SunTrust 2003 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28 SunTrust Banks, Inc. Annual Report 2003

MANAGEMENT’S DISCUSSION continued

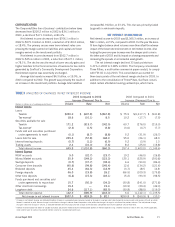

loan type and internal risk rating. The loss migration analysis

provides the basis for factors applied to the commercial and

commercial real estate loan portfolios by examining recent

twelve month loss experience in relation to internal credit risk

ratings over time. Historical loss analyses provide the basis for

factors used for more homogenous pools of smaller loans, such

as residential real estate and other consumer loan categories.

While these analyses that establish the general allowance fac-

tors are formally prepared annually, the Company continuously

monitors credit quality in all portfolio segments and may revise

the general factors whenever necessary in order to address

improving or deteriorating credit quality trends or specific risks

associated with any given loan category. As of December 31,

2003 and 2002, the general allowance calculations totaled

$565 million and $537 million, respectively. The increase

between the periods was primarily the result of the increase

in the overall pooled loan population.

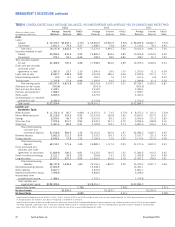

The third element is based on the guidance of various Joint

Interagency Statements issued by bank regulatory agencies and

includes environmental and unallocated components that are not

otherwise evaluated in the first two elements. The environmental

component includes assessments of economic, concentration,

administrative and country transfer risks. The economic risk

assessment considers periodic changes in several widely publi-

cized U.S. economic indicators. This process was enhanced

during 2003 after an analysis of the relationship between specific

economic indicators and historical charge-off levels. The concen-

tration risk methodology considers credit exposure when grouped

by borrower, collateral type, region and industry, and estimates

the incremental risks (see Note 19 for additional details of credit

concentration and Table 8 for Loans by Selected Industries).

Administrative risks are related to specific changes in the organi-

zation or loan portfolio, such as reorganization or centralization

efforts and acquisitions, along with changes in credit policy or

client selection criteria. The unallocated component of the

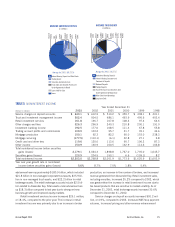

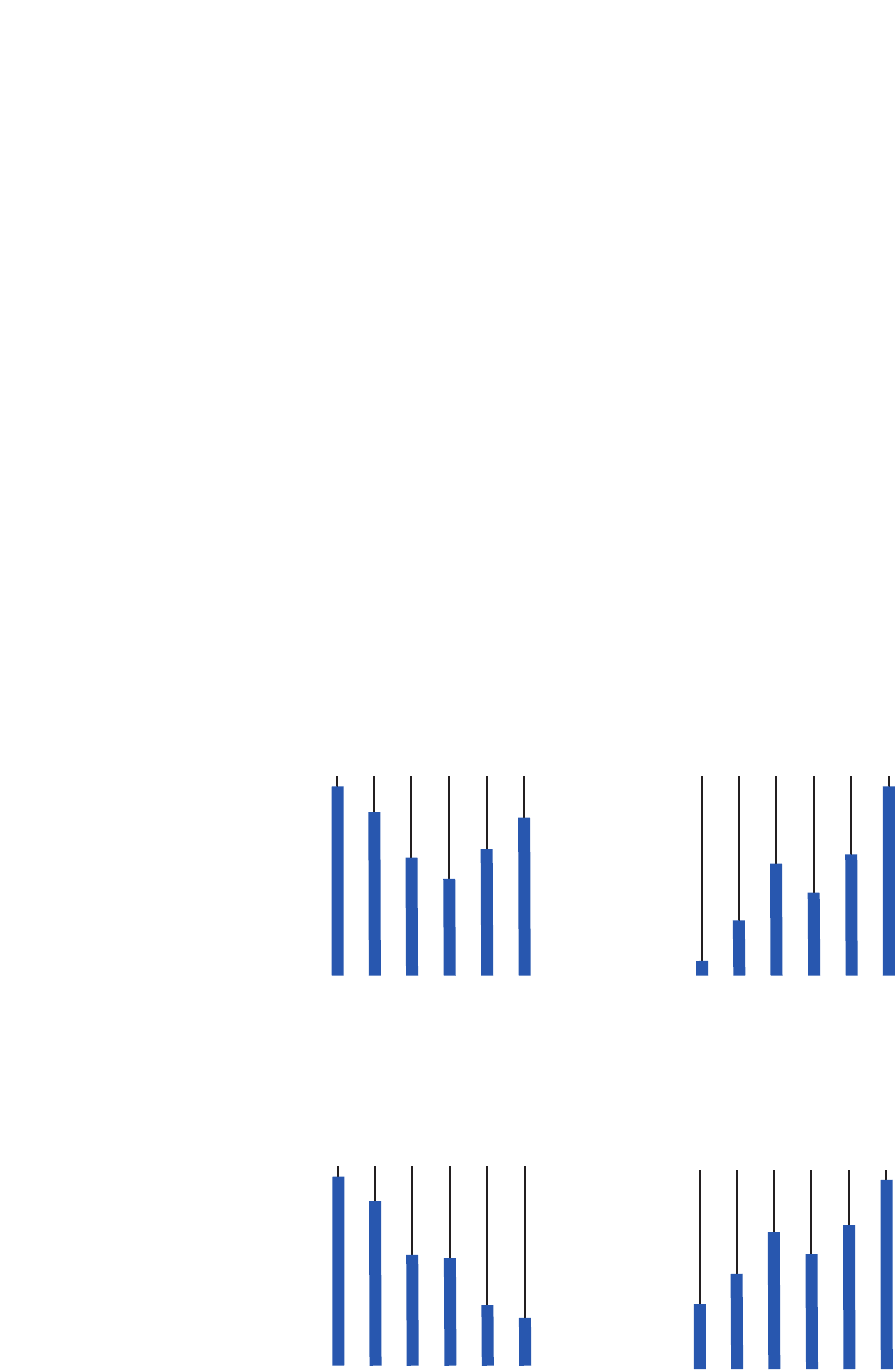

EFFICIENCY

RATIO

%

98 99 00 01 02 03

62.02

60.35

57.47

56.12

57.99

59.99

CORE STAFF

LEVELS

Year-end core staff levels are adjusted

for acquisitions and divestitures.

98 99 00 01 02 03

30,991

30,233

28,513

28,463

26,863

26,455

AVERAGE DEPOSITS

$ in Millions

98 99 00 01 02 03

53,725.3

57,842.1

66,691.9

64,568.7

71,157.2

80,039.0

TOTAL LOANS

$ in Millions

98 99 00 01 02 03

61,540.6

66,002.8

72,239.8

68,959.2

73,167.9

80,732.3