SunTrust 2003 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

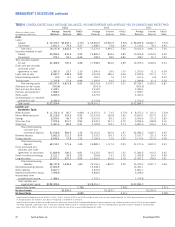

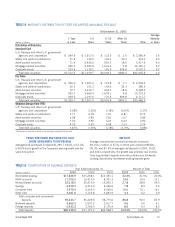

TABLE 13

FUNDS PURCHASED AND SECURITIES SOLD UNDER AGREEMENTS TO REPURCHASE1

Maximum

Outstanding

At December 31 Daily Average at Any

(Dollars in millions) Balance Rate Balance Rate Month-End

2003 $ 9,505.2 0.72% $11,666.9 0.91% $15,089.8

2002 10,402.5 1.01 10,376.2 1.35 12,701.9

2001 10,104.3 1.46 11,283.6 3.65 13,546.6

1Consists of federal funds purchased and securities sold under agreements to repurchase that mature either overnight or at a fixed maturity generally not exceeding three months. Rates on

overnight funds reflect current market rates. Rates on fixed maturity borrowings are set at the time of borrowings.

32 SunTrust Banks, Inc. Annual Report 2003

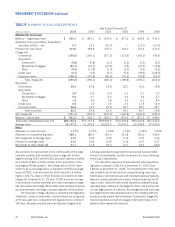

MANAGEMENT’S DISCUSSION continued

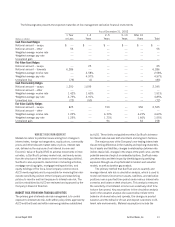

Net securities gains of $123.9 million were realized in 2003

to take advantage of market opportunities while implementing the

Company’s asset and liability management strategy. The carrying

value of the securities portfolio, all of which is classified as “securi-

ties available for sale,” reflected $2.6 billion in net unrealized

securities gains at December 31, 2003, including a $2.5 billion

unrealized gain on the Company’s investment in the common

stock of The Coca-Cola Company. The market value of this com-

mon stock increased $338.8 million, while the unrealized gain on

the remainder of the portfolio decreased $145.9 million compared

to December 31, 2002. These changes in market value did not

affect the net income of SunTrust, but were included in accumu-

lated other comprehensive income.

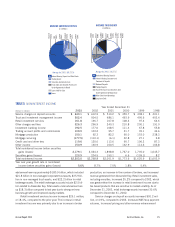

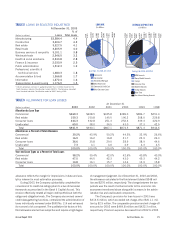

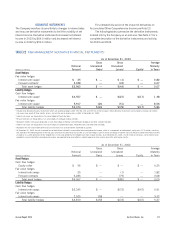

TABLE 12

SECURITIES AVAILABLE FOR SALE

At December 31

Amortized Unrealized Unrealized Fair

(Dollars in millions) Cost Gains Losses Value

U.S. Treasury and other U.S. government

agencies and corporations

2003 $ 2,286.4 $ 14.0 $ 7.9 $ 2,292.5

2002 3,601.5 82.9 0.4 3,684.0

2001 2,229.5 111.2 0.5 2,340.2

States and political subdivisions

2003 363.0 17.8 0.3 380.5

2002 398.6 20.9 0.4 419.1

2001 434.1 11.1 1.5 443.7

Asset-backed securities

2003 5,417.9 36.2 26.1 5,428.0

2002 4,478.2 44.9 5.0 4,518.1

2001 3,508.4 45.5 9.8 3,544.1

Mortgage-backed securities

2003 12,181.1 119.3 26.9 12,273.5

2002 9,467.2 155.6 0.7 9,622.1

2001 8,142.5 163.2 14.0 8,291.7

Corporate bonds

2003 2,097.2 44.0 29.5 2,111.7

2002 1,923.5 64.6 58.4 1,929.7

2001 1,969.5 62.6 48.6 1,983.5

Other securities1

2003 646.8 2,473.9 — 3,120.7

2002 1,154.6 2,117.6 — 3,272.2

2001 740.1 2,313.1 — 3,053.2

Total securities available for sale

2003 $22,992.4 $2,705.2 $90.7 $25,606.9

2002 21,023.6 2,486.5 64.9 23,445.2

2001 17,024.1 2,706.7 74.4 19,656.4

1Includes the Company’s investment in 48,266,496 shares of common stock of The Coca-Cola Company.