SunTrust 2003 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20 SunTrust Banks, Inc. Annual Report 2003

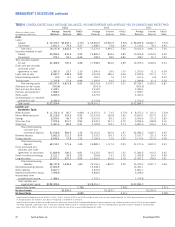

MANAGEMENT’S DISCUSSION continued

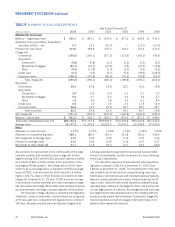

Total noninterest income grew $78.5 million, or 34.4%.

Noninterest income for 2003 included $61.6 million related to

the affordable housing unit of which $25.3 million was associated

with limited partnership income resulting from the consolidation of

certain affordable housing partnerships. An additional $38.8 mil-

lion was attributable to higher tax-effected revenue generated

by SunTrust’s Community Development Corporation, which was

transferred from the Corporate/Other line of business. The

remaining noninterest income growth resulted from increased

deposit service charges, credit card income and loan fees.

Total noninterest expense grew $19.6 million, or 5.8%. The

increase in noninterest expense included $7.3 million related to

the affordable housing unit, with the remainder of the expense

growth related to increased volumes.

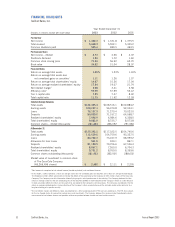

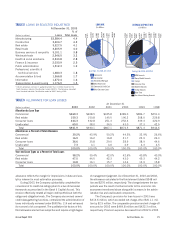

CORPORATE AND INVESTMENT BANKING

Corporate and Investment Banking’s contribution before taxes

increased $149.2 million, or 73.6%, for 2003 as compared

with 2002. The biggest factor in the improvement was a

$119.8 million decrease in the provision for loan losses. The

remaining $29.4 million increase was primarily due to improve-

ments of $20.9 million, or 4.0%, in noninterest income and

$11.4 million, or 4.2%, in net interest income offset by an

increase in noninterest expense of $2.8 million, or 0.8%.

To comply with FIN 46, Three Pillars Funding LLC (Three

Pillars), a multi-seller commercial paper conduit with $3.2 billion

in assets at December 31, 2003, was consolidated in the third

quarter of 2003. Including the effect of this consolidation, which

added $1.1 billion in average loan balances in 2003, average

loans declined $279.0 million, or 1.7%. Despite the decline in

outstanding loan balances, total commitments during 2003

were essentially unchanged from the prior year, but total binding

commitment usage declined to an approximate average of

30.1% in 2003 from 33.9% in 2002. The increase in noninter-

est income was driven largely by a substantial increase in debt

capital markets products.

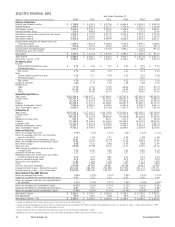

MORTGAGE

Driven by higher mortgage loan production resulting from record

low interest rates, Mortgage’s 2003 contribution before taxes of

$246.3 million was up $88.6 million, or 56.2%, compared to

2002. Mortgage loan production of $43.7 billion in 2003 repre-

sented another record year and was up 41.9% over the prior

record year.

Net interest income was up $171.3 million, or 45.7%, over

2002. Record production pushed average mortgage loans held

for sale balances up $3.6 billion, or 83.0%. The higher balances

were the primary reason for the net interest income increase.

Additionally, residential portfolio loans were up $1.2 billion, or

10.4%, and combined with wider spreads, contributed to the

increase in net interest income. Credit quality has remained high

even with the significant increase in the residential loan portfo-

lio. Net charge-offs were $2.5 million in 2003 compared to

$2.0 million in 2002. Due to high loan payoff levels, average

deposit volume grew $623.4 million, or 61.7%, compared to

2002. However, due to the low rate environment in both years,

the effect on net interest income was minimal.

Total noninterest income increased $1.3 million, or 9.3%,

in 2003 compared with 2002. Higher production-related

income resulting from record production and other noninterest

income was substantially offset by higher mortgage servicing

rights amortization expense. The higher mortgage servicing

rights expense resulted from record loan payoffs and amortiza-

tion of existing serviced loans. At December 31, 2003, loans

serviced totaled $69.0 billion compared with $57.1 billion at

December 31, 2002, a 20.8% increase.

As production volume and related income grew in 2003,

noninterest expense also increased. Noninterest expense was up

$83.5 million, or 37.3%, principally due to volume-related

expenses such as commission-based compensation, overtime,

temporary employees and other lending-related expenses that

vary with loan production.

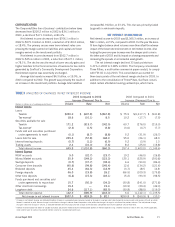

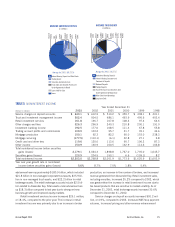

PRIVATE CLIENT SERVICES

Private Client Services’ contribution before taxes decreased

$6.5 million, or 3.3%, for the year ended December 31, 2003

compared to 2002.

Total noninterest income increased $30.6 million, or 4.9%,

for the year ended December 31, 2003 compared to 2002.

Average assets under management increased 4.1% compared

to 2002. Trust and investment management income decreased

$1.9 million, or 0.4%, for the year ended December 31, 2003

compared to 2002. As of December 31, 2003 and 2002, assets

under management were approximately $101.0 billion and

$89.6 billion, respectively. Assets under management increased

12.8% due to appreciation in the equity markets and net new

business. Lost business moderately improved compared to prior

periods, while new business maintained its momentum. Assets

under management include individually managed assets, the STI

Classic Funds, institutional assets managed by Trusco Capital

Management, and participant-directed retirement accounts.

SunTrust’s total assets under advisement were approximately

$180.9 billion, which included $21.8 billion in non-managed

corporate trust assets, $35.9 billion in non-managed trust assets,

and $22.2 billion in retail brokerage assets. The retail brokerage

accounts include $2.5 billion related to Alexander Key. As of

December 31, 2003, brokerage assets increased 30.6%

compared to December 31, 2002.

Retail investment income increased $24.0 million, or

18.0%, for the year ended December 31, 2003 compared to

2002. The increase in retail investment income was primarily

due to an increase in broker production, an increase in the

number of brokers, and increased revenue generated from

Alexander Key.

Noninterest expense increased $41.0 million, or 8.7%, for

the year ended December 31, 2003 compared to 2002. The

expense increases were primarily due to additional personnel

and occupancy expense associated with PCS’ business-related

initiatives. PCS continues to invest in the core business, new

product capabilities, and new distribution channels.