SunTrust 2003 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76 SunTrust Banks, Inc. Annual Report 2003

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

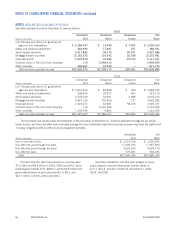

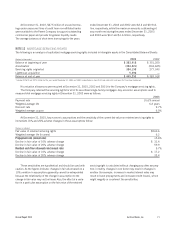

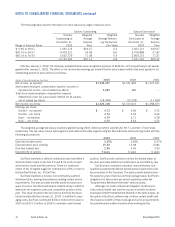

The following table presents information on stock options by ranges of exercise price:

Options Outstanding Options Exercisable

Number Weighted Weighted Number Weighted

Outstanding at Average Average Remain- Exercisable at Average

December 31, Exercise ing Contractual December 31, Exercise

Range of Exercise Prices 2003 Price Life (Years) 2003 Price

$6.96 to 49.61 1,663,113 $32.67 2.4 1,663,113 $32.67

$50.10 to 64.57 9,478,221 56.98 8.0 2,708,888 51.87

$65.19 to 76.50 3,022,729 71.08 5.4 2,869,115 71.21

14,164,063 $57.14 6.8 7,241,116 $55.12

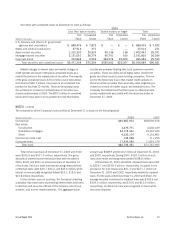

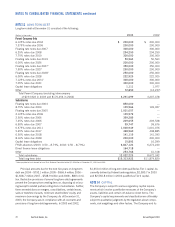

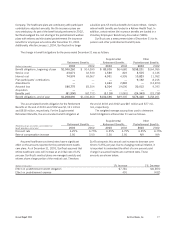

Effective January 1, 2002, the Company adopted the fair-value recognition provision of SFAS No. 123 prospectively to all awards

granted after January 1, 2002. The effect on net income and earnings per share if the fair-value based method had been applied to all

outstanding awards in each period is as follows:

(Dollars in thousands except per share data) 2003 2002 2001

Net income, as reported $1,332,297 $1,331,809 $1,375,537

Stock-based employee compensation expense included in

reported net income, net of related tax effects 5,285 484 —

Total stock-based employee compensation expense

determined under fair-value based method for all awards,

net of related tax effects (14,474) (19,278) (17,464)

Net Income, pro forma $1,323,108 $1,313,015 $1,358,073

Earnings per share:

Diluted – as reported $4.73 $4.66 $ 4.72

Diluted – pro forma 4.70 4.59 4.66

Basic – as reported 4.79 4.71 4.78

Basic – pro forma 4.75 4.64 4.72

The weighted-average fair values of options granted during 2003, 2002 and 2001 were $6.22, $9.71 and $10.73 per share,

respectively. The fair value of each option grant is estimated on the date of grant using the Black-Scholes option-pricing model with the

following assumptions:

2003 2002 2001

Expected dividend yield 3.20% 2.66% 2.47%

Expected stock price volatility 15.52 14.68 15.84

Risk-free interest rate 2.96 4.05 3.90

Expected life of options 5 years 6 years 6 years

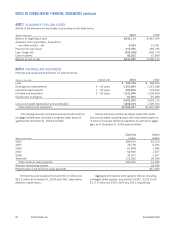

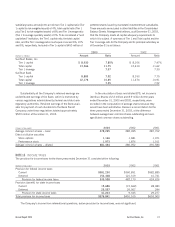

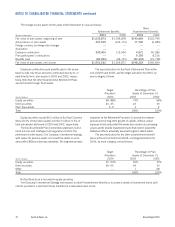

SunTrust maintains a defined contribution plan that offers a

dollar for dollar match on the first 3% and $.50 cents on each

dollar for the fourth and fifth percents. There is a maximum

match of 4% of eligible wages for contributions of 5% or more in

the SunTrust Banks, Inc. 401(k) Plan.

SunTrust maintains a funded, noncontributory qualified

retirement plan covering all employees meeting certain service

requirements. The plan provides benefits based on salary and

years of service. SunTrust performed a benefits study in 2002 to

determine the long-term costs and competitive position of this

plan. This study resulted in the decision by SunTrust to reduce

future benefits effective January 31, 2003. In addition to man-

aging costs, SunTrust contributed $300.0 million to this plan in

2003 and $115.9 million in 2002 to maintain a well-funded

position. SunTrust will continue to review the funded status of

the plan and make additional contributions as permitted by law.

SunTrust also maintains unfunded, noncontributory non-

qualified supplemental defined benefit pension plans that cover

key executives of the Company. The plans provide defined bene-

fits based on years of service and final average salary. SunTrust’s

obligations for these plans are shown separately under the

“Supplemental Retirement Benefits” sections below.

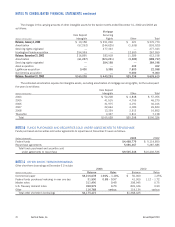

Although not under contractual obligation, SunTrust pro-

vides certain health care and life insurance benefits to retired

employees (Other Postretirement Benefits in the table below). At

the option of SunTrust, retirees may continue certain health and

life insurance benefits if they meet age and service requirements

for postretirement welfare benefits while working for the