SunTrust 2003 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2003 SunTrust Banks, Inc. 43

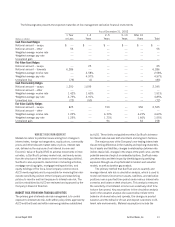

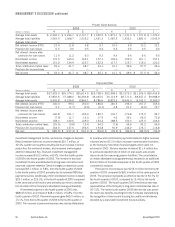

the current behavior of these products. The impact of the

change shortened the duration of these products to reflect the

sharp increase in balances that may be temporary, and at a

minimum, are highly volatile. Shortening the duration of the

deposit base decreased EVE’s exposure to declining rates, and

at the same time decreased the benefit EVE would have in ris-

ing rates. Actions taken to mitigate EVE’s exposure to declining

rates were the same as those noted for net interest income sen-

sitivity previously: extending investment portfolio duration and

reducing liability duration through swapping debt from longer

to shorter durations. The change in indeterminate deposit

methodology and actions to mitigate exposure to lower rates

significantly reduced the market value volatility for 2003 com-

pared to 2002.

The net interest income simulation and valuation analyses

(EVE) do not necessarily include certain actions that manage-

ment may undertake to manage this risk in response to

anticipated changes in interest rates.

TRADING ACTIVITIES

Most of the Company’s trading activities are designed to support

secondary trading with customers rather than for the purpose of

positioning itself to profit from market movements. Product offer-

ings include the sale of debt securities, including loans traded in

the secondary market, equity securities, derivatives and foreign

exchange contracts, and similar financial instruments. The

Company also participates in underwritings and acts as a market

maker in certain equity securities. Also, in the normal course of

business, the Company maintains an inventory of securities to

support secondary trading. When executing orders on behalf of

customers, which are not sold out of inventory, such as deriva-

tives, the Company enters into subsequent transactions to

manage the resulting risk in accordance with approved limits.

The Company has developed policies and procedures to

manage market risk associated with trading, capital markets and

foreign exchange activities using a value-at-risk (VaR) approach

that combines interest rate risk, equity risk, foreign exchange risk,

spread risk and volatility risk. For trading portfolios, VaR meas-

ures the maximum fair value the Company could lose on a trading

position, given a specified confidence level and time horizon.

VaR limits and exposures are monitored daily for each significant

trading portfolio. The Company’s VaR calculation measures the

potential losses in fair value using a 99% confidence level. This

equates to 2.33 standard deviations from the mean under a nor-

mal distribution. This means that, on average, daily profits and

losses are expected to exceed VaR one out of every 100 overnight

trading days. The VaR methodology includes holding periods for

each position based upon an assessment of relative trading mar-

ket liquidity. For the Foreign Exchange and Derivatives desks, the

Company estimates VaR by applying the Monte Carlo simulation

platform as designed by RiskMetrics,™ and for the estimate of

the Fixed Income and Equity desks’ VaR, the Company uses

Bloomberg™ analytics. The Company uses internally devel-

oped methodology to estimate VaR for credit derivatives and

loan trading.

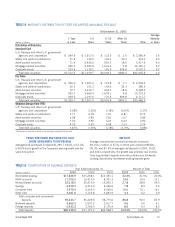

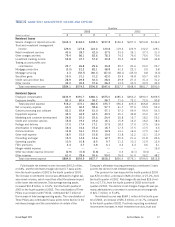

The estimated average combined Undiversified VaR

(Undiversified VaR represents a simple summation of the VaR

calculated across each Desk) was $1.8 million for 2003 and

$2.4 million for 2002. Trading assets net of trading liabilities

averaged $796.3 million for 2003 and $898.7 million for

2002. The estimated combined period-end Undiversified VaR

was $1.3 million at December 31, 2003 and $1.4 million at

December 31, 2002. Trading assets net of trading liabilities

were $804.6 million at December 31, 2003 and $787.1 million

at December 31, 2002.

OTHER MARKET RISK

Other sources of market risk include mortgage servicing rights

(MSRs) and the risk associated with holding mortgage loans

prior to selling them (mortgage warehouse) into the secondary

market, and commitments to customers to make mortgage loans

(mortgage pipeline) that will be sold to the secondary market.

The value of the MSRs asset is dependent upon the

assumed prepayment speed of the mortgage servicing portfolio.

Future expected net cash flows from servicing a loan in the serv-

icing portfolio would not be realized if the loan pays off earlier

than anticipated. MSRs are the discounted present value of

future net cash flows that are expected to be received from the

servicing portfolio. Accordingly, prepayment risk subjects the

MSRs to impairment risk. The Company does not specifically

hedge the MSRs asset for the potential impairment risk; it does

however employ a balanced business strategy using the natural

counter-cyclicality of servicing and production to mitigate the

cost of higher MSR amortization resulting from prepayments.

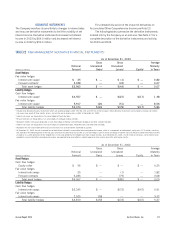

The fair value determination, key economic assumptions and

the sensitivity of the current fair value of the MSRs as of

December 31, 2003 is discussed in greater detail in Note 12.

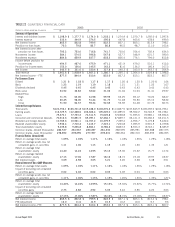

The Company hedges the risks associated with the mort-

gage warehouse and pipeline. The mortgage warehouse and

pipeline consist primarily of fixed and adjustable-rate single

family residential real estate loans. The risk associated with the

mortgage warehouse and pipeline is the potential change in

interest rates between the time the customer locks in the rate

on the loan and the time the loan is sold. This period is usually

90-150 days. To hedge this risk, forward sales agreements and

option contracts are executed. The Company has set exposure

limits on the risk associated with the changes in market value of

the mortgage warehouse and pipeline. The limit is based on a

percentage of the aggregate mortgage warehouse and pipeline

for price movements within two standard deviations.

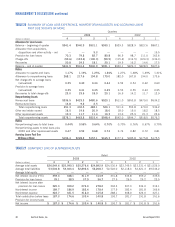

The Company is also subject to risk from changes in equity

prices that arise from owning The Coca-Cola Company common

stock. SunTrust owns 48,266,496 shares of common stock of

The Coca-Cola Company, which had a carrying value of $2.4 bil-

lion at December 31, 2003. A 10% decrease in share price of

The Coca-Cola Company common stock at December 31, 2003

would result in a decrease, net of deferred taxes, of approximately

$159 million in accumulated other comprehensive income.