SunTrust 2003 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24 SunTrust Banks, Inc. Annual Report 2003

MANAGEMENT’S DISCUSSION continued

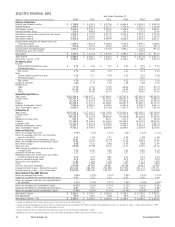

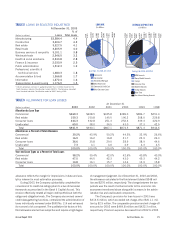

negative one basis point impact on net interest margin for 2003.

The earning asset yield for 2003 declined 96 basis points from

2002. For 2003, loan yields decreased 83 basis points and

securities available for sale yields declined 161 basis points

compared to 2002. In 2003, total interest-bearing liability costs

declined 76 basis points from 2002. The larger decrease in

earning asset yield versus the decrease in liability cost resulted

in the overall net interest margin decline.

The decrease in the margin was due to a number of factors.

The shift in the Company’s balance sheet structure in 2001 and

2002 to a slightly asset-sensitive position in anticipation of rising

rates did not produce the expected margin benefit. This was due to

rates continuing to trend lower during the first half of 2003. After

the Fed reduced the Fed Funds rate mid-year to 1.00%, the yield

curve finally began to steepen late in the third quarter and into the

fourth quarter, helping the fourth quarter margin. SunTrust’s prime

rate averaged 4.12% for 2003, a decline of approximately 55

basis points from 2002. The Federal Reserve Bank Fed Funds rate

averaged 1.12% for the year, 55 basis points below the 2002

average. The lower rates and flattening of the yield curve in the lat-

ter part of 2002 and the first half of 2003 created an acceleration

of prepayments in the mortgage industry. As prepayments acceler-

ated, higher yielding assets were replaced by lower yielding assets,

which reduced the yield on the residential mortgage loan and the

mortgage-backed securities portfolios. The Company’s reposition-

ing of its investment portfolio during 2001 and 2002 shortened

the duration of the portfolio and contributed to the decrease in the

portfolio yield. Net free funding sources, comprised of demand

deposits, equity and other liabilities, net of other assets, are worth

less in a low/declining rate environment, contributing to compres-

sion of the net interest margin. During 2003, the Company began

to moderately increase the duration of the securities portfolio from

1.3 to 2.7 at December 31, 2002 and 2003, respectively. This

moderate increase began to help the margin in the second half of

2003. Duration is a measure of price sensitivity of a bond portfolio

to an immediate change in interest rates. A duration of 2.7 sug-

gests an expected price change of approximately 2.7% for a one

percent change in interest rates, without considering any embed-

ded call or prepayment options.

Average earning assets were up 13.4% and average interest-

bearing liabilities increased 12.1% compared to 2002. Average

earning assets and average interest-bearing liabilities each

included $1.3 billion related to Three Pillars for 2003. Average

loans rose $4.9 billion, securities available for sale increased

$4.1 billion, and loans held for sale increased $4.2 billion in

2003. Loans held for sale increased due to increased mortgage

refinancing activity.

The Company continued to take steps to obtain alternative

lower cost funding sources, such as developing initiatives to

grow customer deposits. Campaigns to attract customer deposits

were implemented in 2002 and 2003. The Company believes

that deposit growth has also benefited from the volatility in the

financial markets. Average money market deposits grew 8.5%,

NOW accounts increased 13.4% and demand deposits

increased 16.8% in 2003.

Interest income that the Company was unable to recognize

on nonperforming loans had a negative impact of two basis

points for 2003 and three basis points for 2002. Table 4

contains more detailed information concerning average loans,

yields and rates paid.

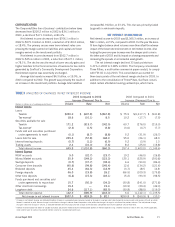

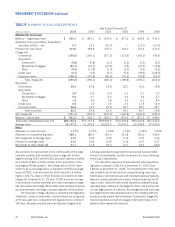

PROVISION FOR LOAN LOSSES

The provision for loan losses charged to expense is based upon

credit loss experience and the results of a detailed analysis estimat-

ing an appropriate and adequate allowance for loan losses. The

analysis includes the evaluation of impaired loans as prescribed

under SFAS Nos. 114 and 118, pooled loans as prescribed under

SFAS No. 5 and economic and other risk factors as outlined in vari-

ous Joint Interagency Statements issued by the bank regulatory

agencies. For the year ended December 31, 2003, the provision for

loan losses was $313.6 million, a decline of $156.2 million, or

33.3%, compared to 2002. The decline was primarily due to

improvement in credit quality during 2003. The 2002 provision for

loan losses also included an additional $45.3 million to bring the

acquired Huntington-Florida loan portfolio into compliance with

SunTrust’s credit standards.

Net charge-offs for 2003 were $311.1 million, a decrease of

$111.2 million, or 26.3%, from 2002. The decline was due to a

$111.6 million, or 41.8%, reduction in commercial net charge-

offs. Commercial charge-offs in 2002 included $74.9 million

related to the bankruptcy of a large corporate energy company.

Net charge-offs related to large corporate loans, generally national

and large business clients with total annual revenues in excess

of $250 million, totaled $115.0 million in 2003, compared to

$241.5 million in 2002. Net charge-offs related to the other

portfolios totaled $196.1 million in 2003 and $180.8 million

in 2002.

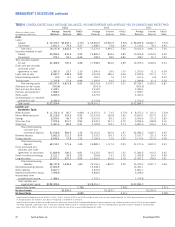

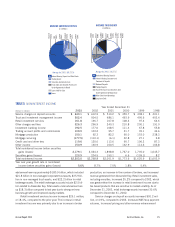

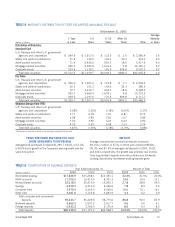

NONINTEREST INCOME

Noninterest income has grown to comprise 41% of total revenues

compared with 36% in 1998. Noninterest income for 2003 was

$2,303.0 million, an increase of 1.5% compared to 2002.

Trust and investment management income decreased

$2.1 million, or 0.4%, compared to 2002. As of December 31,

2003 and 2002, assets under management were approxi-

mately $101.0 billion and $89.6 billion, respectively. Assets

under management increased 12.8% due to appreciation in the

equity markets and net new business. Lost business moder-

ately improved compared to prior periods, while new business

maintained its momentum. Average assets under management

increased 4.1% compared to 2002. The growth in trust and

investment management income was offset by less non-recurring

revenue, primarily estate fees. Assets under management include

individually managed assets, the STI Classic Funds, institutional

assets managed by Trusco Capital Management, and partici-

pant-directed retirement accounts. SunTrust’s total assets under