SunTrust 2003 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74 SunTrust Banks, Inc. Annual Report 2003

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

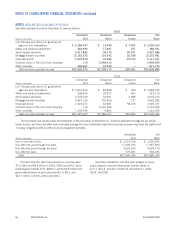

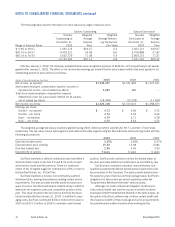

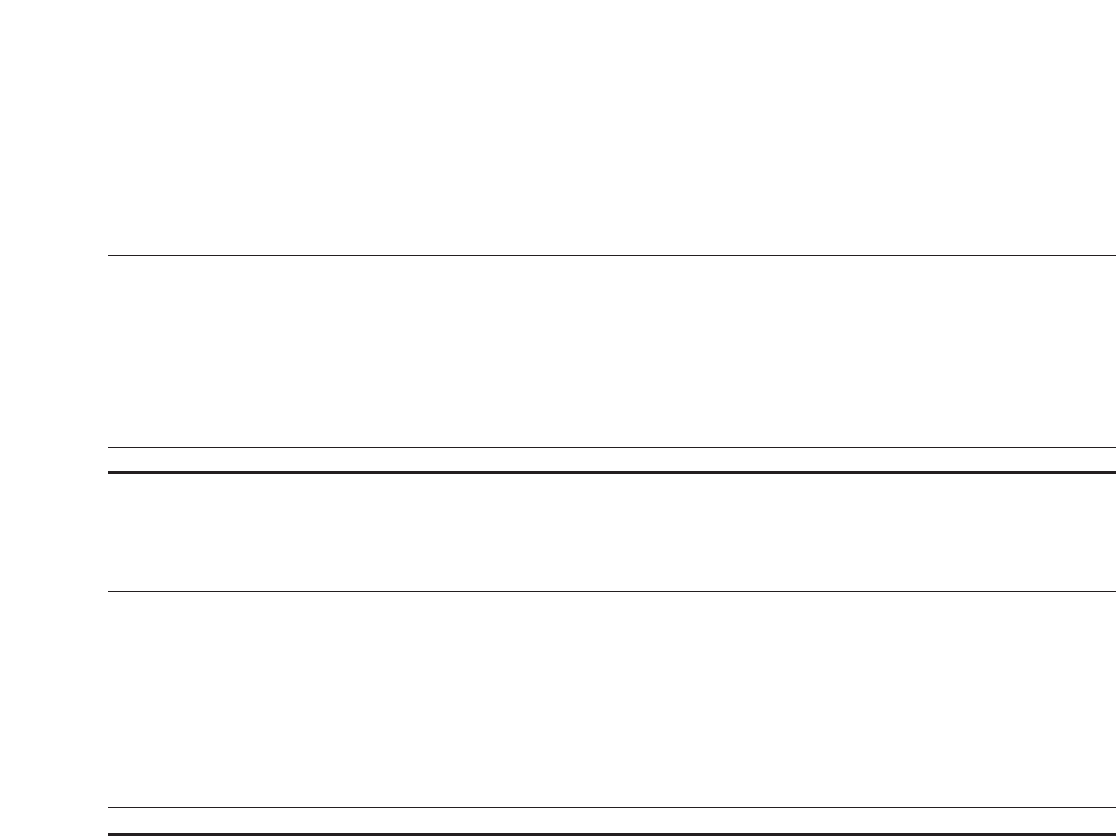

The Company’s provisions for income taxes for the three years ended December 31 differ from the amounts computed by applying the

statutory federal income tax rate of 35% to income before income taxes. A reconciliation of this difference is as follows:

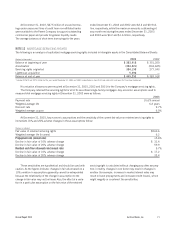

(Dollars in thousands) 2003 2002 2001

Tax provision at federal statutory rate $668,198 $638,163 $706,902

(Decrease) increase resulting from

Tax-exempt interest (31,951) (29,366) (29,848)

Income tax credits, net (39,653) (51,243) (17,320)

State income taxes, net of federal benefit 26,807 6,074 13,943

Dividends on subsidiary preferred stock (23,567) (25,530) —

Reversal of deferred liability —(25,000) —

Other (22,993) (21,583) (19,774)

Provision for income taxes $576,841 $491,515 $653,903

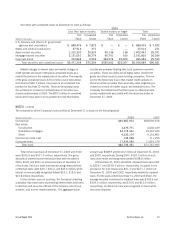

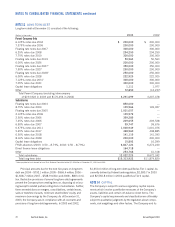

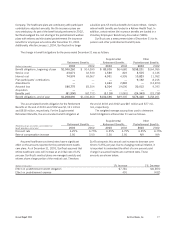

Temporary differences create deferred tax assets and liabilities that are detailed below as of December 31, 2003 and 2002:

Deferred Tax Assets (Liabilities)

(Dollars in thousands) 2003 2002

Allowance for loan losses $342,510 $321,491

Employee benefits (248,225) (150,675)

Fixed assets (65,159) (34,402)

Loans (41,518) (27,863)

Mortgage (118,379) (80,797)

Leasing (677,515) (562,171)

Accrued expenses 76,522 83,003

Unrealized gains on securities available for sale (847,538) (779,274)

Other 76,705 54,664

Net deferred tax liability $(1,502,597) $(1,176,024)

SunTrust and its subsidiaries file consolidated income tax

returns where permissible. Each subsidiary remits current taxes

to or receives current refunds from the Parent Company based

on what would be required had the subsidiary filed an income

tax return as a separate entity. The Company’s federal and state

income tax returns are subject to review and examination by

government authorities. Various such examinations are now in

progress. In the opinion of management, any adjustments which

may result from these examinations will not have a material

effect on the Company’s Consolidated Financial Statements.

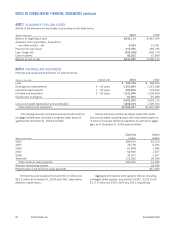

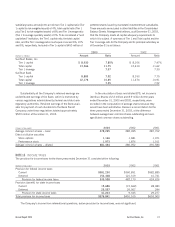

NOTE 16

EMPLOYEE BENEFIT PLANS

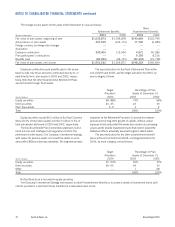

SunTrust sponsors various incentive plans for eligible employees.

The Management Incentive Plan for key executives provides for

annual cash awards, if any, based on the attainment of a profit

plan goal and the achievement of business unit, as well as, indi-

vidual performance objectives. The Performance Unit Plan (PUP)

for key executives provides awards, if any, based on three-year

earnings performance in relation to earnings goals established

by the Compensation Committee (Committee) of the Company’s

Board of Directors. In 2003, a restricted stock grant was made

in lieu of implementing the PUP for the 2003-2005 cycle. This

restricted stock grant will vest after a three year restricted period,

and will be transferred to the participant upon vesting; a pro rata

number of shares immediately vests upon death, disability, or

retirement. Participants receive dividends and maintain voting

rights on these shares.

The Company also sponsors an Executive Stock Plan (Stock

Plan) under which the Committee has the authority to grant

stock options, restricted stock and performance based restricted

stock (performance stock) to key employees of the Company.

The Company has 14 million shares of common stock reserved

for issuance under the Stock Plan, of which no more than 4 mil-

lion shares may be issued as restricted stock. Options granted

are at no less than the fair market value of a share of stock on

the grant date and may be either tax-qualified incentive stock

options or nonqualified options. Prior to 2002, the Company did

not record expense as a result of the grant or exercise of any of

the stock options. Effective January 1, 2002, the Company

adopted the fair-value recognition provision of SFAS No. 123,

Accounting for Stock-Based Compensation, prospectively and

began expensing the cost of stock options.

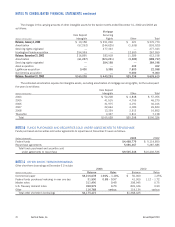

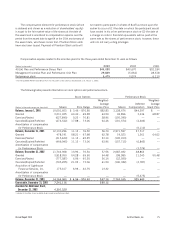

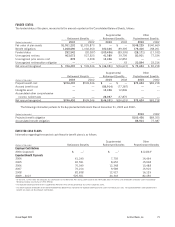

With respect to performance stock, shares must be granted,

awarded and vested before participants take full title. Awards are

distributed on the earliest of (i) fifteen years after the date shares

are awarded to participants; (ii) the participant attaining age 64;

(iii) death or disability of a participant; or (iv) a change in control

of the Company as defined in the Stock Plan. Dividends are paid

on awarded but unvested performance stock and participants

may exercise voting privileges on such shares.