SunTrust 2003 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2003 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38 SunTrust Banks, Inc. Annual Report 2003

MANAGEMENT’S DISCUSSION continued

Prior to year-end, the Regulatory Agencies issued an interim

rule allowing sponsoring banking organizations to remove Asset

Backed Commercial Paper (ABCP) program assets consolidated

under FIN 46, “Consolidation of Variable Interest Entities” from

their risk-weighted asset bases for purposes of calculating risk-

based capital ratios. This interim rule does not affect the average

assets used in the calculation of Tier 1 Leverage. This provision,

unless otherwise amended or modified, expires after March 31,

2004. Without the interim rule, Tier 1 Risk-Based Capital and

Total Risk-Based Capital would be negatively impacted by 17

and 25 basis points, respectively.

The Regulatory Agencies concurrently issued for comment

proposals on the risk-based treatment of ABCP conduits by spon-

soring organizations, regardless of their consolidation under FIN

46. The proposal provides for a 20% credit conversion factor on the

liquidity facilities supporting the underlying assets of the program.

The new proposal would negatively impact the Tier 1 Risk-Based

Capital and Total Risk-Based Capital ratios by five and seven basis

points, respectively, compared to its current treatment.

In December 2003, the Financial Accounting Standards

Board issued a revised interpretation of FIN 46, which required

deconsolidation of subordinated beneficial interests. As a result,

the Company deconsolidated its Trust Preferred Securities in the

fourth quarter of 2003. There was no impact to the results of

operations and a less than .04% impact to the statement of con-

dition as a result of the deconsolidation. These notes payable to

trusts established to issue the preferred securities are included in

long-term debt and totaled $1.65 billion at December 31, 2003

and 2002.

As a result of FASB’s Interpretation, questions have been

raised whether Trust Preferred Securities would still qualify for

treatment as Tier 1 Capital given the new accounting treatment. In

July of 2003, the Federal Reserve instructed bank holding compa-

nies to continue to include Trust Preferred Securities in Tier 1

Capital for regulatory capital purposes, until notice is given to the

contrary. Management does not expect the final rules will result in

the immediate elimination of existing Trust Preferred Securities as

Tier 1 Capital. These securities comprised 18.5% of Tier 1 Capital

as of December 31, 2003. If it were determined that the existing

Trust Preferred Securities do not qualify as Tier 1 Capital, SunTrust

would still meet the requirements for well-capitalized institutions

at December 31, 2003.

SunTrust manages capital through dividends and share

repurchases authorized by the Company’s Board of Directors.

Management assesses capital needs based on expected growth

and the current economic climate. In 2003, the Company repur-

chased 3.3 million shares for $182 million compared to 5.7

million shares for $341 million repurchased in 2002. Shares

issued under various compensation programs of 1.4 million and

1.0 million in 2003 and 2002, respectively, partially offset

these repurchases. As of December 31, 2003, the Company

was authorized to purchase up to an additional 6.2 million

shares under current Board resolutions.

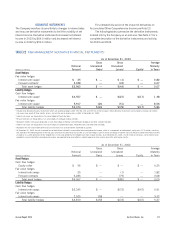

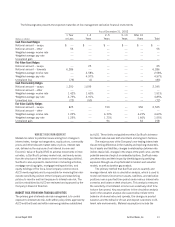

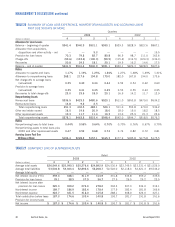

TABLE 21

SHARE REPURCHASES

Number of shares Maximum number of

Total number Average purchased as part of shares that may yet be

of shares price paid Broker-dealer used publicly announced purchased under the

purchased per share to effect purchases plans or programs plans or programs1

January 300,000 $55.92 SunTrust Robinson Humphrey 300,000 9,202,796

February 1,243,000 56.02 SunTrust Robinson Humphrey 1,243,000 7,959,796

March 1,460,000 54.45 SunTrust Robinson Humphrey 1,460,000 6,499,796

April — — — — 6,499,796

May — — — — 6,499,796

June — — — — 6,499,796

July — — — — 6,499,796

August 257,000 59.36 SunTrust Robinson Humphrey 257,000 6,242,796

September 15,000 60.00 SunTrust Robinson Humphrey 15,000 6,227,796

October — — — — 6,227,796

November — — — — 6,227,796

December — — — — 6,227,796

Total 3,275,000 $55.59 3,275,000

1On November 12, 2002, the Board of Directors authorized to purchase 10 million shares of SunTrust common stock in addition to 2,796 shares which were remaining from a June 13, 2001

authorization. There is no expiration date for this authorization.