SunTrust 2003 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30 SunTrust Banks, Inc. Annual Report 2003

MANAGEMENT’S DISCUSSION continued

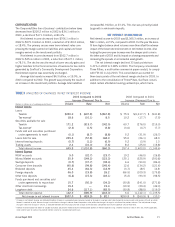

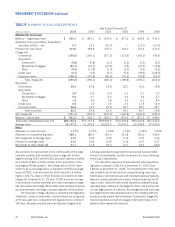

TABLE 10

SUMMARY OF LOAN LOSS EXPERIENCE

Year Ended December 31

(Dollars in millions) 2003 2002 2001 2000 1999 1998

Allowance for Loan Losses

Balance – beginning of year $930.1 $867.1 $ 874.5 $ 871.3 $ 944.6 $ 933.5

Allowance from acquisitions, dispositions

and other activity – net 9.3 15.5 (10.2) — (13.3) (10.0)

Provision for loan losses 313.6 469.8 275.2 134.0 170.4 214.6

Charge-offs

Commercial (195.0) (295.1) (217.3) (115.6) (142.0) (49.0)

Real estate

Construction (0.8) (0.8) (0.3) (0.2) (2.2) (3.2)

Residential mortgages (22.1) (16.7) (10.8) (7.8) (15.0) (13.8)

Other (5.6) (17.8) (5.9) (3.3) (5.2) (5.2)

Credit card (2.7) (1.9) (2.7) (5.4) (78.9) (129.5)

Consumer loans (168.1) (157.8) (89.0) (57.5) (52.8) (63.6)

Total charge-offs (394.3) (490.1) (326.0) (189.8) (296.1) (264.3)

Recoveries

Commercial 39.3 27.8 23.8 22.7 15.5 14.8

Real estate

Construction 0.4 0.4 0.4 0.3 0.7 0.3

Residential mortgages 5.0 3.7 2.2 3.3 3.4 2.7

Other 1.4 3.9 1.8 3.9 6.1 8.4

Credit card 0.5 1.0 1.6 3.1 11.9 14.9

Consumer loans 36.6 31.0 23.8 25.7 28.1 29.7

Total recoveries 83.2 67.8 53.6 59.0 65.7 70.8

Net charge-offs (311.1) (422.3) (272.4) (130.8) (230.4) (193.5)

Balance – end of year $941.9 $930.1 $ 867.1 $ 874.5 $ 871.3 $ 944.6

Total loans outstanding at year end $80,732.3 $73,167.9 $68,959.2 $72,239.8 $66,002.8 $61,540.6

Average loans 76,137.9 71,270.4 70,023.0 70,044.3 62,749.4 57,590.5

Ratios

Allowance to year-end loans 1.17% 1.27% 1.26% 1.21% 1.32% 1.53%

Allowance to nonperforming loans 268.1 182.0 155.4 215.8 350.0 456.0

Net charge-offs to average loans 0.41 0.59 0.39 0.19 0.37 0.34

Provision to average loans 0.41 0.66 0.39 0.19 0.27 0.37

Recoveries to total charge-offs 21.1 13.8 16.4 31.1 22.2 26.8

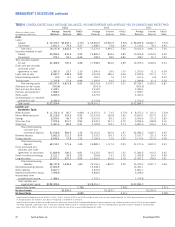

due primarily to improvement in the credit quality of the large

corporate portfolio that resulted in lower charge-offs for that

segment during 2003 and the 2002 provision expense included

an increase of $45.3 million related to the acquisition of the

Huntington-Florida portfolio. Net charge-offs for 2003 repre-

sented 0.41% of average loans, compared to 0.59% of average

loans for 2002. Loan recoveries for 2003 were $15.4 million

higher, or 22.7%, than in 2002. The ratio of recoveries to total

charge-offs increased to 21.1% from 13.8% due to an increase

in the amount of overall recoveries and lower overall gross charge-

offs. Recoveries and charge-offs for 2003 were favorably impacted

by improvements in the large corporate segment of the portfolio.

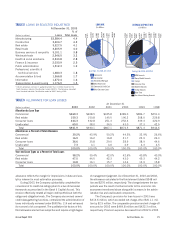

The Company’s charge-off policy is consistent with regulatory

standards. Losses on unsecured consumer loans are recognized

at 90 days past due, compared to the regulatory loss criteria of

120 days. Secured consumer loans are typically charged off at

120 days past due if repayment from all sources has been deter-

mined to be improbable, or at the occurrence of a loss confirming

event (e.g., repossession).

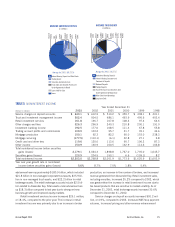

The ratio of the allowance for loan losses to total nonperform-

ing loans increased to 268.1% at December 31, 2003 from

182.0% at December 31, 2002. The improvement in this ratio

was primarily due to the decline in nonperforming loans men-

tioned above. Commercial loans and real estate loans are typically

placed on nonaccrual when principal or interest is past due for 90

days or more, unless the loan is both secured by collateral having

realizable value sufficient to discharge the debt in full and the loan

is in the legal process of collection. Accordingly, secured loans may

be charged down to the estimated value of the collateral with pre-

viously accrued unpaid interest reversed. Subsequent charge-offs

may be required as a result of changes in the market value of col-

lateral or other repayment prospects.