SunTrust 2003 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2003 SunTrust Banks, Inc. 79

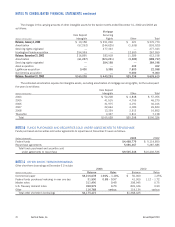

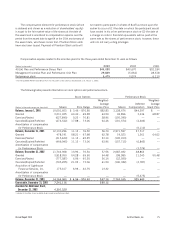

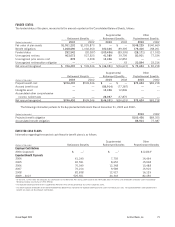

FUNDED STATUS

The funded status of the plans, reconciled to the amount reported on the Consolidated Balance Sheets, follows:

Supplemental Other

Retirement Benefits Retirement Benefits Postretirement Benefits

(Dollars in thousands) 2003 2002 2003 2002 2003 2002

Fair value of plan assets $1,551,232 $1,025,873 $—$—$148,229 $140,669

Benefit obligations 1,268,690 1,046,260 100,436 89,305 176,400 158,201

Funded status 282,542 (20,387) (100,436) (89,305) (28,171) (17,532)

Unrecognized net loss 463,073 527,525 41,589 39,795 80,901 77,534

Unrecognized prior service cost 878 2,208 12,496 12,852 ——

Unrecognized net transition obligation ———43 20,894 23,216

Net amount recognized $746,493 $509,346 $(46,351) $(36,615) $73,624 $83,218

Supplemental Other

Retirement Benefits Retirement Benefits Postretirement Benefits

(Dollars in thousands) 2003 2002 2003 2002 2003 2002

Prepaid benefit cost $746,493 $509,346 $—$—$73,624 $83,218

Accrued benefit cost ——(86,914) (77,387) ——

Intangible asset ——12,496 12,896 ——

Accumulated other comprehensive

income, before taxes ——28,067 27,876 ——

Net amount recognized $746,493 $509,346 $(46,351) $(36,615) $73,624 $83,218

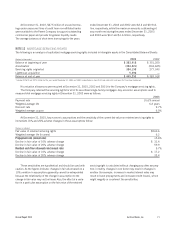

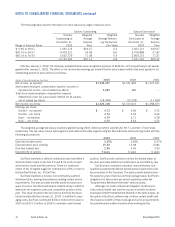

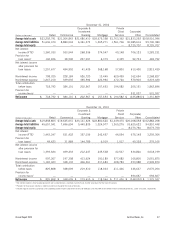

The following information pertains to the Supplemental Retirement Plan at December 31, 2003 and 2002:

(Dollars in thousands) 2003 2002

Projected benefit obligation $100,436 $89,305

Accumulated benefit obligation 86,914 77,387

EXPECTED CASH FLOWS

Information regarding the expected cash flows for benefit plans is as follows:

Supplemental Other

(Dollars in thousands) Retirement Benefits Retirement Benefits Postretirement Benefits

Employer Contributions

2004 (expected) $ —1$—

2$12,8323

Expected Benefit Payments

2004 61,240 7,793 14,494

2005 65,591 8,652 15,008

2006 70,549 12,348 15,488

2007 76,214 9,589 15,916

2008 82,838 12,527 16,129

2009 – 2013 525,501 44,343 82,456

1At this time, SunTrust does not anticipate any contributions to the Retirement Plan during 2004 based on the well-funded status of the Plan and contribution limitations under the Employee

Retirement Income Security Act of 1974 (ERISA).

2The expected benefit payments for the Supplemental Retirement Plan will be paid directly by SunTrust corporate assets.

3The 2004 expected contribution for the Other Postretirement Benefit Plans represents the expected benefit payments under the medical plans only. The expected benefits under postretirement

benefits are shown net of participant contributions.