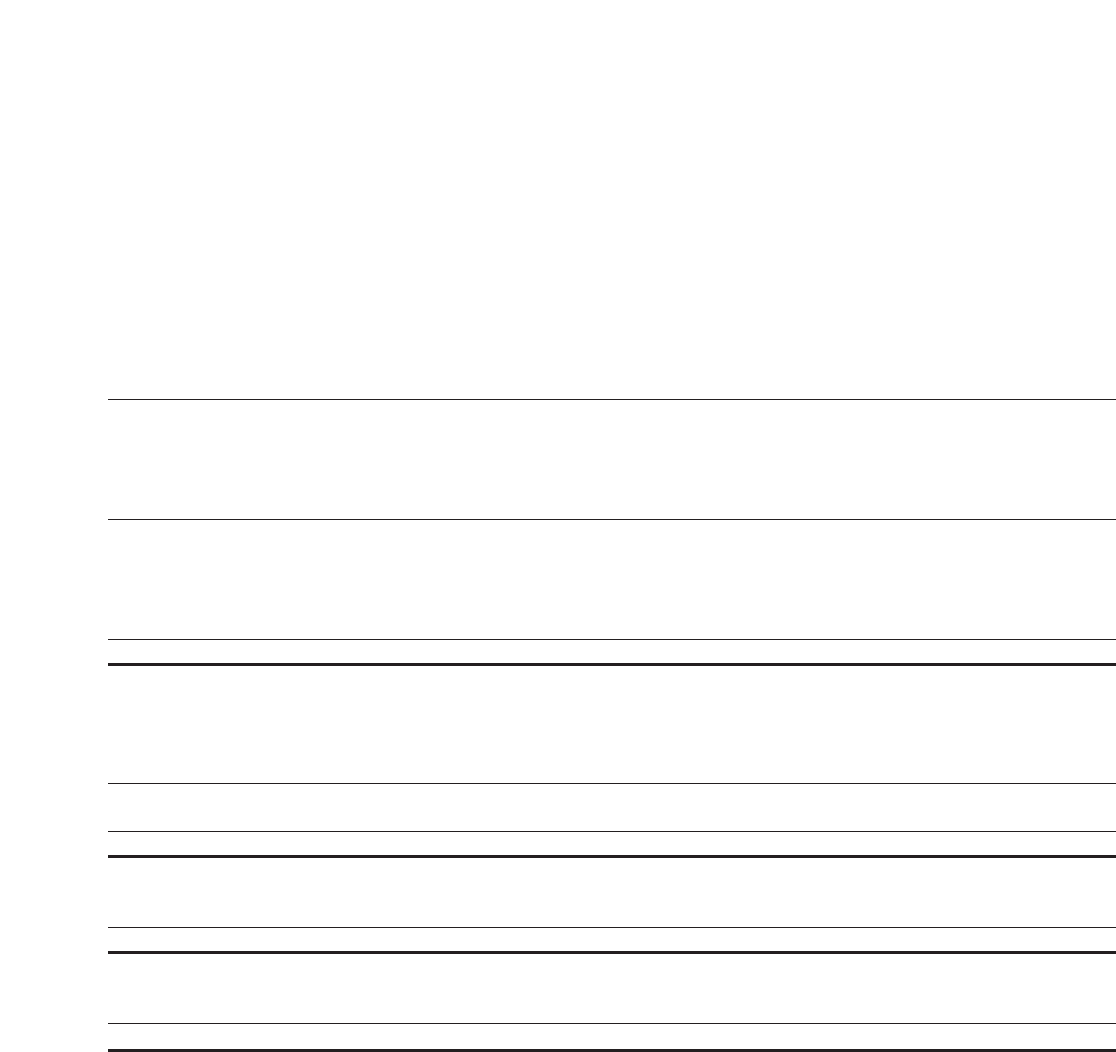

The Company adopted SFAS No. 142, in its entirety, effective January 1, 2002. The following presents the net income that would

have been reported had SFAS No. 142 been implemented January 1, 2001.

(Dollars in thousands, except per share data) 2003 2002 2001

Reported net income $1,332,297 $1,331,809 $1,375,537

Goodwill amortization, net of taxes ——36,115

Adjusted net income $1,332,297 $1,331,809 $1,411,652

Reported diluted earnings per share $4.73 $4.66 $ 4.72

Goodwill amortization, net of taxes ——0.12

Adjusted diluted earnings per share $4.73 $4.66 $ 4.84

Reported basic earnings per share $4.79 $4.71 $ 4.78

Goodwill amortization, net of taxes ——0.13

Adjusted basic earnings per share $4.79 $4.71 $ 4.91

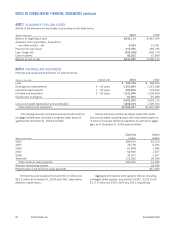

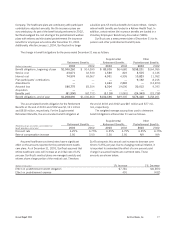

NOTE 9

INTANGIBLE ASSETS

Under the provisions of SFAS No. 142, goodwill is tested

for impairment on an annual basis and as events or circum-

stances arise that would more likely than not reduce fair value

of a reporting unit below its carrying amount. The Company

completed its annual review as of December 31, 2003, and

determined there was no impairment of goodwill as of this date.

The changes in the carrying amount of goodwill by reportable

segment for the twelve months ended December 31, 2002 and

2003 are as follows: