SunTrust 2003 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2003 SunTrust Banks, Inc. 35

The increase was due to a combination of Global Bank Note and

Federal Home Loan Bank debt issuances during 2003 to take

advantage of the low interest rate environment and to further

diversify the Company’s funding sources. The Company man-

ages reliance on short-term unsecured borrowings as well as

total wholesale funding through policy established and reviewed

by ALCO.

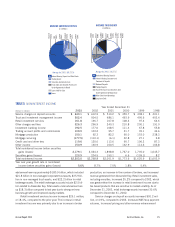

The Company maintains access to a diversified base of

wholesale funding sources. These sources include fed funds

purchased, securities sold under agreements to repurchase,

negotiable certificates of deposit, offshore deposits, Federal Home

Loan Bank advances, Global Bank Note issuance and commercial

paper issuance. As of December 31, 2003, SunTrust had $6.1 bil-

lion of capacity remaining under its Global Bank Note program

after issuing $850 million in Bank Notes in December of 2003.

Liquidity is also available through unpledged securities in the

investment portfolio and capacity to securitize loans, including

single-family mortgage loans. The Company’s credit ratings are

important to its access of unsecured wholesale borrowings.

Significant changes in these ratings could change the cost and

availability of these sources.

The low rate environment has created heavy refinance

activity and an increase in the amount of mortgage loans origi-

nated by the Company. The Company sells most of these loans

into the secondary market and they are reflected in loans held for

sale. This refinance activity slowed in the second half of 2003,

particularly in the fourth quarter of 2003. Mortgage originations

declined $5.0 billion from fourth quarter of 2002 to a total of

$6.3 billion in the fourth quarter of 2003. Total production in

2003 was $43.7 billion compared to $30.8 billion in 2002. As

of December 31, 2003, the balance of loans held for sale was

$5.6 billion compared to $7.7 billion on December 31, 2002, a

decrease of $2.2 billion. Excluding the addition of Three Pillars

in 2003, net short-term unsecured borrowed funds declined

$2.0 billion during the same period reflecting the reduced fund-

ing need for loans held for sale.

The Company has a contingency funding plan that stress

tests liquidity needs that may arise from certain events such as

agency rating downgrades, rapid loan growth, or significant

deposit runoff. The plan also provides for continual monitoring of

net borrowed funds dependence and available sources of liquid-

ity. Management believes the Company has the funding capacity

to meet the liquidity needs arising from potential events. Liquidity

is measured and monitored for the Bank and Bank Holding

Company. The Company reviews the Parent Holding Company’s

net short-term mismatch. This measures the ability of the hold-

ing company to meet obligations through the sale or pledging of

assets should access to Bank dividends be constrained.

Certain provisions of long-term debt agreements and

Holding Company lines of credit prevent the Company from cre-

ating liens on, disposing of, or issuing (except to related parties)

voting stock of subsidiaries. Further, there are restrictions on

mergers, consolidations, certain leases, sales or transfers of

assets, and minimum shareholders’ equity ratios. As of

December 31, 2003, the Company was in compliance with all

covenants and provisions of these agreements.

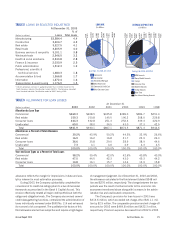

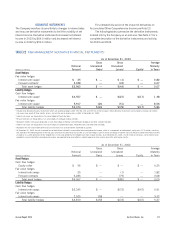

TABLE 18

UNFUNDED LENDING COMMITMENTS

(Dollars in millions) At December 31, 2003

Unused lines of credit

Commercial $36,694.4

Mortgage commitments110,665.8

Home equity lines 7,792.2

Commercial real estate 3,650.0

Commercial credit card 576.4

Total unused lines of credit $59,378.8

Letters of credit

Financial standby $9,385.8

Performance standby 265.8

Commercial 191.6

Total letters of credit $9,843.2

1Includes $2,794.6 million in interest rate locks accounted for as derivatives.

OFF-BALANCE SHEET ARRANGEMENTS

In the normal course of business, the Company engages in finan-

cial transactions that, in accordance with accounting principles

generally accepted in the United States, are either not recorded

on the Company’s balance sheet or may be recorded on the

Company’s balance sheet at an amount that differs from the full

contract or notional amount of the transaction. These transac-

tions are structured to meet the financial needs of customers,

manage the Company’s credit, market or liquidity risks, diversify

funding sources or optimize capital.

As a financial services provider, the Company routinely

enters into commitments to extend credit, including, but not lim-

ited to, loan commitments, financial and performance standby

letters of credit and financial guarantees. While these contractual

obligations could potentially result in material current or future

effects on financial condition, results of operations, liquidity, capi-

tal expenditures, capital resources, or significant components of

revenues or expenses, a significant portion of commitments to

extend credit expire without being drawn upon. Such commit-

ments are subject to the same credit policies and approval

processes accorded to loans made by the Company.

The Company has undertaken certain guarantee obligations

in the ordinary course of business. In following the provisions of

FIN 45, as addressed in Note 1, the Company must consider

guarantees that have any of the following four characteristics (i)

contracts that contingently require the guarantor to make pay-

ments to a guaranteed party based on changes in an underlying

factor that is related to an asset, a liability, or an equity security

of the guaranteed party; (ii) contracts that contingently require

the guarantor to make payments to a guaranteed party based on