SunTrust 2003 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66 SunTrust Banks, Inc. Annual Report 2003

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

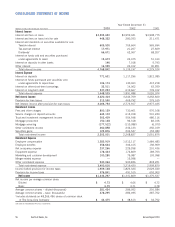

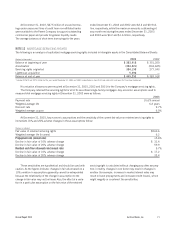

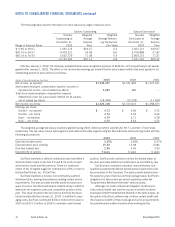

NOTE 5

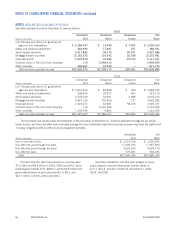

SECURITIES AVAILABLE FOR SALE

Securities available for sale at December 31 were as follows:

2003

Amortized Unrealized Unrealized Fair

(Dollars in thousands) Cost Gains Losses Value

U.S. Treasury and other U.S. government

agencies and corporations $2,286,427 $ 13,959 $ 7,872 $ 2,292,514

States and political subdivisions 362,995 17,807 271 380,531

Asset-backed securities 5,417,882 36,175 26,071 5,427,986

Mortgage-backed securities 12,181,073 119,342 26,934 12,273,481

Corporate bonds 2,097,218 43,966 29,513 2,111,671

Common stock of The Coca-Cola Company 110 2,449,415 — 2,449,525

Other securities 646,667 24,509 — 671,176

Total securities available for sale $22,992,372 $2,705,173 $90,661 $25,606,884

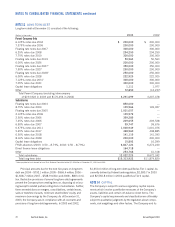

2002

Amortized Unrealized Unrealized Fair

(Dollars in thousands) Cost Gains Losses Value

U.S. Treasury and other U.S. government

agencies and corporations $ 3,601,544 $ 82,828 $ 360 $ 3,684,012

States and political subdivisions 398,640 20,877 407 419,110

Asset-backed securities 4,478,169 44,961 4,986 4,518,144

Mortgage-backed securities 9,467,150 155,660 727 9,622,083

Corporate bonds 1,923,471 64,681 58,415 1,929,737

Common stock of The Coca-Cola Company 110 2,110,584 — 2,110,694

Other securities 1,154,536 6,866 — 1,161,402

Total securities available for sale $21,023,620 $2,486,457 $64,895 $23,445,182

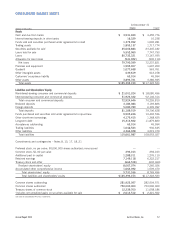

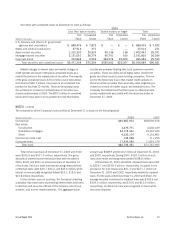

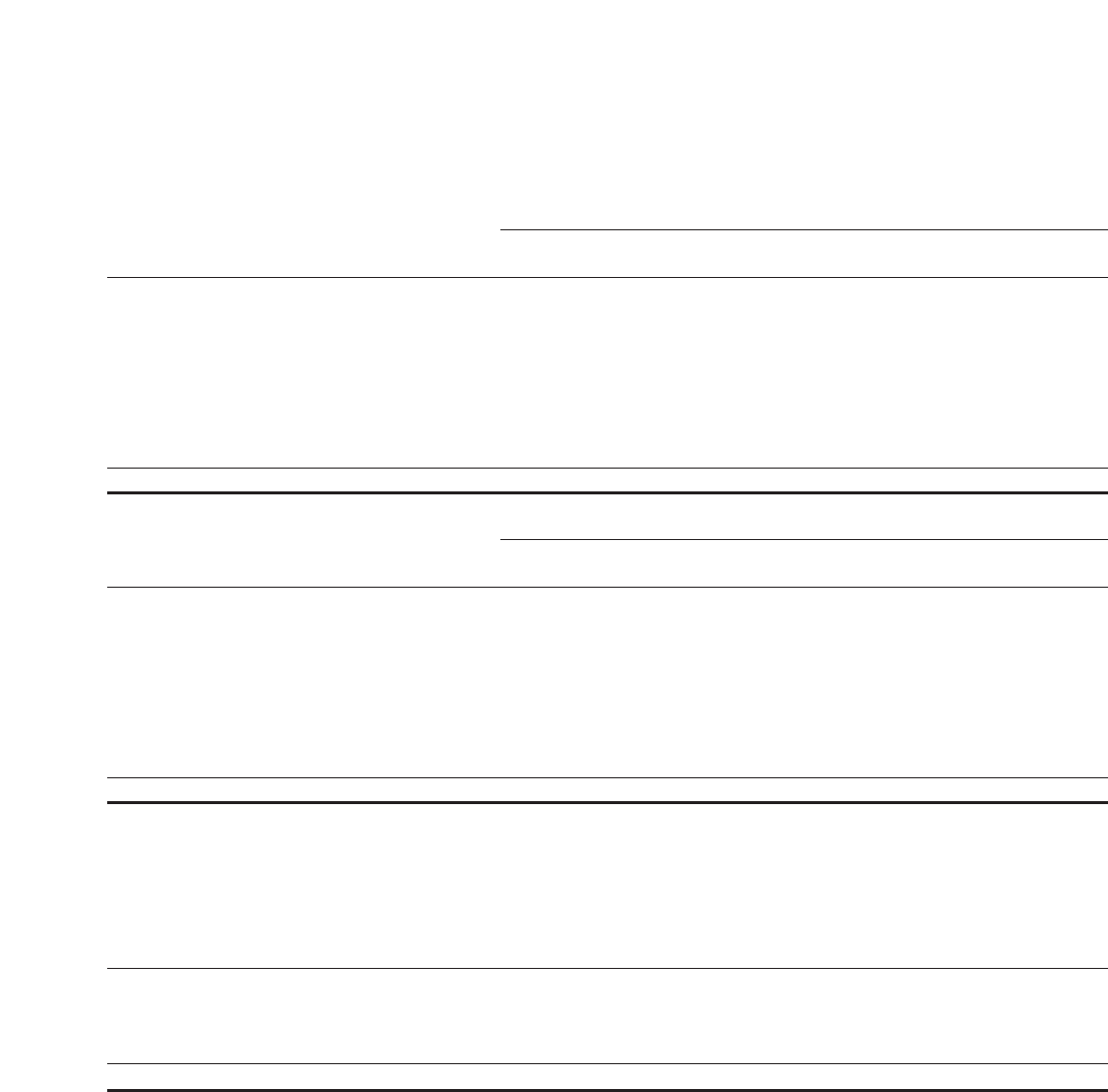

The amortized cost and fair value of investments in debt securities at December 31, 2003 by estimated average life are shown

below. Actual cash flows will differ from estimated average lives and contractual maturities because borrowers may have the right to call

or prepay obligations with or without call or prepayment penalties.

Amortized Fair

(Dollars in thousands) Cost Value

Due in one year or less $ 1,512,410 $ 1,529,655

Due after one year through five years 17,249,703 17,367,564

Due after five years through ten years 3,003,515 3,025,770

Due after ten years 579,967 563,194

Total $22,345,595 $22,486,183

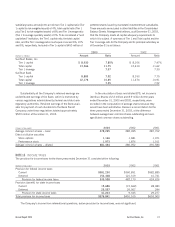

Proceeds from the sale of investments in securities were

$7.6, $5.6 and $5.4 billion in 2003, 2002 and 2001. Gross

realized gains were $124.9, $206.5, and $166.8 million and

gross realized losses on such sales were $1.0, $2.0, and

$13.7 million in 2003, 2002, and 2001.

Securities available for sale that were pledged to secure

public deposits, trust and other funds had fair values of

$13.7, $14.2, and $12.9 billion at December 31, 2003,

2002, and 2001.