SunTrust 2003 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50 SunTrust Banks, Inc. Annual Report 2003

MANAGEMENT’S DISCUSSION continued

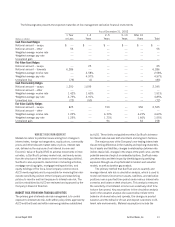

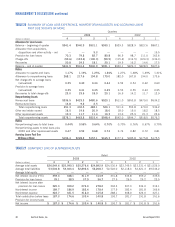

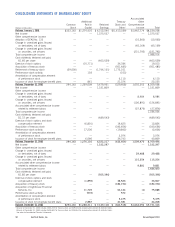

Private Client Services

2003 2002

(Dollars in millions) 432143 21

Average total assets $ 2,362.2 $ 2,296.7 $ 2,137.7 $ 1,930.5 $ 1,873.1 $ 1,731.0 $ 1,727.8 $ 1,720.2

Average total liabilities 1,563.9 1,568.7 1,535.2 1,451.3 1,587.2 1,532.1 1,583.4 1,543.9

Average total equity — — — — — — — —

Net interest income (FTE) 12.4 11.8 9.8 9.7 10.0 9.9 10.2 10.1

Provision for loan losses 0.5 0.6 0.5 0.4 0.6 0.5 0.6 0.6

Net interest income after

provision for loan losses 11.9 11.2 9.3 9.3 9.4 9.4 9.6 9.5

Noninterest income 172.5 165.4 165.1 157.1 149.4 155.9 167.1 157.1

Noninterest expense 131.0 134.9 125.7 122.3 117.7 115.7 119.2 120.2

Total contribution before taxes 53.4 41.7 48.7 44.1 41.1 49.6 57.5 46.4

Provision for income taxes — — — — — — — —

Net income $ 53.4 $ 41.7 $ 48.7 $ 44.1 $ 41.1 $ 49.6 $ 57.5 $ 46.4

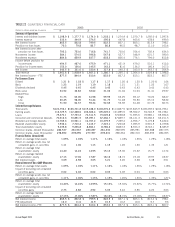

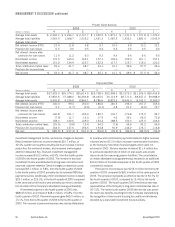

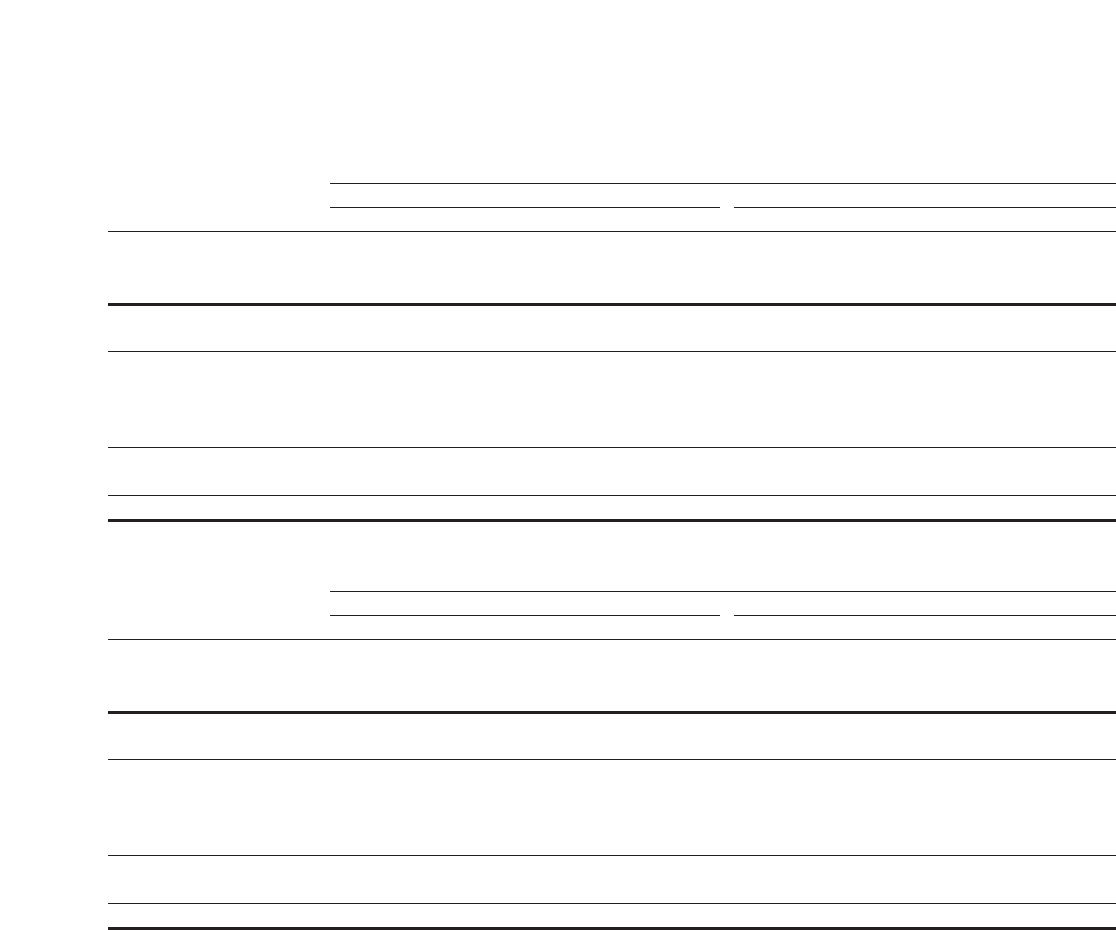

Corporate/Other

2003 2002

(Dollars in millions) 432143 21

Average total assets $27,929.9 $25,374.3 $25,614.9 $25,798.4 $23,958.5 $21,575.3 $21,306.9 $20,456.8

Average total liabilities 37,832.6 37,488.2 36,293.8 36,445.5 33,114.9 28,771.6 28,447.2 29,988.9

Average total equity 9,435.8 9,236.8 8,864.1 8,786.6 8,823.3 8,943.3 8,743.2 8,385.9

Net interest income (FTE) 146.0 99.4 150.0 180.6 181.5 192.0 167.2 165.4

Provision for loan losses 5.2 (1.7) (0.4) (0.1) 4.8 21.2 (6.0) 72.7

Net interest income after

provision for loan losses 140.8 101.1 150.4 180.7 176.7 170.8 173.2 92.7

Noninterest income (7.9) 11.7 14.0 17.9 4.2 39.1 45.5 73.8

Noninterest expense 158.4 122.6 149.0 144.4 188.5 150.3 125.5 106.6

Total contribution before taxes (25.5) (9.8) 15.4 54.2 (7.6) 59.6 93.2 59.9

Provision for income taxes 164.0 147.6 156.5 153.8 91.9 146.2 176.1 116.8

Net loss $ (189.5) $ (157.4) $ (141.1) $ (99.6) $ (99.5) $ (86.6) $ (82.9) $ (56.9)

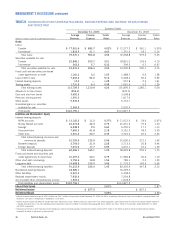

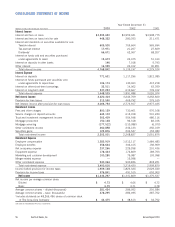

investment management income, and service charges on deposits.

Retail investment services income increased $10.7 million, or

32.4%, quarter over quarter, primarily due to an increase in broker

production, the number of brokers, and increased revenue gener-

ated from Alexander Key. Trust and investment management

income increased $10.2 million, or 8.5%, from the fourth quarter

of 2002 to the fourth quarter of 2003. The increase in trust and

investment income was attributed to strong sales momentum and

improved customer retention. Service charges on deposit accounts

increased $9.1 million, or 5.8%, from the fourth quarter of 2002

to the fourth quarter of 2003 primarily due to increased NSF/stop

payment volumes. Additionally, other noninterest income increased

$29.1 million, or 225.3%, in the fourth quarter of 2003 compared

to the same period of the prior year primarily due to the consolida-

tion of certain of the Company’s affordable housing partnerships.

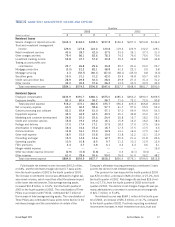

Noninterest expense in the fourth quarter of 2003 was

$884.8 million, an increase of $48.4 million, or 5.8%, from the

fourth quarter of 2002. Personnel expense grew $60.0 million, or

13.1%, from the fourth quarter of 2002 to the fourth quarter of

2003. The increase in personnel expense was mainly attributable

to incentive and commissions payments related to higher business

volumes and an $11.5 million increase in performance incentives

as the Company met certain financial targets which were not

achieved in 2002. Pension expense increased $11.4 million due

to a reduced expected rate of return on plan assets and a lower

discount rate for measuring pension liabilities. The consolidation

of certain affordable housing partnerships resulted in an additional

$14.6 million of noninterest expense in the fourth quarter of 2003

compared to last year.

Provision for income taxes was $152.0 million for the fourth

quarter of 2003 compared to $81.6 million in the same period of

2002. The provision represents an effective tax rate of 30.7% for

the fourth quarter of 2003, compared to 19.4% for the fourth

quarter of 2002. The fourth quarter 2003 effective tax rate was

representative of the Company’s long-term normalized tax rate of

30-31%. The lower fourth quarter 2002 effective tax was prima-

rily due to tax benefits resulting from the Company standardizing

the recognition of low income housing tax credits and dividends

declared by a real estate investment trust subsidiary.