SunTrust 2003 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2003 SunTrust Banks, Inc. 27

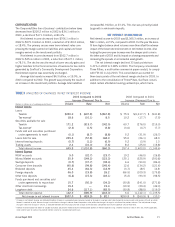

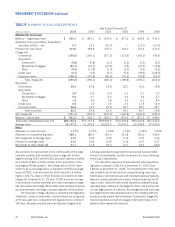

TABLE 7

LOAN PORTFOLIO BY TYPES OF LOANS

At December 31

(Dollars in millions) 2003 2002 2001 2000 1999 1998

Commercial $30,681.9 $28,693.6 $28,945.9 $30,781.1 $26,933.5 $24,589.6

Real estate

Construction 4,479.8 4,002.4 3,627.3 2,966.1 2,457.1 2,085.0

Residential mortgages 24,173.4 19,443.4 17,297.1 19,953.0 19,619.3 16,880.9

Other 9,330.1 9,101.8 8,152.0 8,121.4 7,794.9 8,254.3

Credit card 133.0 111.3 92.0 76.8 77.4 1,563.5

Consumer loans 11,934.1 11,815.4 10,844.9 10,341.4 9,120.6 8,167.3

Total loans $80,732.3 $73,167.9 $68,959.2 $72,239.8 $66,002.8 $61,540.6

In 2002, the One Bank initiative resulted in $56.2 million

of noninterest expense. The One Bank initiative represented

enhancements to customer-based systems across the Company’s

geographic footprint in an effort to yield operating efficiencies and

was completed in the fourth quarter of 2002.

The efficiency ratio for 2003 was 60.0%, an increase from

58.0% for 2002.

PROVISION FOR INCOME TAXES

The provision for income taxes covers federal and state income

taxes. In 2003, the provision was $576.8 million, compared to

$491.5 million in 2002. The provision represents an effective

tax rate of 30.2% for 2003 compared to 27.0% for 2002. The

2003 effective tax rate was representative of the Company’s

long-term normalized tax rate of 30–31%.

The 2002 effective tax rate was lower than historical levels

due to several factors. In the first quarter, the Company realized

a tax benefit upon the reversal of a deferred liability, which

resulted from the change in status of a subsidiary to a real estate

investment trust (REIT). A tax benefit was also realized when the

Company standardized the recognition of low income housing

tax credits during the fourth quarter of 2002.

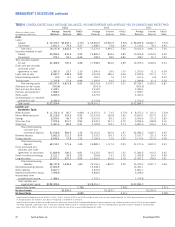

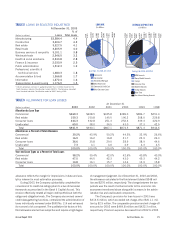

LOANS

The Company’s loan portfolio increased $7.6 billion, or 10.3%,

from December 31, 2002 to December 31, 2003. The increase

was primarily due to an increase in residential mortgages, the

acquisition of Lighthouse, and the consolidation in the third quar-

ter of 2003 of SunTrust’s multi-seller commercial paper conduit,

Three Pillars. Commercial loans related to Three Pillars were

$2.8 billion at December 31, 2003. Compared to the prior year-

end, the Company’s portfolio of commercial loans, which included

Three Pillars, increased 6.9%, real estate loans grew 16.7% and

consumer loans grew 1.0%. The loan portfolio continues to be

well diversified from both a product and industry concentration

standpoint. The product mix remained relatively constant from

year-end 2002 to 2003, with real estate loans accounting for the

largest segment (47.0% of total loans). Residential real estate rep-

resented 29.9% of total loans at year-end, including $17.3 billion

in home mortgages and $6.9 billion in home equity lines. The

increase of $1.7 billion in home equity lines was due to the

Company’s marketing campaigns, appreciation in the housing

market, and the favorable interest rate environment. The

Lighthouse acquisition added $567.4 million of loans to the

portfolio as of the June 2003 acquisition date.

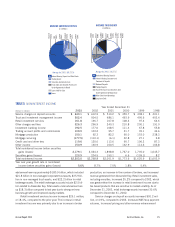

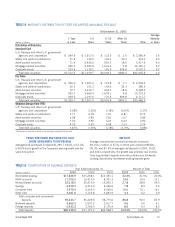

ALLOWANCE FOR LOAN LOSSES

SunTrust continuously reviews its loan portfolio and maintains an

allowance for loan losses sufficient to absorb losses inherent in

the portfolio. The Company is committed to the early recognition

of problem loans and to an appropriate and adequate level of

allowance. At year-end 2003, the Company’s total allowance

was $941.9 million, which represented 1.17% of period-end

loans. In addition to the review of credit quality through ongoing

credit review processes, the Company constructs an independent

and comprehensive allowance analysis for its loan portfolios on a

quarterly basis. The analysis includes three basic elements: spe-

cific allowances for individual loans, general allowances for loan

pools and allowances based on economic conditions and other

risk factors. The SunTrust Allowance for Loan Losses Review

Committee has the responsibility of affirming the allowance

methodology and assessing all of the risk elements in order to

determine the appropriate level of allowance for the inherent

losses in the loan portfolio at the point in time being reviewed.

The first element of the allowance for loan losses analysis

involves the calculation of specific allowances for individual

impaired loans as required by SFAS Nos. 114 and 118. In this

process, specific allowances are established for nonaccrual

loans greater than $0.5 million based on a thorough analysis of

the most probable sources of repayment, including discounted

future cash flows, liquidation of collateral or the market value of

the loan itself. As of December 31, 2003 and 2002, the specific

allowance related to SFAS No. 114 and 118 prescribed calcula-

tions totaled $29 million and $117 million, respectively. The

decrease between these two periods was primarily due to the

substantial decline in the level of nonperforming loans and an

overall improvement in credit quality.

The second element — the general allowance for loan

pools — is determined per SFAS No. 5 by applying loan loss

allowance factors to groups of loans within the portfolio that

have similar characteristics. The general allowance factors are

based upon the results of an annual statistical loss migration

analysis and other analyses of recent and historical charge-off

experience and are typically applied to the portfolio in terms of